Question: help help asap help please Question 24 (2 points) Staff underwriters periodically review and update rates and rating plans. Which of the criteria below is

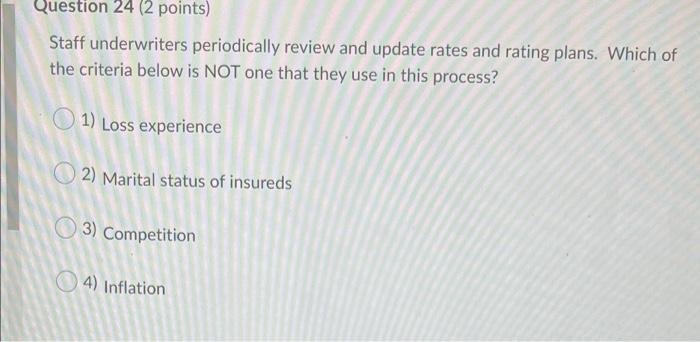

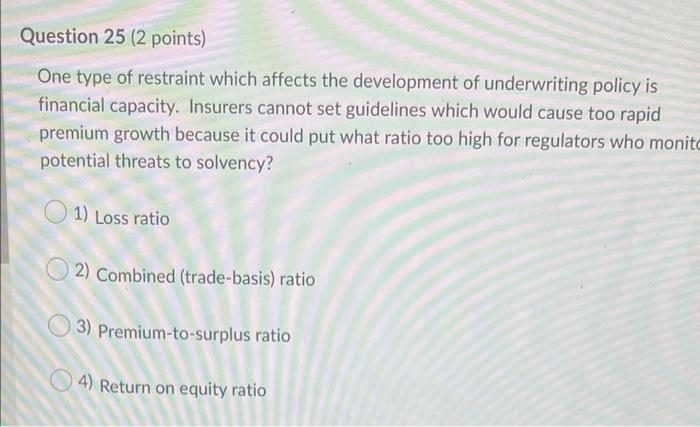

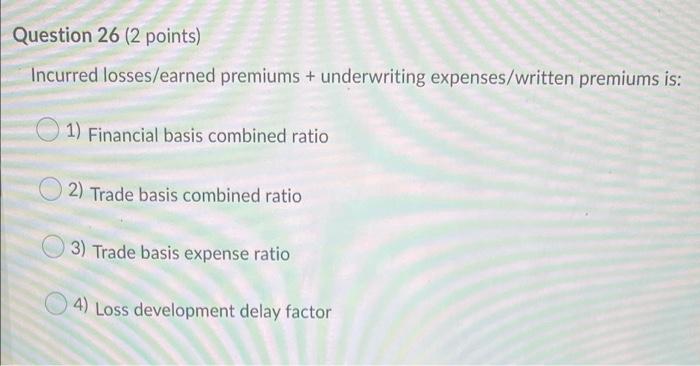

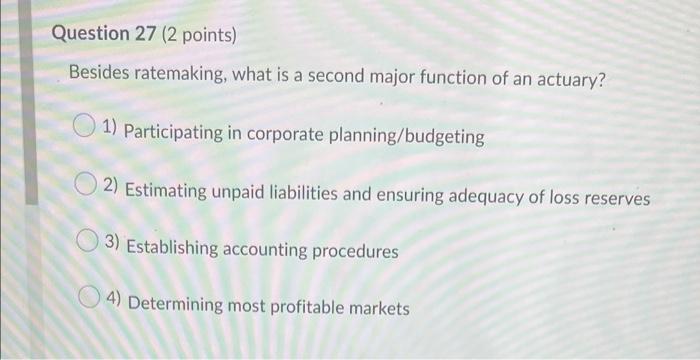

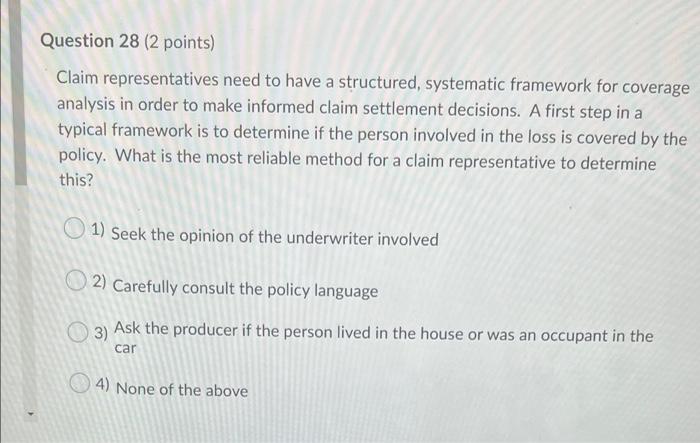

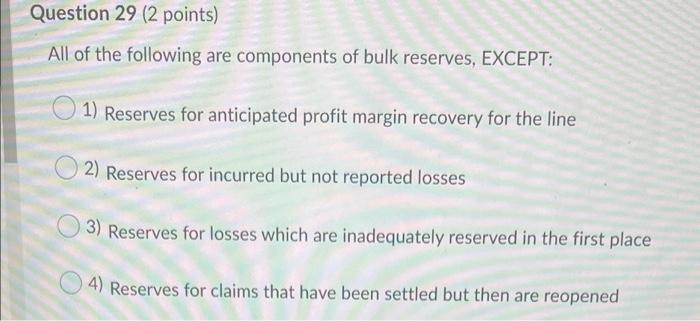

Question 24 (2 points) Staff underwriters periodically review and update rates and rating plans. Which of the criteria below is NOT one that they use in this process? 1) Loss experience 2) Marital status of insureds 3) Competition 4) Inflation Question 25 (2 points) One type of restraint which affects the development of underwriting policy is financial capacity. Insurers cannot set guidelines which would cause too rapid premium growth because it could put what ratio too high for regulators who monito potential threats to solvency? 1) Loss ratio 2) Combined (trade-basis) ratio 3) Premium-to-surplus ratio 4) Return on equity ratio Question 26 (2 points) Incurred losses/earned premiums + underwriting expenses/written premiums is: 1) Financial basis combined ratio 2) Trade basis combined ratio 3) Trade basis expense ratio 4) Loss development delay factor Question 27 (2 points) Besides ratemaking, what is a second major function of an actuary? 1) Participating in corporate planning/budgeting 2) Estimating unpaid liabilities and ensuring adequacy of loss reserves 3) Establishing accounting procedures 4) Determining most profitable markets Question 28 (2 points) Claim representatives need to have a structured, systematic framework for coverage analysis in order to make informed claim settlement decisions. A first step in a typical framework is to determine if the person involved in the loss is covered by the policy. What is the most reliable method for a claim representative to determine this? 1) Seek the opinion of the underwriter involved 2) Carefully consult the policy language 3) Ask the producer if the person lived in the house or was an occupant in the car 4) None of the above Question 29 (2 points) All of the following are components of bulk reserves, EXCEPT: 1) Reserves for anticipated profit margin recovery for the line 2) Reserves for incurred but not reported losses 3) Reserves for losses which are inadequately reserved in the first place 4) Reserves for claims that have been settled but then are reopened

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts