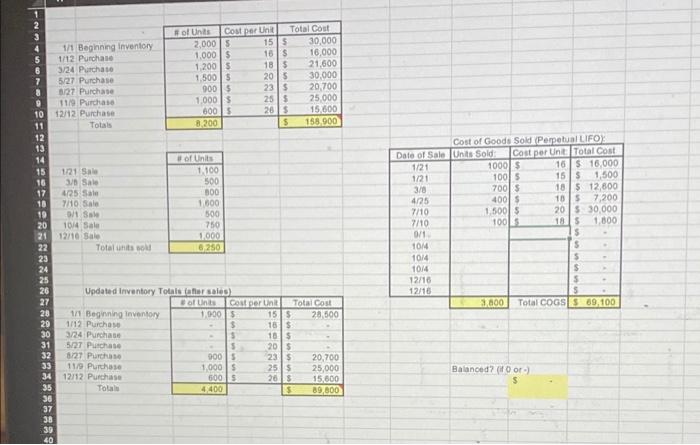

Question: help finding the COGS using the LIFO Method 17 21 2 Date Description 3 1/1 BEGINNING BALANCES 4 1/8 Indiana pays off the beginning sa

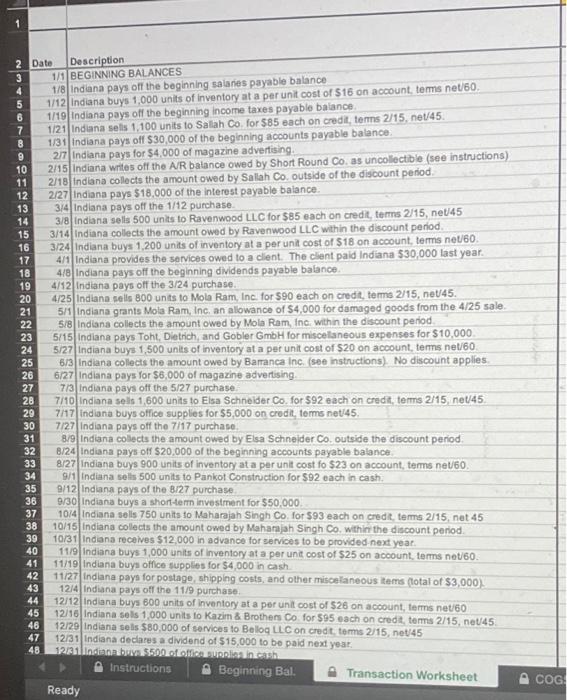

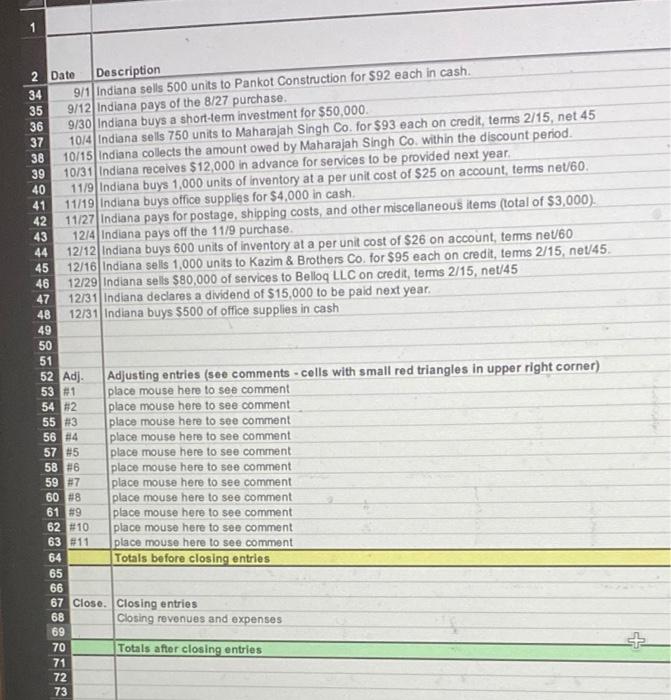

17 21 2 Date Description 3 1/1 BEGINNING BALANCES 4 1/8 Indiana pays off the beginning sa lanes payable balance 5 1/12 Indiana buys 1,000 units of inventory at a per unit cost of $16 on account terms net/60 6 1/19 Indiana pays off the beginning income taxes payablo balance 1/21 Indiana sels 1,100 units to Salah Co. for $85 each on credit, terms 2/15, net/45 8 1/31 Indiana pays off $30,000 of the beginning accounts payable balance 277 Indiana pays for $4,000 of magazine advertising 10 2/15 Indiana writes off the A/R balance owed by Short Round Co. as uncollectible (see instructions) 11 2/18 Indiana collects the amount owed by Salah Co. outside of the discount period 12 2/27 Indiana pays $18,000 of the interest payable balance. 13 3/4 Indiana pays off the 1/12 purchase 14 3/8 Indiana selis 500 units to Ravenwood LLC for $85 each on credit, terms 2/15 net45 15 3/14 Indiana collects the amount owed by Ravenwood LLC within the discount period 16 3/24 Indiana buys 1.200 units of inventory at a per un cost of $18 on account, terms net/60 4/1 Indiana provides the services owed to a client. The client paid Indiana $30,000 last year. 18 4/8 Indiana pays off the beginning dividends payable balance 19 4/12 Indiana pays off the 3/24 purchase. 20 4/25 Indiana sells 800 units to Mola Ram, Inc. for $90 each on credit, torms 2/15, net/45. 5/1 Indiana grants Mola Ram, Inc. an allowance of $4,000 for damaged goods from the 4/25 sale 22 5/8 Indiana collects the amount owed by Mola Ram, Inc. within the discount period 23 5/15 Indiana pays Toht, Dietrich and Gobler GmbH for miscellaneous expenses for $10,000 24 5/27 Indiana buys 1,500 units of inventory at a per unit cost of $20 on account, terms nel/60 25 6/3 Indiana collects the amount owed by Barranca Inc. (see instructions). No discount applies 26 6/27 Indiana pays for $6,000 of magazine advertising 27 7/3 Indiana pays off the 5/27 purchase 28 7/10 Indiana seis 1,600 units to Elsa Schneider Co. for $92 each on credit, terms 2015, net/45 7/17 indiana buys office supplies for $5,000 on credit, terms net45. 30 7/27 Indiana pays off the 7/17 purchase. 8/9 Indiana collects the amount owed by Elsa Schneider Co. outside the discount period 32 8/24 Indiana pays off $20,000 of the beginning accounts payable balance 8/27 Indiana buys 900 units of inventory ata per unit cost fo $23 on account, ters net/60 34 9/1 Indiana sols 500 units to Pankot Construction for $92 each in cash. 35 9/12 Indiana pays of the 8/27 purchase 36 9/30 Indiana buys a short-term investment for $50,000 37 1074 Indiana sells 750 units to Maharajah Singh Co for $93 each on credit, tems 2/15, net 45 38 10/15 Indiana colects the amount owed by Maharajah Singh Co. within the discount period. 39 10/31 Indiana receives $12,000 in advance for services to be provided next year. 40 11/0 Indiana buys 1,000 units of Inventory at a per unit cost of $25 on account, terms net/60 11/19 Indiana buys office supplies for $4,000 in cash 11/27 Indiana pays for postage shipping costs, and other miscellaneous tems (total of $3,000) 43 12/4 Indiana pays off the 11/9 purchase 44 12/12 Indiana buys 600 units of inventory at a per unit cost of $26 on account, terms net/60 45 12/16 Indiana sols 1.000 units to Kazim & Brothers Co for $95 each on creda, terms 2/15, net45 46 12/20 Indiana sels $80,000 of services to Bello LLC on credt, terms 2/15, net:45 47 12/31 Indiana declares a dividend of $15,000 to be paid next year. 48 12500ftonesh Instructions Beginning Bal. Transaction Worksheet Ready 29 31 33 41 42 COG! 2 Date Description 34 9/1 Indiana sells 500 units to Pankot Construction for $92 each in cash. 35 9/12 Indiana pays of the 8/27 purchase. 36 9/30 Indiana buys a short-term investment for $50,000 37 10/4 Indiana sells 750 units to Maharajah Singh Co. for $93 each on credit, terms 2/15, net 45 38 10/15 Indiana collects the amount owed by Maharajah Singh Co. within the discount period 39 10/31 Indiana receives $12,000 in advance for services to be provided next year 40 11/9 Indiana buys 1,000 units of Inventory at a per unit cost of $25 on account, terms net/60. 41 11/19 Indiana buys office supplies for $4,000 in cash 42 11/27 Indiana pays for postage, shipping costs, and other miscellaneous items (total of $3,000). 43 12/4 Indiana pays off the 11/9 purchase 44 12/12 Indiana buys 600 units of inventory at a per unit cost of $26 on account, tems net/60 45 12/16 Indiana sels 1,000 units to Kazim & Brothers Co. for $95 each on credit, tems 2/15, net/45 46 12/29 Indiana selis $80,000 of services to Belloq LLC on credit, terms 2/15, net/45 47 12/31 Indiana declares a dividend of $15,000 to be paid next year. 48 12/31 Indiana buys $500 of office supplies in cash 49 50 51 52 Adj. Adjusting entries (see comments - cells with small red triangles in upper right corner) 53 #1 place mouse here to see comment 54 #2 place mouse here to see comment 55 #3 place mouse here to see comment 56 64 place mouse here to see comment 57 #5 place mouse here to see comment 58 #6 place mouse here to see comment 59 #7 place mouse here to see comment 60 #8 place mouse here to see comment 61 #9 place mouse here to see comment 62 #10 place mouse here to see comment 63 11 place mouse here to see comment 64 Totals before closing entries 65 66 67 Close Closing entries Closing revenues and expenses 69 70 Totals after closing entries 71 72 73 68 1 2 3 5 6 1/1 Beginning inventory 1/12 Purchase 3/24 Purchase 5/27 Purchase 127 Purchase 11/9 Purchase 12/12 Purchase Totais Bol Units Cost per Unit Total Cost 2,000 $ 153 30.000 1,000 $ 18 19 16,000 1.2005 1815 21,600 1.500 5 2015 30,000 900 $ 23 $ 20.700 1.000 $ 25 25.000 6005 265 15,600 8.200 $ 158.000 11 13 1:21 Sale 3 Sale 425 Sale 7/10 Sale WS 1014 Sale 12/10 Sale Total units ou of Units 1.100 500 300 1600 500 750 1,000 6250 10 12 10 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Cost of Good Sold Perpetual LIFO) Date of Sale Units Sold Cost per Unt Total Cost 1/21 1000$ 16 S 16,000 1/21 10015 15$ 1,500 3/8 70015 18 $ 12,800 4/25 400 s 185 7,200 7/10 1.500 5 20 $30,000 7/10 10015 1815 1,800 0/1 $ 10M $ 1014 $ 1014 $ 12/10 5 12/16 5 3,800 Total COGS S 89.100 Updated Inventory Totals after sales) of Units Coster Unit Total Cost 1/1 Beginning inventory 1,9005 15S 28,500 1112 Purchase $ 15$ 3/24 Purchase $ 1815 5/27 Purchase $ 2015 8/27 Purchase 9005 235 20,700 11/9 Purchase 1 000 $ 25 s 25,000 12/12 Purchase 6005 20$ 15,800 Total 4,400 S 89,800 Balanced for S 34 35 36 37 38 39 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts