Question: Help I would rather not use excel--- I can use my calculator and formulas better.... can you step by step help me solve this... I

Help I would rather not use excel--- I can use my calculator and formulas better.... can you step by step help me solve this... I already have the answer but need someone to explain how to do each step. Thanks!

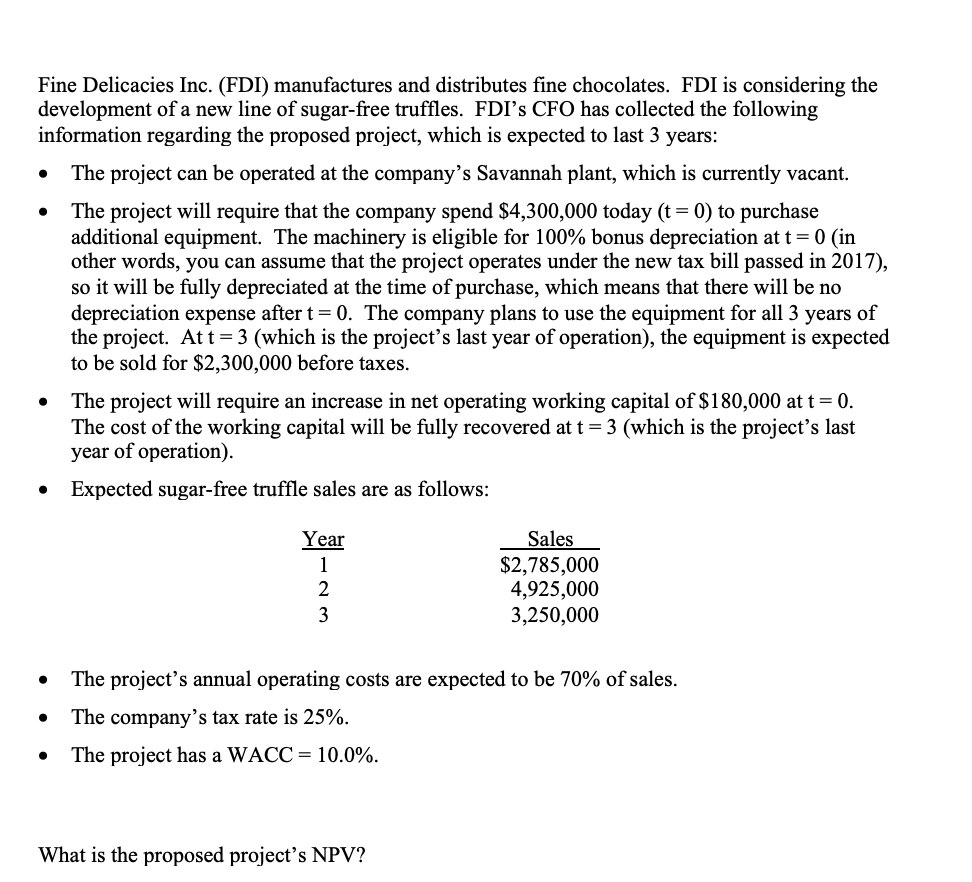

. Fine Delicacies Inc. (FDI) manufactures and distributes fine chocolates. FDI is considering the development of a new line of sugar-free truffles. FDI's CFO has collected the following information regarding the proposed project, which is expected to last 3 years: The project can be operated at the company's Savannah plant, which is currently vacant. The project will require that the company spend $4,300,000 today (t = 0) to purchase additional equipment. The machinery is eligible for 100% bonus depreciation at t=0 (in other words, you can assume that the project operates under the new tax bill passed in 2017), so it will be fully depreciated at the time of purchase, which means that there will be no depreciation expense after t= 0. The company plans to use the equipment for all 3 years of the project. At t= 3 (which is the project's last year of operation), the equipment is expected to be sold for $2,300,000 before taxes. The project will require an increase in net operating working capital of $180,000 at t= 0. The cost of the working capital will be fully recovered at t = 3 (which is the project's last year of operation). Expected sugar-free truffle sales are as follows: . Year 1 2 3 Sales $2,785,000 4,925,000 3,250,000 . The project's annual operating costs are expected to be 70% of sales. The company's tax rate is 25%. The project has a WACC = 10.0%. What is the proposed project's NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts