Question: HELP!!! I Can't figure out Requirement 5 ! Please note, eveything but number 5 has been verified and is correct. Thank you!! Tru Developers, Incorporated,

HELP!!! I Can't figure out Requirement Please note, eveything but number has been verified and is correct. Thank you!!

Tru Developers, Incorporated, sells plots of land for industrial development. Tru recognizes income for financial reporting purposes in the year it sells the plots. For some of the plots sold this year, Tru took the position that it could recognize the income for tax purposes when the installments are collected. Income that Tru recognized for financial reporting purposes in for plots in this category was $ million. The company expected to collect of each sale in and in This amount over the next two years is as follows:

$ millionmillion$ million

Trus pretax accounting income for was $ million. In its income statement, Tru reported interest income of $ million, unrelated to the land sales, for which the companys position is that the interest is not taxable. Accordingly, the interest was not reported on the tax return. There are no differences between accounting income and taxable income other than those described above. The enacted tax rate is percent.

Management believes the tax position taken on the land sales has a greater than chance of being upheld based on its technical merits, but the position taken on the interest has a less than chance of being upheld. It is further believed that the following likelihood percentages apply to the tax treatment of the land sales $ in millions:

Amount Qualifying for Installment Sales TreatmentPercentage Likelihood of Tax Treatment Being Sustained$

Required:

What portion of the tax benefit of taxfree interest will Tru recognize on its tax return?

What portion of the tax benefit of taxfree interest will Tru recognize on its financial statements?

a What portion of the tax on the $ million income from the plots sold on an installment basis will Tru defer on its tax return?

b What portion of the tax on the $ million income from the plots sold on an installment basis will Tru show as a deferred tax asset or liability in its financial statements?

Prepare the journal entry to record income taxes in assuming full recognition of the tax benefits in the financial statements of both differences between pretax accounting income and taxable income.

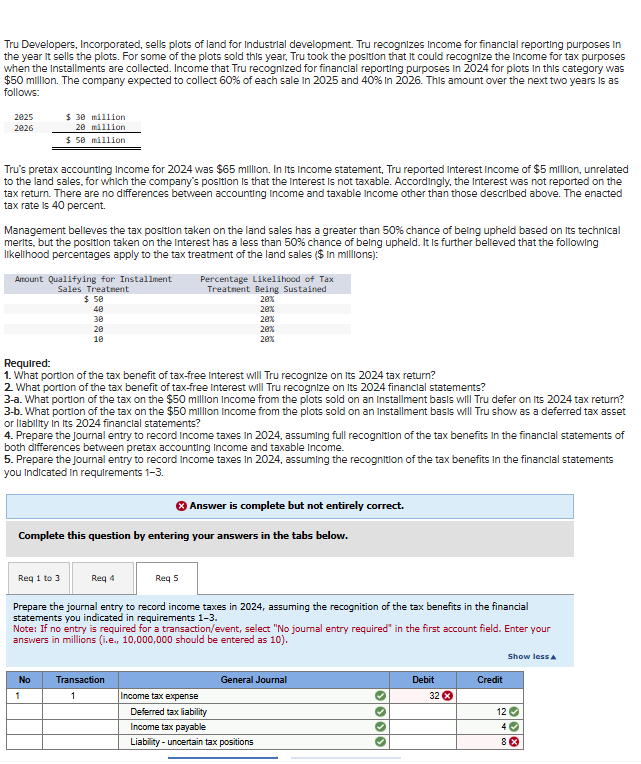

Prepare the journal entry to record income taxes in assuming the recognition of the tax benefits in the financial statements you indicated in requirements

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock