Question: Help for C? Problem 2 (30 points) A company that manufactures amplified pressure transducers wishes to decide between the machines shown-variable speed (VS) and dual

Help for C?

Help for C?

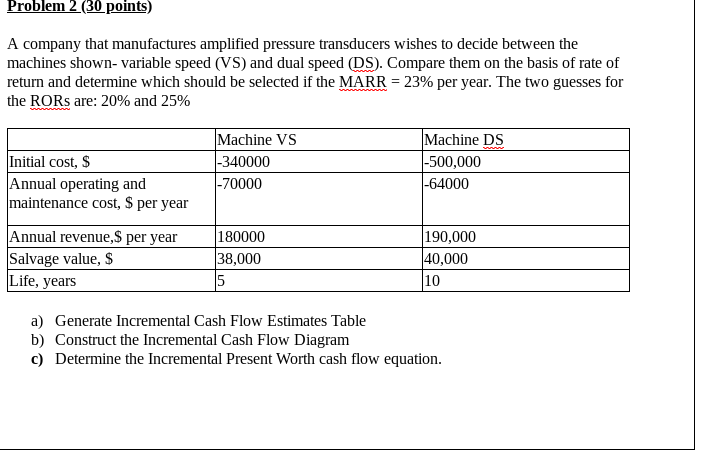

Problem 2 (30 points) A company that manufactures amplified pressure transducers wishes to decide between the machines shown-variable speed (VS) and dual speed (DS). Compare them on the basis of rate of return and determine which should be selected if the MARR = 23% per year. The two guesses for the RORs are: 20% and 25% Initial cost, $ Annual operating and maintenance cost, $ per year Machine VS -340000 -70000 Machine DS -500,000 |-64000 Annual revenue, $ per year Salvage value, $ Life, years 180000 38,000 190,000 40,000 10 a) Generate Incremental Cash Flow Estimates Table b) Construct the Incremental Cash Flow Diagram c) Determine the Incremental Present Worth cash flow equation. Problem 2 (30 points) A company that manufactures amplified pressure transducers wishes to decide between the machines shown-variable speed (VS) and dual speed (DS). Compare them on the basis of rate of return and determine which should be selected if the MARR = 23% per year. The two guesses for the RORs are: 20% and 25% Initial cost, $ Annual operating and maintenance cost, $ per year Machine VS -340000 -70000 Machine DS -500,000 |-64000 Annual revenue, $ per year Salvage value, $ Life, years 180000 38,000 190,000 40,000 10 a) Generate Incremental Cash Flow Estimates Table b) Construct the Incremental Cash Flow Diagram c) Determine the Incremental Present Worth cash flow equation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts