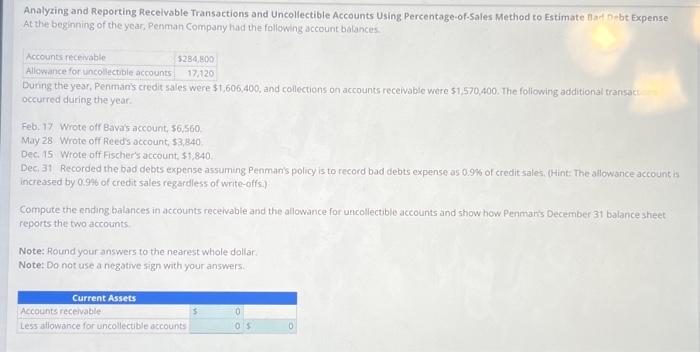

Question: help finiding answer and understanding! Analyzing and Reporting Receivable Transactions and Uncollectible Accounts Using Percentage-of-Sales Method to Estimate Barf n-bt Expense. At the beginning of

Analyzing and Reporting Receivable Transactions and Uncollectible Accounts Using Percentage-of-Sales Method to Estimate Barf n-bt Expense. At the beginning of the year, Penman Company had the fallewing ictount batances Dunng the yes, Penman's credit sales were $1,606,400, and collections on accounts receivable were $1,570,400, The following additional transact occurred during the year. Feb. 17 Wrote off Bavis account, $6,560. May 28 Wrote off Reeds account, $3,840. Dec. 15 Wrote off Fischer's account, $1,840. Dec. 31 Recorded the bad debts expense assuming Penman's policy is to record bad debts expense as 0.9% of credit sales. (Hint: The allowance account is increased by 0.996 of credit sales regardless of write-offsi) Compute the ending batances in accounts receivable and the allowance for uncollectible accounts and show how Penmain's December 31 balance sheet reports the two accounts. Note: Round your answers to the nearest whole dollar. Note: Do not use a negative sign with your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts