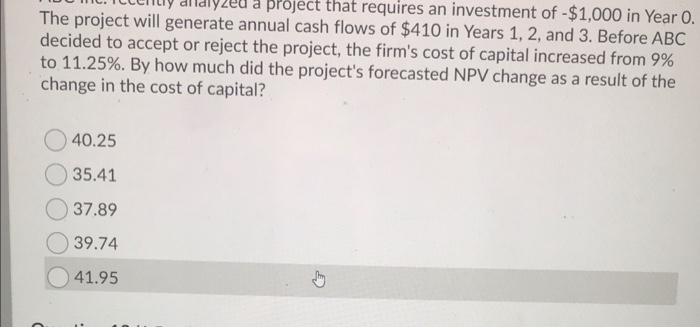

Question: help help ASAP PLEASE please a project that requires an investment of - $1,000 in Year 0. The project will generate annual cash flows of

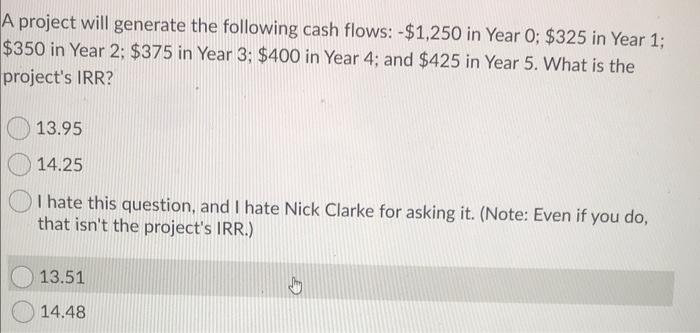

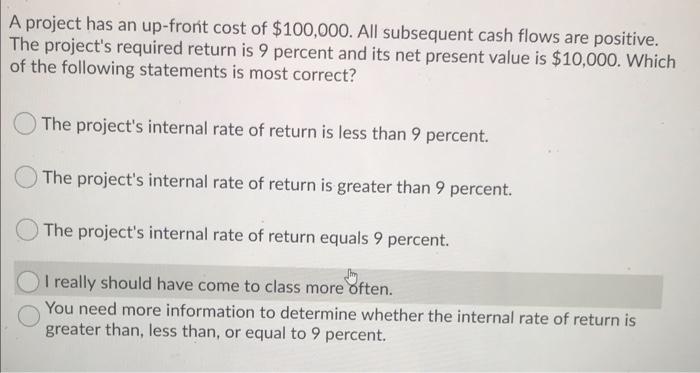

a project that requires an investment of - $1,000 in Year 0. The project will generate annual cash flows of $410 in Years 1, 2, and 3. Before ABC decided to accept or reject the project, the firm's cost of capital increased from 9% to 11.25%. By how much did the project's forecasted NPV change as a result of the change in the cost of capital? 40.25 35.41 37.89 39.74 41.95 C A project will generate the following cash flows: - $1,250 in Year 0; $325 in Year 1; $350 in Year 2: $375 in Year 3; $400 in Year 4; and $425 in Year 5. What is the project's IRR? 13.95 14.25 I hate this question, and I hate Nick Clarke for asking it. (Note: Even if you do, that isn't the project's IRR.) 13.51 14.48 A project has an up-front cost of $100,000. All subsequent cash flows are positive. The project's required return is 9 percent and its net present value is $10,000. Which of the following statements is most correct? The project's internal rate of return is less than 9 percent. The project's internal rate of return is greater than 9 percent. The project's internal rate of return equals 9 percent. I really should have come to class more often. You need more information to determine whether the internal rate of return is greater than, less than, or equal to 9 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts