Question: help!!! i need help with numbers 35-39 79 D 80 35 . Income taxes are to be computed at the rate of 25 percent of

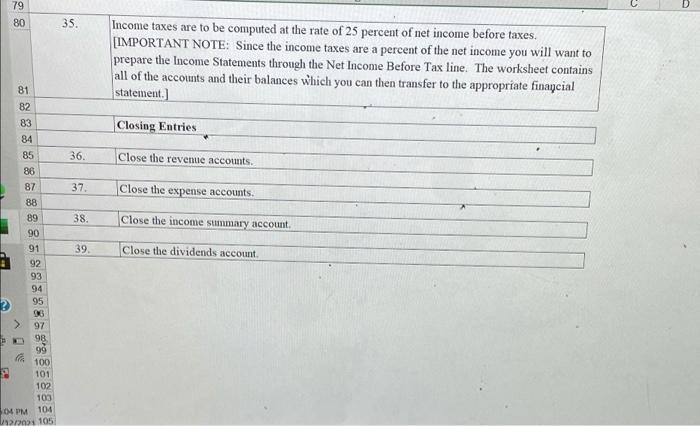

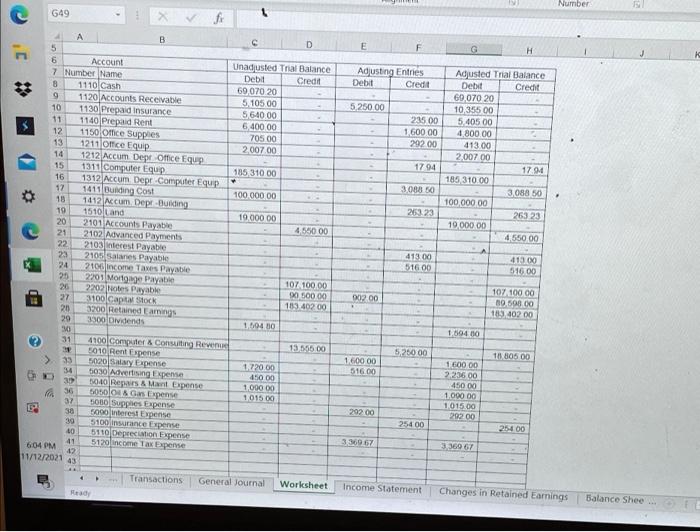

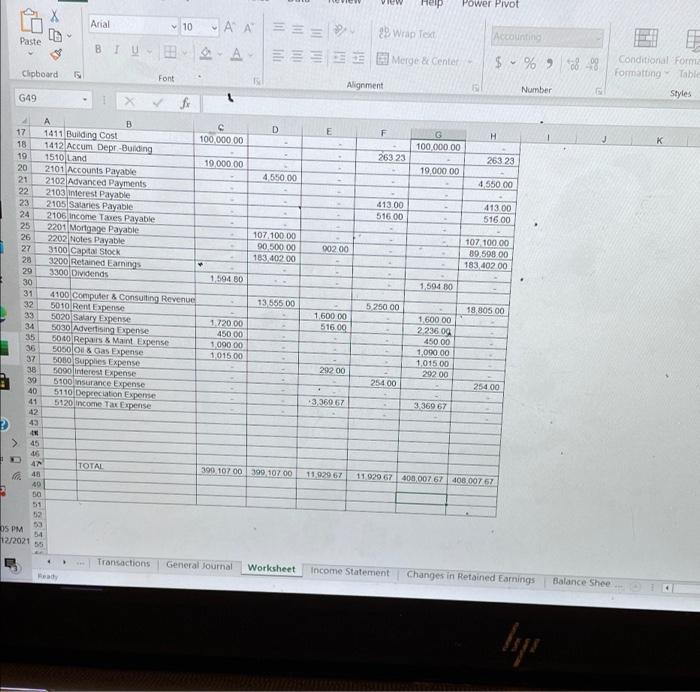

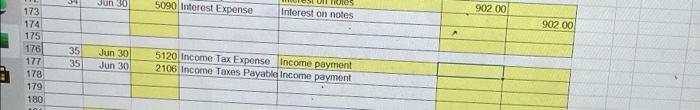

79 D 80 35 . Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate finaqcial statement.) 81 82 83 84 85 86 Closing Entries 36. Close the revenue accounts. 37. Close the expense accounts. 38. Close the income summary account 39. Close the dividends account. 87 88 89 90 91 92 93 94 95 36 > 97 99 100 101 102 103 OPM 104 27200 105 Number 649 E G H - Adjusting Entries Adjusted Trial Balance Debit Credit Debit Credit 60,070 20 5.250 00 10,35500 235.00 5.405 00 1.600.00 4.800 00 29200 41300 2007 00 1794 1794 185 310.00 3088 50 3.088 50 100,000.00 26323 263 23 19,000.00 4550 00 . A D 5 6 Account Unadjusted Trial Balance 7 Number Name Debit Credit 8 1110 Cash 69,070 20 9 1120 Accounts Receivable 5.105.00 10 1130 Prepaid insurance 5640.00 11 1140 Prepaid Rent 6400 00 12 1150 Office Supplies 705 00 13 1211 once Equip 2007 00 14 1212 Accum Dept Office Eque 15 1311 Computer Equip 185 310 00 16 1312 Accum Dept Computer Equip 12 1411 Buiding Cost 100 000 00 18 1412 Acum Depr-Building 19 1510 Land 19.000.00 20 2101 Accounts Payable 4.550 00 21 2102 Advanced Payments 22 2103 interest Payable 23 210 Laliar Pay theo 24 2106 income Taxes Payable 25 2209 Mortgage Payable 107,100.00 26 2202 Notes Payable 500.00 27 3100 captan Stock 103.40200 20 3200 Retained Earnings 29 3300 Didends 1.104 10 MO 31 4100 Computer & Consulting Revenue 13.555.00 5010 Rent Expense 33 5020 Salary Fxpense 1.720.00 34 5030 Advertising Expense 450 00 30 10:40 Repairs & Maunt Expense 1.000 00 36 Solo Gas Expense 101500 37 Sono Supplies Expense 0 30 5000 berest Expense 39 5100 insurance Expense 00 5110 Depreciation Expense 41 604 PM 512lincome Tax Expense 12 413.00 516 00 41300 516.00 002.00 107 100 00 19.500.00 10,402 00 1 504 00 5.25000 11 805 00 1.600 00 51600 1 600 00 2.235 00 450 00 1.000.00 1015.00 29200 292 00 254 00 25400 3.360.67 336067 11/12/2021 43 Transactions General Journal Worksheet Income Statement Changes in Retained Earnings Balance Shee Power Pivot Arial 10 AA ===> F Paste BIU III 29 Wanted Merge & Center Accounting $%8-09 Conditional Forma Formatting Table Clipboard Font Alignment Number G49 f 1 Styles D E F H G 100,000.00 263 23 263 23 19 000 00 4.550 00 4 550 00 41300 51600 41300 516.00 107 100 00 90.500.00 183 40200 00200 107 100.00 89.598.00 183,402.00 A B 17 1411 Building Cost 100 000 00 18 1412 Accum Depr.-Building 19 1510 Land 19.000.00 20 2101 Accounts Payable 21 2102 Advanced Payments 22 2103 Interest Payable 23 2105 Sataries Payable 24 2106 Income Taxes Payable 25 2201 Mortgage Payable 26 2202 Notes Payable 27 3100 Capital Stock 3200 Retained Earnings 3300 Dividends 1 594 80 30 31 4100 Computer & Consulting Revenue 32 5010 Rent Expense 33 5020 Salary Expense 120.00 34 5030 Advertising Expense 450 00 35 50.00 Repairs & Maint Expense 1090 00 36 5050 OU & Gas Expense 1.015.00 37 500 Supplies Expense 38 5.090 interest Expense 39 5100 insurance Expense 40 5110 Depreciation Expense 41 5120 Income Tax Expense 42 43 1,50480 N88388 13 555 00 5250 00 18.805.00 1 600 00 51600 1 600 00 2236 09 450.00 1.000.00 101500 292 00 29200 25400 254.00 336067 336067 > HD 45 05 41 TOTAL 48 390 1070039910700 11.929 67 11 9206740000767408 00757 49 30 DS PM 52 03 54 12/2021 55 Transactions General Journal Worksheet Income Statement Heat Changes in Retained Earnings Balance Shee Jun 30 5090 Interest Expense Interest on notes 902 00 173 174 902.00 175 A 35 35 Jun 30 Jun 30 176 177 178 179 180 5120 Income Tax Expense Income payment 2106 Income Taxes Payable Income payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts