Question: help!! I know this is technically two problems but I ran out of question so please help if you can. I don't have anymore questions

help!! I know this is technically two problems but I ran out of question so please help if you can. I don't have anymore questions left!

help!! I know this is technically two problems but I ran out of question so please help if you can. I don't have anymore questions left!

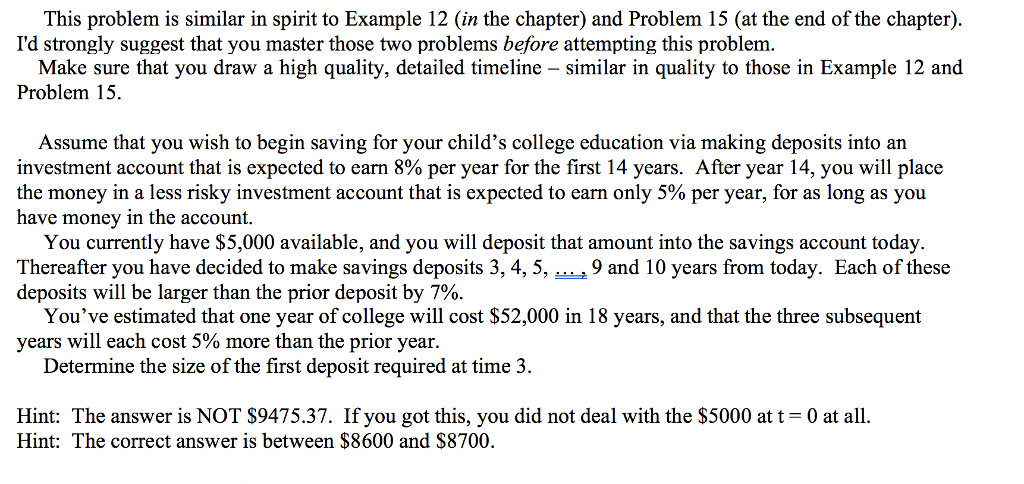

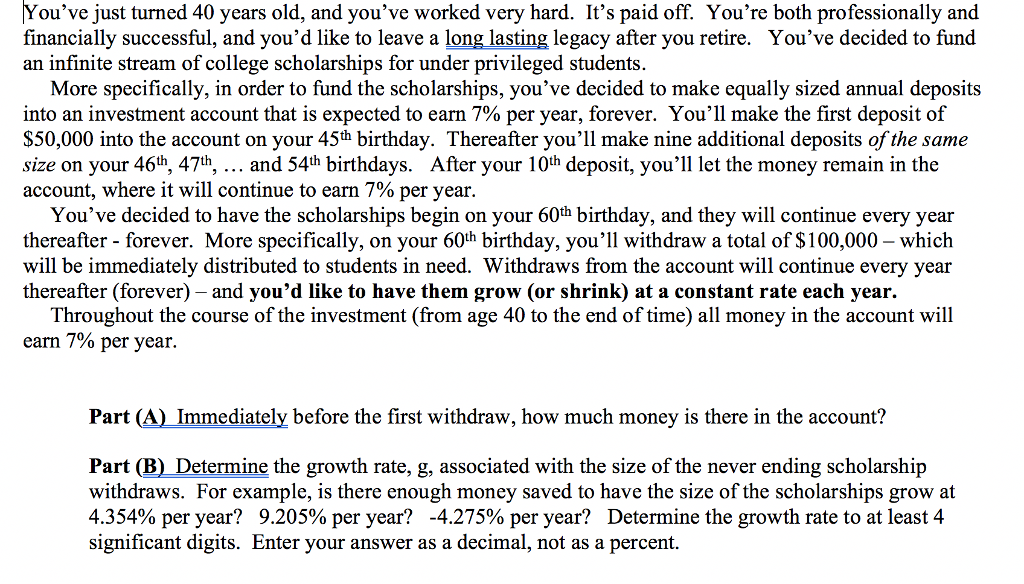

This problem is similar in spirit to Example 12 (in the chapter) and Problem 15 (at the end of the chapter). I'd strongly suggest that you master those two problems before attempting this problem Make sure that you draw a high quality, detailed timeline - similar in quality to those in Example 12 and Problem 15. Assume that you wish to begin saving for your child's college education via making deposits into an investment account that is expected to earn 8% per year for the first 14 years. After year 14, you will place the money in a less risky investment account that is expected to earn only 5% per year, for as long as you have money in the account. You currently have $5,000 available, and you will deposit that amount into the savings account today. Thereafter you have decided to make savings deposits 3, 4, 5, 9 and 10 years from today. Each of these deposits will be larger than the prior deposit by 7%. You've estimated that one year of college will cost $52,000 in 18 years, and that the three subsequent years will each cost 5% more than the prior year. Determine the size of the first deposit required at time 3. Hint: The answer is NOT S9475.37. If you got this, you did not deal with the $5000 at t 0 at all. Hint: The correct answer is between $8600 and $8700. You've just turned 40 years old, and you've worked very hard. It's paid off. You're both professionally and financially successful, and you'd like to leave a long lasting legacy after you retire. You've decided to fund an infinite stream of college scholarships for under privileged students. More specifically, in order to fund the scholarships, you've decided to make equally sized annual deposits into an investment account that is expected to earn 7% per year, forever. You'll make the first deposit of $50,000 into the account on your 45th birthday. Thereafter you'll make nine additional deposits of the same size on your 46th, 471h, and 54th birthdays. After your 10th deposit, you'll let the money remain in the account, where it will continue to earn 7% per year You've decided to have the scholarships begin on your 60th birthday, and they will continue every year thereafter - forever. More specifically, on your 60th birthday, you'll withdraw a total of $100,000 - which will be immediately distributed to students in need. Withdraws from the account will continue every year thereafter (forever) - and you'd like to have them grow (or shrink) at a constant rate each year. Throughout the course of the investment (from age 40 to the end of time) all money in the account will earn 7% per year Part (A) Immediately before the first withdraw, how much money is there in the account? Part (B) Determine the growth rate, g, associated with the size of the never ending scholarship withdraws. For example, is there enough money saved to have the size of the scholarships grow at 4.354% per year? 9.205% per year? -4.275% per year? Determine the growth rate to at least 4 significant digits. Enter your answer as a decimal, not as a percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts