Question: Help how do I do the second part? II. (25 points) Games & Games Company is a local merchandise company that buys and re-sells game

Help how do I do the second part?

Help how do I do the second part?

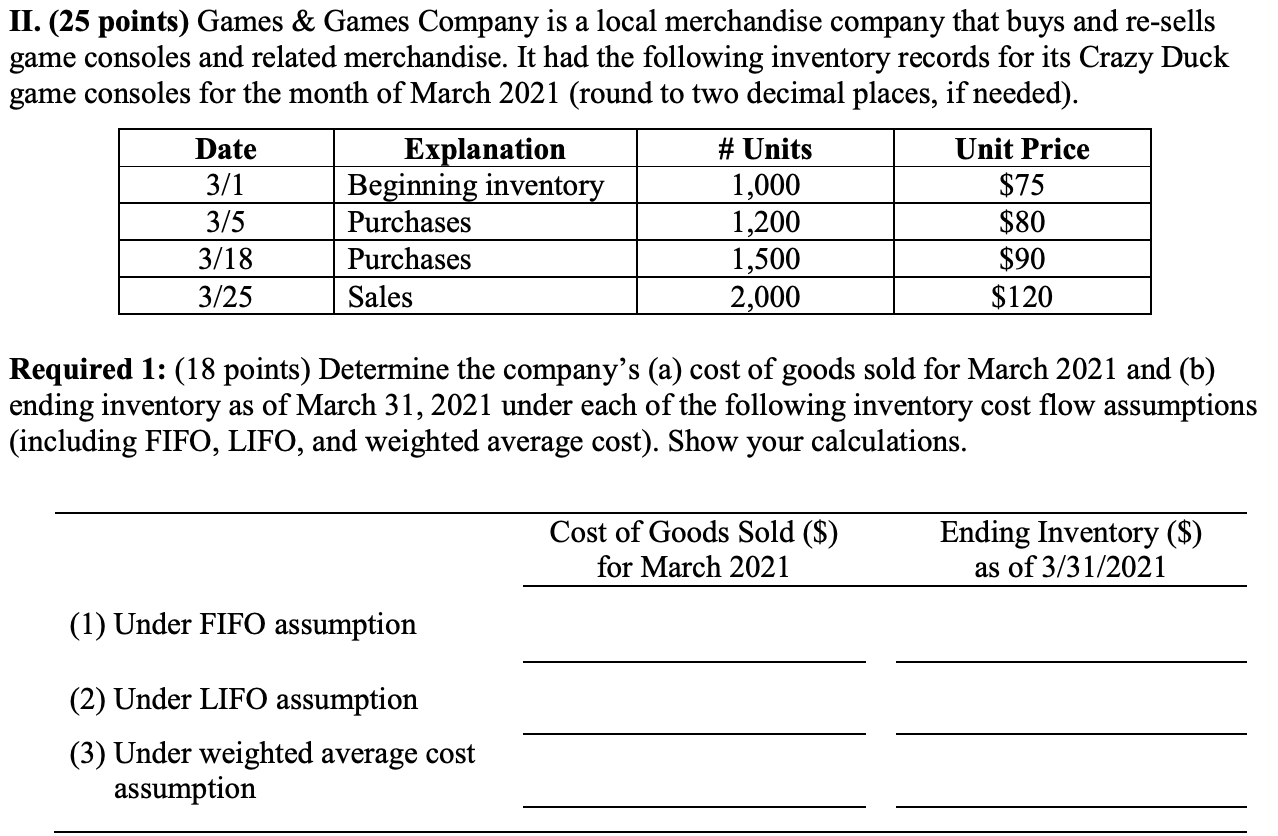

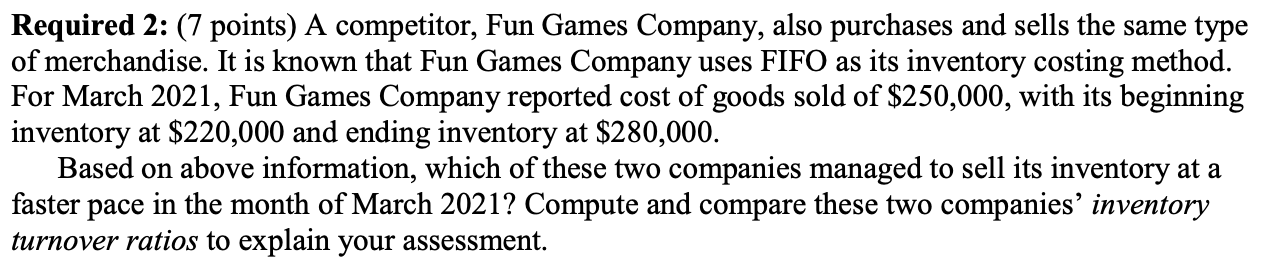

II. (25 points) Games & Games Company is a local merchandise company that buys and re-sells game consoles and related merchandise. It had the following inventory records for its Crazy Duck game consoles for the month of March 2021 (round to two decimal places, if needed). Date Explanation # Units Unit Price Beginning inventory 1,000 $75 3/5 Purchases 1,200 $80 3/18 Purchases 1,500 $90 3/25 Sales 2,000 $120 3/1 Required 1: (18 points) Determine the company's (a) cost of goods sold for March 2021 and (b) ending inventory as of March 31, 2021 under each of the following inventory cost flow assumptions (including FIFO, LIFO, and weighted average cost). Show your calculations. Cost of Goods Sold ($) for March 2021 Ending Inventory ($) as of 3/31/2021 (1) Under FIFO assumption (2) Under LIFO assumption (3) Under weighted average cost assumption Required 2: (7 points) A competitor, Fun Games Company, also purchases and sells the same type of merchandise. It is known that Fun Games Company uses FIFO as its inventory costing method. For March 2021, Fun Games Company reported cost of goods sold of $250,000, with its beginning inventory at $220,000 and ending inventory at $280,000. Based on above information, which of these two companies managed to sell its inventory at a faster pace in the month of March 2021? Compute and compare these two companies' inventory turnover ratios to explain your assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts