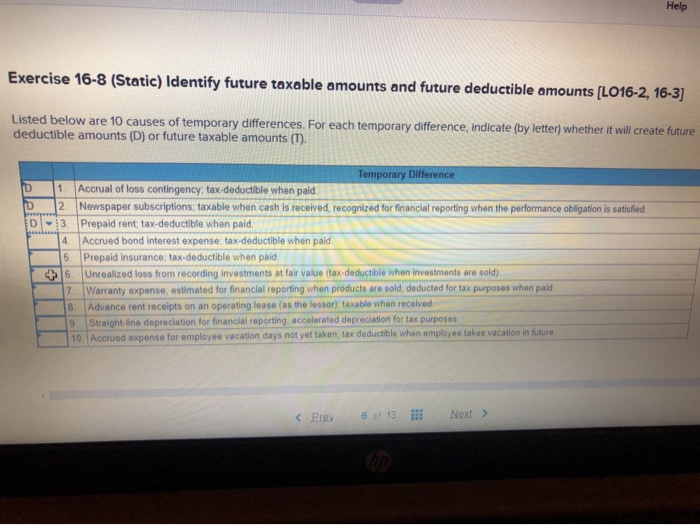

Question: Help Exercise 16-8 (Static) Identify future taxable amounts and future deductible amounts (L016-2, 16-3] Listed below are 10 causes of temporary differences. For each temporary

Help Exercise 16-8 (Static) Identify future taxable amounts and future deductible amounts (L016-2, 16-3] Listed below are 10 causes of temporary differences. For each temporary difference, indicate (by letter) whether it will create future deductible amounts (D) or future taxable amounts (T). Temporary Difference 1 Accrual of loss contingency, tax deductible when paid D 2. Newspaper subscriptions taxable when cash is received, recognized for financial reporting when the performance obligation is satisfied D-13 Prepaid rent, tax deductible when paid. 4 Accrued bond interest expense tax-deductible when paid 5. Prepaid insurance, tax deductible when paid Unrealized loss from recording investments at fair value (tax deductible when investments are sold) 7. Warranty expense, estimated for financial reporting when products are sold, deducted for tax purposes when paid 8 Advance rent receipts on an operating lease (as the lessor)taxable when received 9 Straight-line depreciation for financial reporting accelerated depreciation for tax purposes 10 Accrued expense for employee vacation days not yet taken tax deductible when employee takes vacation in future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts