Question: HELP I ONLY HAVE TWENTY MINUTES!!! HELP HELP HELP! I HAVE POSTED SEVERAL DIFFERENT QUESTIONS PLEASE HELP!!! Red & Blue Corporation signs a contract at

HELP I ONLY HAVE TWENTY MINUTES!!! HELP HELP HELP! I HAVE POSTED SEVERAL DIFFERENT QUESTIONS PLEASE HELP!!!

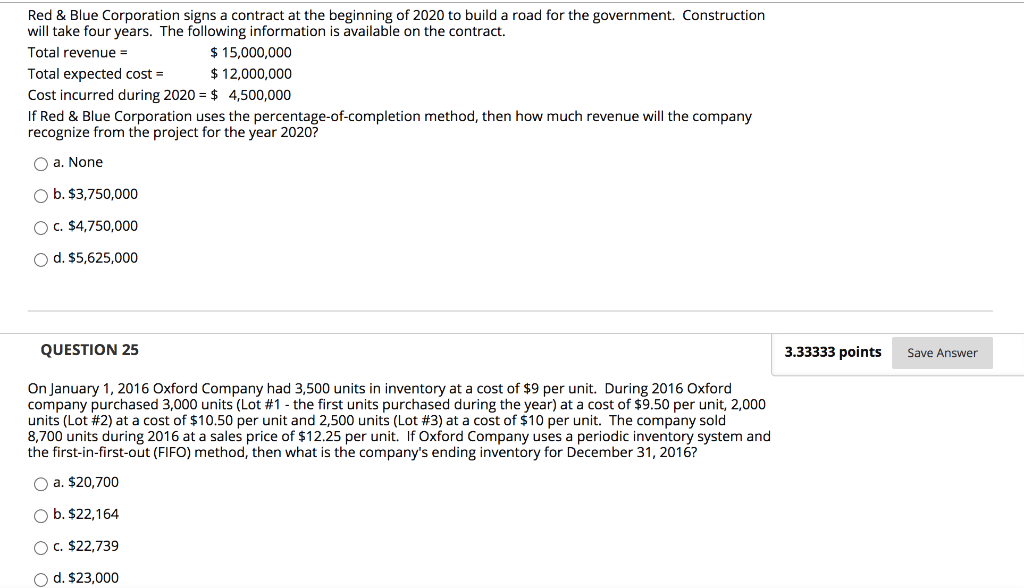

Red & Blue Corporation signs a contract at the beginning of 2020 to build a road for the government. Construction will take four years. The following information is available on the contract. Total revenue = $ 15,000,000 Total expected cost = $ 12,000,000 Cost incurred during 2020 = $ 4,500,000 If Red & Blue Corporation uses the percentage-of-completion method, then how much revenue will the company recognize from the project for the year 2020? O a. None b. $3,750,000 O c. $4,750,000 d. $5,625,000 QUESTION 25 3.33333 points Save Answer On January 1, 2016 Oxford Company had 3,500 units in inventory at a cost of $9 per unit. During 2016 Oxford company purchased 3,000 units (Lot #1 - the first units purchased during the year) at a cost of $9.50 per unit, 2,000 units (Lot #2) at a cost of $10.50 per unit and 2,500 units (Lot #3) at a cost of $10 per unit. The company sold 8,700 units during 2016 at a sales price of $12.25 per unit. If Oxford Company uses a periodic inventory system and the first-in-first-out (FIFO) method, then what is the company's ending inventory for December 31, 2016? O a. $20,700 b. $22,164 O c. $22,739 d. $23,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts