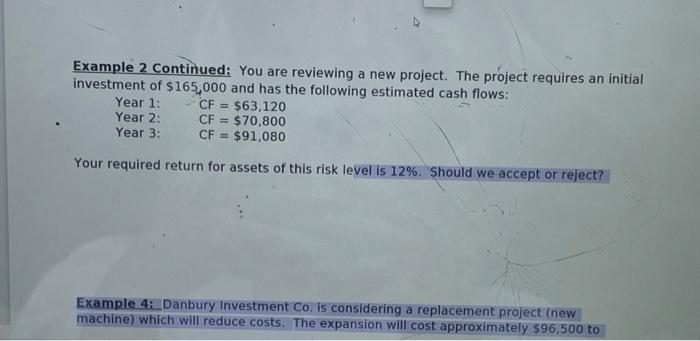

Question: help! Example 2 Continued: You are reviewing a new project. The project requires an initial investment of $165,000 and has the following estimated cash flows:

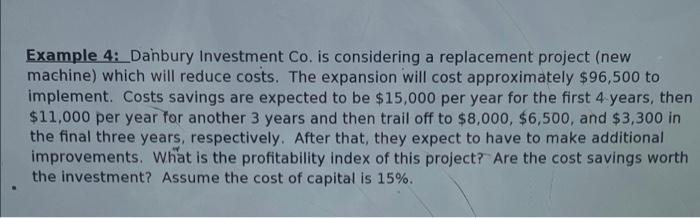

Example 2 Continued: You are reviewing a new project. The project requires an initial investment of $165,000 and has the following estimated cash flows: Year 1: $63,120 Year 2: CF = $70,800 Year 3: CF = $91,080 CF = Your required return for assets of this risk level is 12%. Should we accept or reject? Example 4: _Danbury Investment Co. is considering a replacement project (new machine) which will reduce costs. The expansion will cost approximately $96,500 to Example 4: _Danbury Investment Co. is considering a replacement project (new machine) which will reduce costs. The expansion will cost approximately $96,500 to implement. Costs savings are expected to be $15,000 per year for the first 4 years, then $11,000 per year for another 3 years and then trail off to $8,000, $6,500, and $3,300 in the final three years, respectively. After that, they expect to have to make additional improvements. What is the profitability index of this project? Are the cost savings worth the investment? Assume the cost of capital is 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts