Question: Help!! I am in need of assitance with this problem. Please fill in the grey spaces and provide some details for the Dupont for 2019

Help!! I am in need of assitance with this problem.

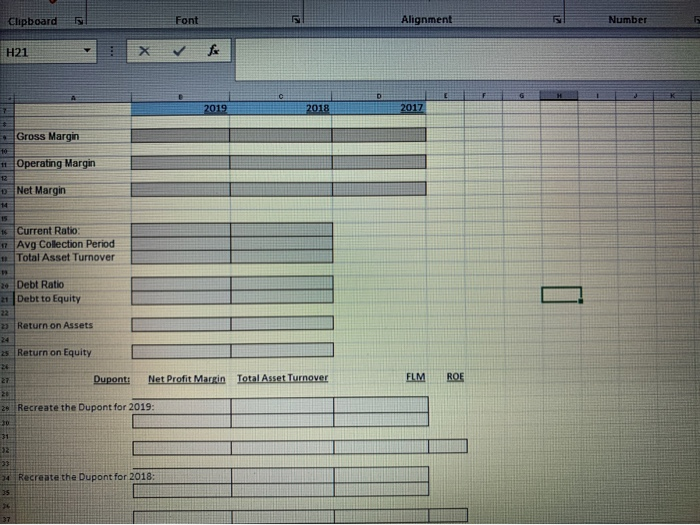

Please fill in the grey spaces and provide some details for the Dupont for 2019 & 2018

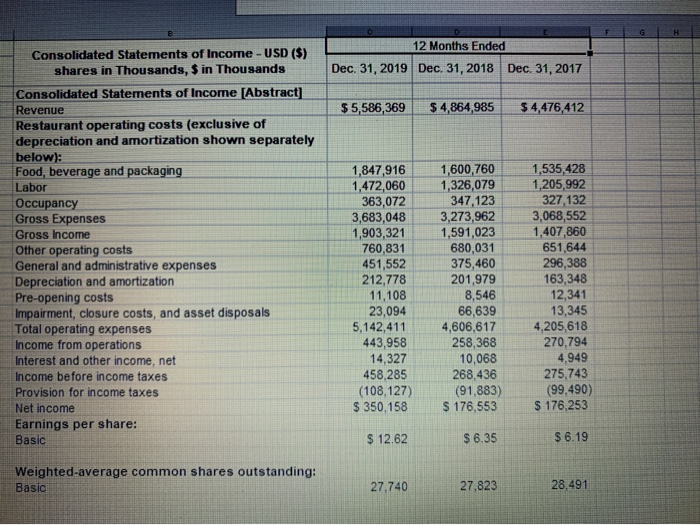

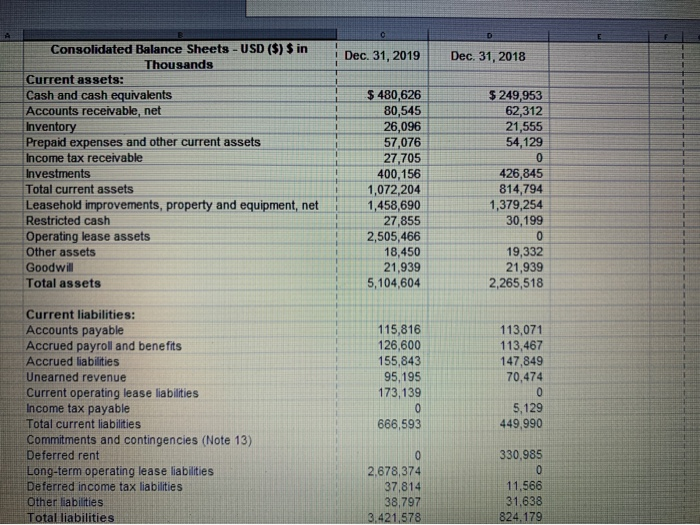

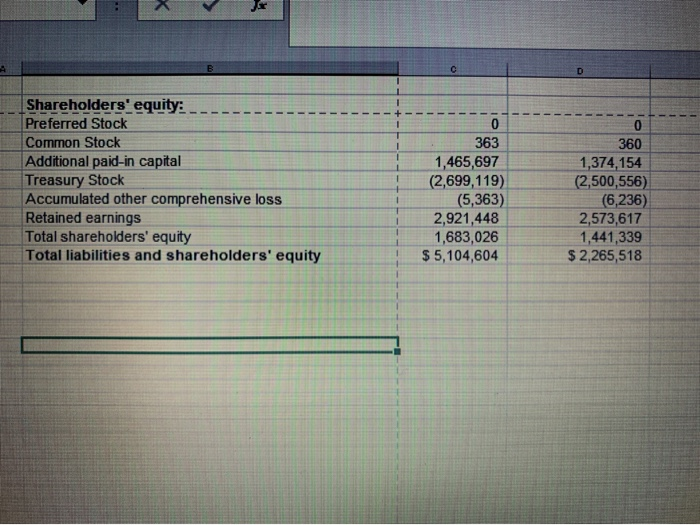

12 Months Ended Dec. 31, 2019 Dec. 31, 2018 Dec 31, 2017 $ 5,586,369 $4,864,985 $ 4,476,412 Consolidated Statements of Income - USD ($) shares in Thousands, $ in Thousands Consolidated Statements of Income [Abstract] Revenue Restaurant operating costs (exclusive of depreciation and amortization shown separately below): Food, beverage and packaging Labor Occupancy Gross Expenses Gross Income Other operating costs General and administrative expenses Depreciation and amortization Pre-opening costs Impairment, closure costs, and asset disposals Total operating expenses Income from operations Interest and other income, net Income before income taxes Provision for income taxes Net income Earnings per share: Basic 1,847,916 1,472,060 363,072 3,683,048 1,903,321 760,831 451,552 212,778 11,108 23,094 5,142,411 443,958 14,327 458,285 (108,127) $ 350,158 1,600,760 1,326,079 347,123 3,273,962 1,591,023 680,031 375,460 201,979 8,546 66,639 4,606,617 258,368 10,068 268,436 (91,883) $ 176,553 1,535,428 1,205,992 327,132 3,068,552 1,407,860 651,644 296,388 163,348 12,341 13,345 4,205,618 270,794 4,949 275,743 (99,490) $ 176,253 $ 12.62 $6.35 $ 6.19 Weighted average common shares outstanding: Basic 27,740 27,823 28,491 D 1 Shareholders' equity: Preferred Stock Common Stock Additional paid-in capital Treasury Stock Accumulated other comprehensive loss Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 1 0 360 1,374,154 (2,500,556) (6,236) 2,573,617 1,441,339 $ 2,265,518 363 1,465,697 (2,699,119) (5,363) 2,921,448 1,683,026 $ 5,104,604 1 1 1 Clipboard Font Alignment Number H21 X fx 2019 2018 2017 * Gross Margin 10 11 Operating Margin Net Margin 14 15 16 Current Ratio 12 Avg Collection Period 11 Total Asset Turnover 20 Debt Ratio 21 Debt to Equity 23 Return on Assets 24 25 Return on Equity FLM ROF 27 Dupont: Net Profit Margin Total Asset Turnover 21 29 Recreate the Dupont for 2019: 30 31 33 34 Recreate the Dupont for 2018: 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts