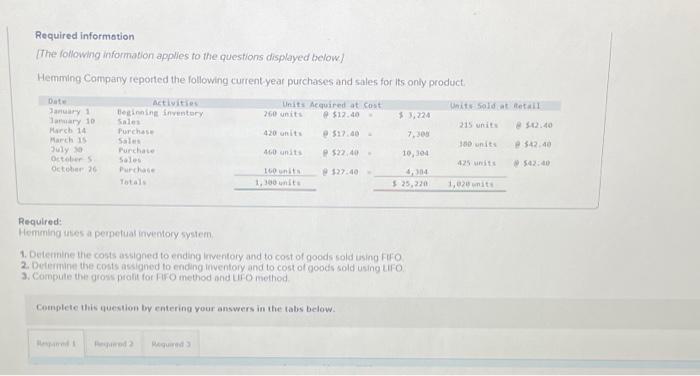

Question: help fast help fast Required information The following information applies to the questions displayed below) Hemming Company reported the following current year purchases and sales

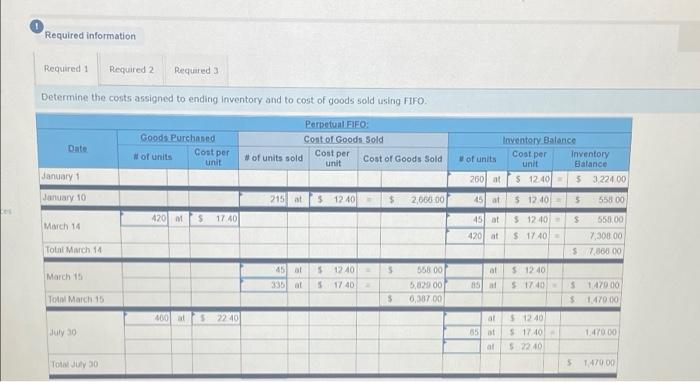

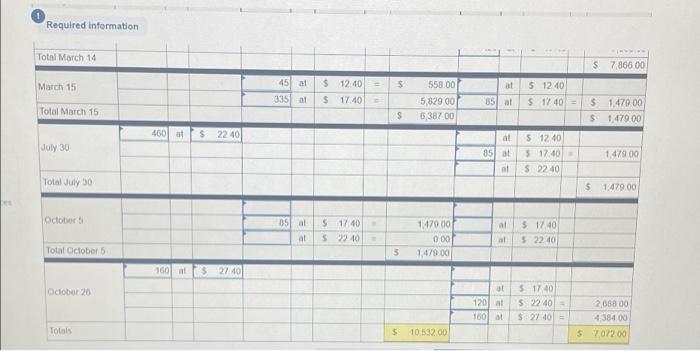

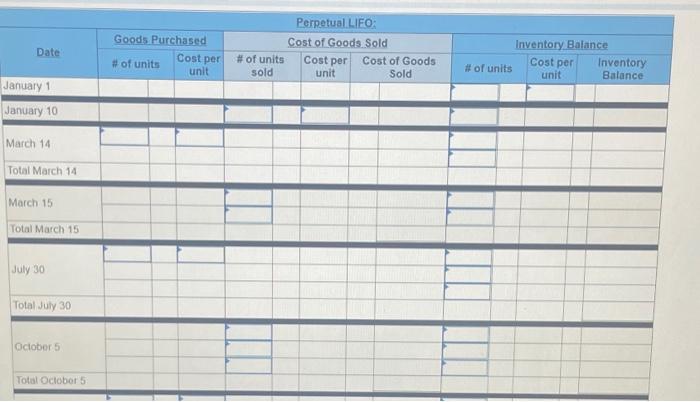

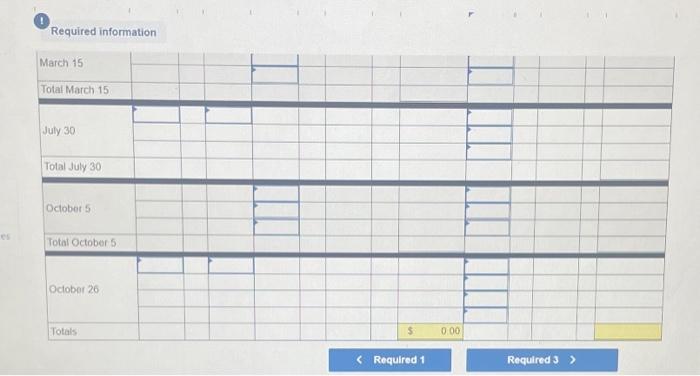

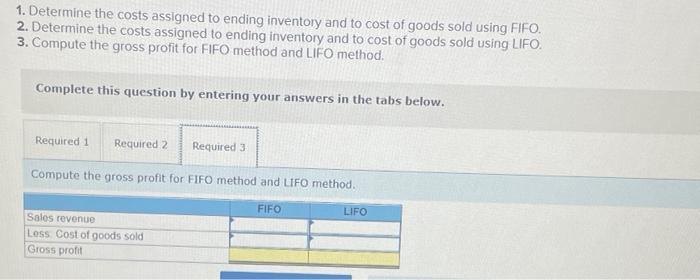

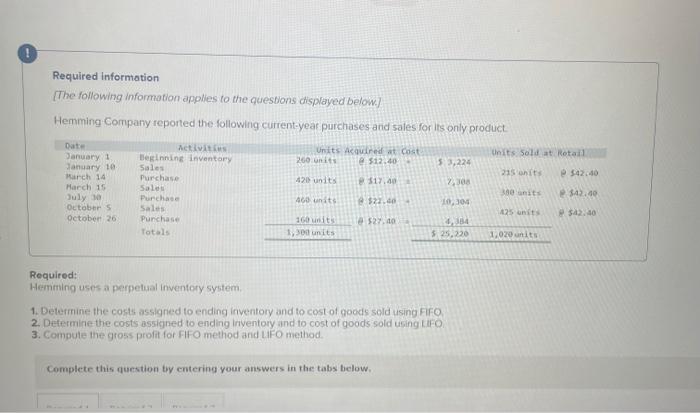

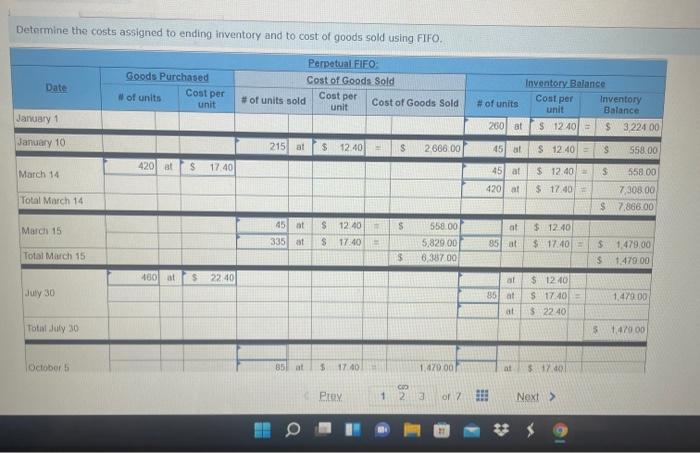

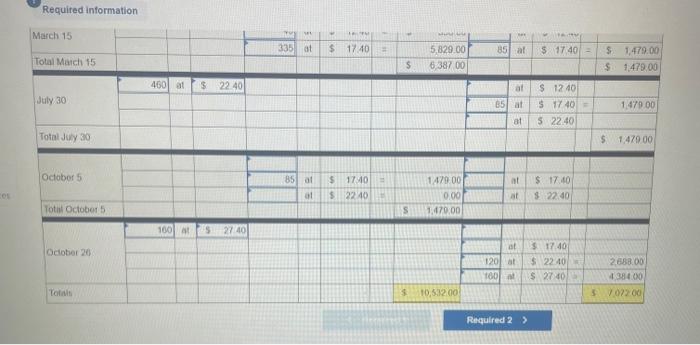

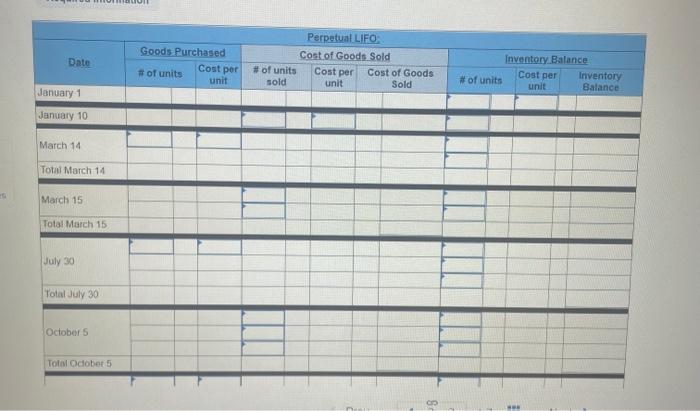

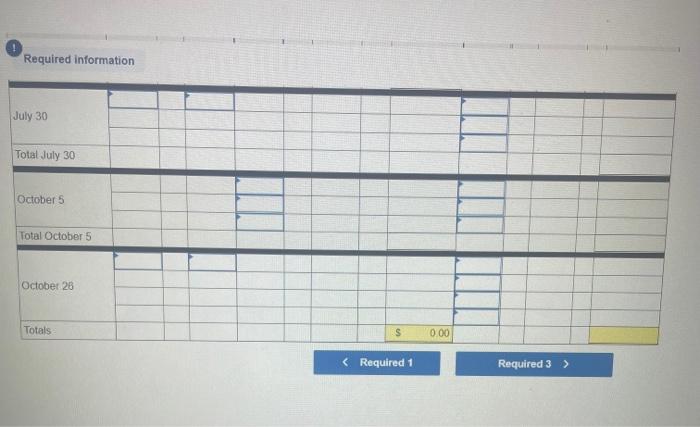

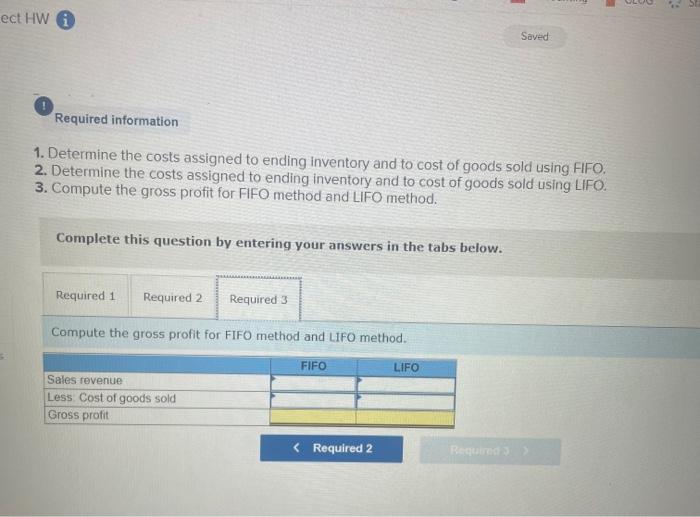

Required information The following information applies to the questions displayed below) Hemming Company reported the following current year purchases and sales for its only product Date activities Units Aequired at cost Unit Sold at Retail January 1 Beginning inventory 260 unit $12.40 $1,224 January 10 Sales 215 units March in Purchase 420 unit $12.00 7.300 March Sale 180 unit 542:40 July Purcha 40 unit 52240 10,104 October Sales 425 unit 5:40 October 26 Purchase 160 units 12:40 Total 1,300 units $ 25,220 1,028 its Required: Hemming wes a perpetuat inventory system 1. Determine the costs assigned to ending inventory and to cost of goods sold Using FFO 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO 3. Compute the grows pralt for FIFO method and UFO method Complete this question by entering your answers in the tabs below: Wed Required information Required 1 Required 2 Required 3 Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetunt FIFO: Goods Purchased Cost of Goods Sold Date # of units Cost per #of units sold Cost per unit unit Cost of Goods Sold January 1 January 10 215 5 12.40 $ 2,66000 42011 $ 1740 March 14 Inventory Balance w of units Cost per Inventory unit Balance 260 $ 12.405 322400 45 at $ 12.40 5 55800 $ 12.40 45 at 420 at $ 1740 s 550.00 7,300.00 57.368.00 Total Minch 14 5 at March 15 4501 3351 51240 1740 638 00 5,629.00 0,337.00 51240 $ 1740 85 S147000 $1470.00 Ton March 15 5 2005 2240 al July 30 65 $12.40 51710 5.22.40 1.47000 TO JUL 00 5470.00 Required information Total March 14 $ 786600 451 March 15 - $ $ 12.40 $ 1740 558.00 5,829 00 6,387.00 al 85 at $ 12.40 $17.40 335 at Total March 15 S $ 1.470.00 S1479.00 460 at $ 2240 al July 30 85 at 5 12 40 5 17.40 $ 2240 1.47900 at Total July 30 $ 1.479.00 October al 05 al al $17.40 $ 22:40 1.470.00 000 1.470.00 5 17.40 5 22.40 al Total October 3 1601 at $ 27.40 October 20 ut 120 at 160 t 51740 52240 $27.40 = 2,06800 438400 57072.00 Total $ 10.532.00 Goods Purchased Date Perpetual LIFO Cost of Goods Sold #of units Cost per Cost of Goods sold unit Sold Cost per Inventory Balance Cost per Inventory # of units unit Balance # of units unit January 1 January 10 March 14 Total March 14 March 15 Total March 15 July 30 Total July 30 October 5 Total October 5 Required information March 15 Total March 15 July 30 Total July 30 October 5 Total October 5 October 26 Totals $ 0.00 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the gross profit for FIFO method and LIFO method. FIFO LIFO Sales revenue Loss Cost of goods sold Gross profit ! Required information (The following information applies to the questions displayed below.) Hemming Company reported the following current-year purchases and sales for its only product Units Acquired at cost 260 units @ $12.40 Units Sold at Retail 53,224 215 units 542.40 Date January 1 January 10 march 14 March 15 July October 5 October 26 420 units $17.40 2. Activities Beginning Inventory Sales Purchase Sales Purchase Sales Purchase Totals 30 nits $43.40 460 units $22.00 10.30 25 unit $12.40 16its 1,30 units $27.40 14 5.25,220 12020 units Required: Hemming uses a perpetual inventory system, 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO 2. Determine the costs assigned to ending Inventory and to cost of goods sold using LFO 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Date Goods Purchased Cost per of units unit Perpetual FIFO Cost of Goods Sold Cost per # of units sold Cost of Goods Sold unit Inventory Balance Cost per Inventory #of units unit Balance 200 at $ 12.40 = $3224 00 January 1 January 10 215 at $ 12.40 S 2666.00 45 al S 12.40 = S 558.00 420al $ 17.40 March 14 S 558 00 45 at 420 at $ 12.40 $ 12.40 Total March 14 7 308.00 $ 7,866.00 S 12.40 S March 15 45 335 at at 85 at 558.00 5,829.00 6,38700 $ 12.40 $ 17:40 $ 17.40 Total March 15 $ 51.479.00 S1479.00 1801 $ 22.40 al July 30 85 at $ 12.40 S 17:40 $ 2240 1.470.00 = Tots July 30 5 1.47000 Octobort 851a $ 17:40 1.470.00 $ 170 Proy 1 COP 2 a of !!! Next > Required information March 15 335 at $17.40 85) at $ 1740 Total March 15 5,829.00 6,387 00 $ 1,479.00 $1479.00 $ 4601 at $22.40 July 30 ar 85 at $ 12.40 $ 1740 5 22 40 1479.00 at Total July 30 $ 1.479.00 October 5 85 at $ 1740 $ 2240 1420.00 0.00 S 1.170.00 at at $ 17.00 $ 22.40 Os Total October 5 100 5 27401 October 20 ot 1201 at 180 $17.40 $ 22.40 $ 270 2688.00 438400 57.022.00 Totius $ 10,512.00 Required 2 > Date Goods Purchased Cost per # of units unit Perpetual LIFO Cost of Goods Sold #of units Cost per Cost of Goods sold unit Sold Inventory Balance Inventory #of units unit Balance Cost per January 1 January 10 March 14 Total March 14 - March 15 Total March 15 July 30 Total July 30 October 5 Total October 5 Required information July 30 Total July 30 October 5 Total October 5 October 28 Totals $ 0.00 ect HW Saved Required information 1. Determine the costs assigned to ending Inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the gross profit for FIFO method and LIFO method. FIFO LIFO Sales revenue Less Cost of goods sold Gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts