Question: Help help help ASAP please please please please a Inc. estimates that its average-risk projects have a cost of capital of 10%, its below-average risk

Help help help ASAP please please please please

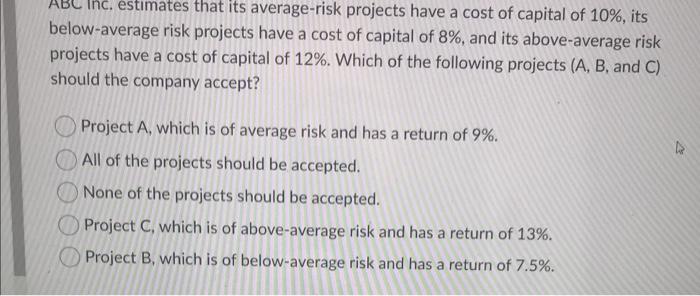

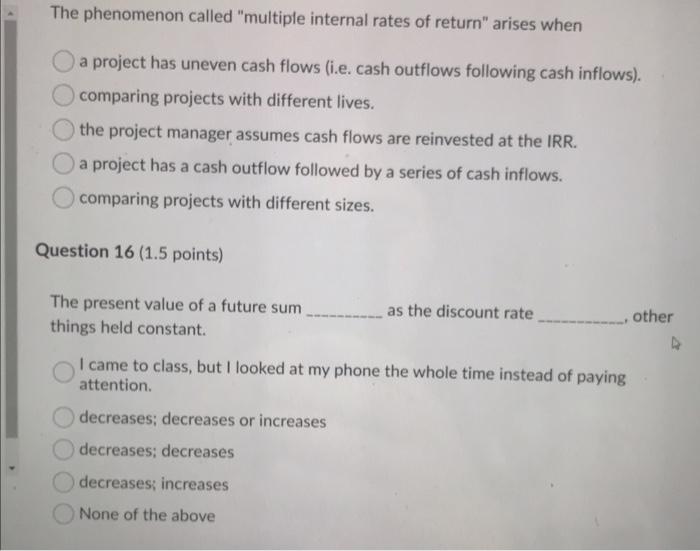

a Inc. estimates that its average-risk projects have a cost of capital of 10%, its below-average risk projects have a cost of capital of 8%, and its above-average risk projects have a cost of capital of 12%. Which of the following projects (A, B, and C) should the company accept? V Project A, which is of average risk and has a return of 9%. All of the projects should be accepted. None of the projects should be accepted. Project C, which is of above-average risk and has a return of 13%. Project B, which is of below-average risk and has a return of 7.5%. The phenomenon called "multiple internal rates of return" arises when a project has uneven cash flows (i.e. cash outflows following cash inflows). comparing projects with different lives. the project manager assumes cash flows are reinvested at the IRR. a project has a cash outflow followed by a series of cash inflows. comparing projects with different sizes. Question 16 (1.5 points) The present value of a future sum as the discount rate other things held constant. I came to class, but I looked at my phone the whole time instead of paying attention decreases; decreases or increases decreases; decreases decreases: increases None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts