Question: Help help help ASAP please please please please Consider two stocks, 1 and 2. Separately for each stock, you plot the stock's excess return (y-axis)

Help help help ASAP please please please please

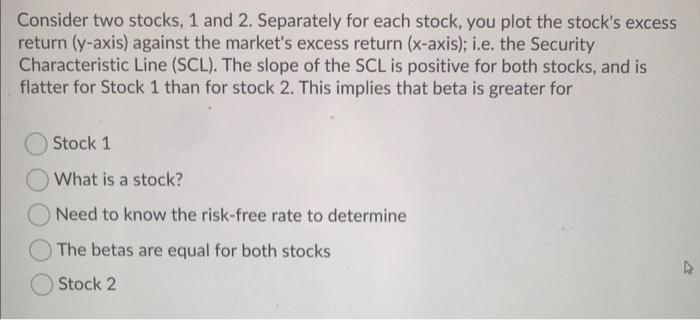

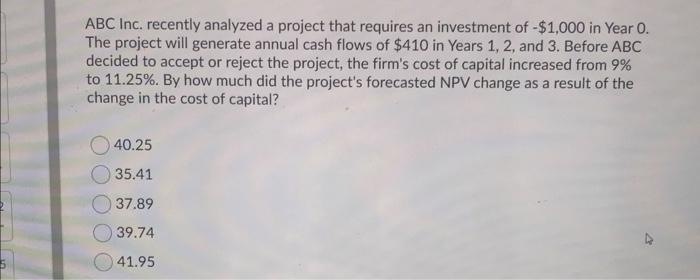

Consider two stocks, 1 and 2. Separately for each stock, you plot the stock's excess return (y-axis) against the market's excess return (x-axis); i.e. the Security Characteristic Line (SCL). The slope of the SCL is positive for both stocks, and is flatter for Stock 1 than for stock 2. This implies that beta is greater for Stock 1 What is a stock? Need to know the risk-free rate to determine The betas are equal for both stocks Stock 2 ABC Inc. recently analyzed a project that requires an investment of -$1,000 in Year 0. The project will generate annual cash flows of $410 in Years 1, 2, and 3. Before ABC decided to accept or reject the project, the firm's cost of capital increased from 9% to 11.25%. By how much did the project's forecasted NPV change as a result of the change in the cost of capital? 40.25 35.41 37.89 39.74 V 41.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts