Question: HELP! HOW DO I DO THIS? Advantech, Inc is considering a new product. The company spent $200,000 to develop the product. The estimated life of

HELP! HOW DO I DO THIS?

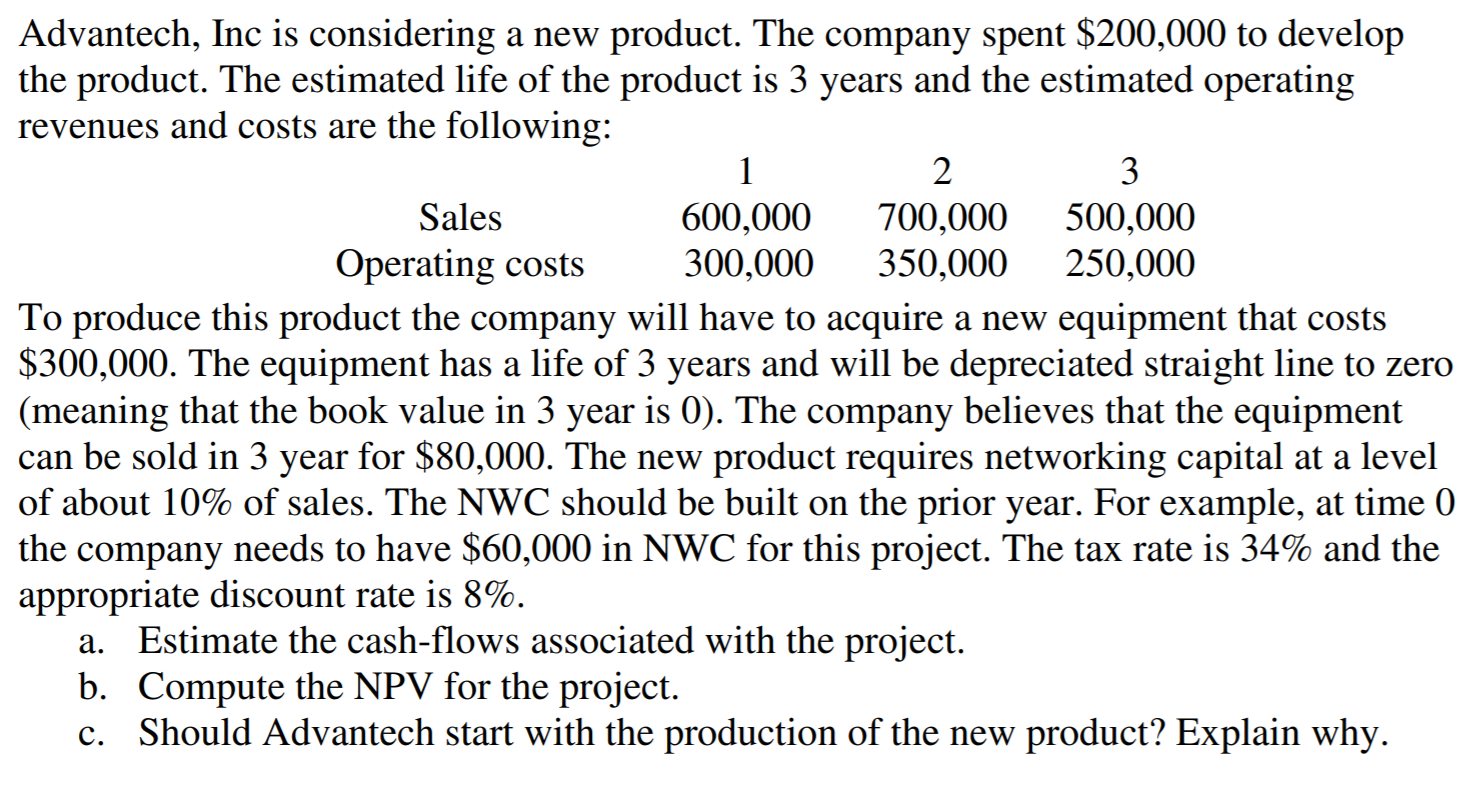

Advantech, Inc is considering a new product. The company spent $200,000 to develop the product. The estimated life of the product is 3 years and the estimated operating revenues and costs are the following: 1 2 3 Sales 600,000 700,000 500,000 Operating costs 300,000 350,000 250,000 To produce this product the company will have to acquire a new equipment that costs $300,000. The equipment has a life of 3 years and will be depreciated straight line to zero (meaning that the book value in 3 year is 0). The company believes that the equipment can be sold in 3 year for $80,000. The new product requires networking capital at a level of about 10% of sales. The NWC should be built on the prior year. For example, at time 0 the company needs to have $60,000 in NWC for this project. The tax rate is 34% and the appropriate discount rate is 8%. a. Estimate the cash-flows associated with the project. b. Compute the NPV for the project. Should Advantech start with the production of the new product? Explain why. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts