Question: help in Part A please Blackboard Remaining Time: 1 hour, 58 minutes, 16 seconds. Question Completion Status: Question 2 0 points Save Answer You are

help in Part A please

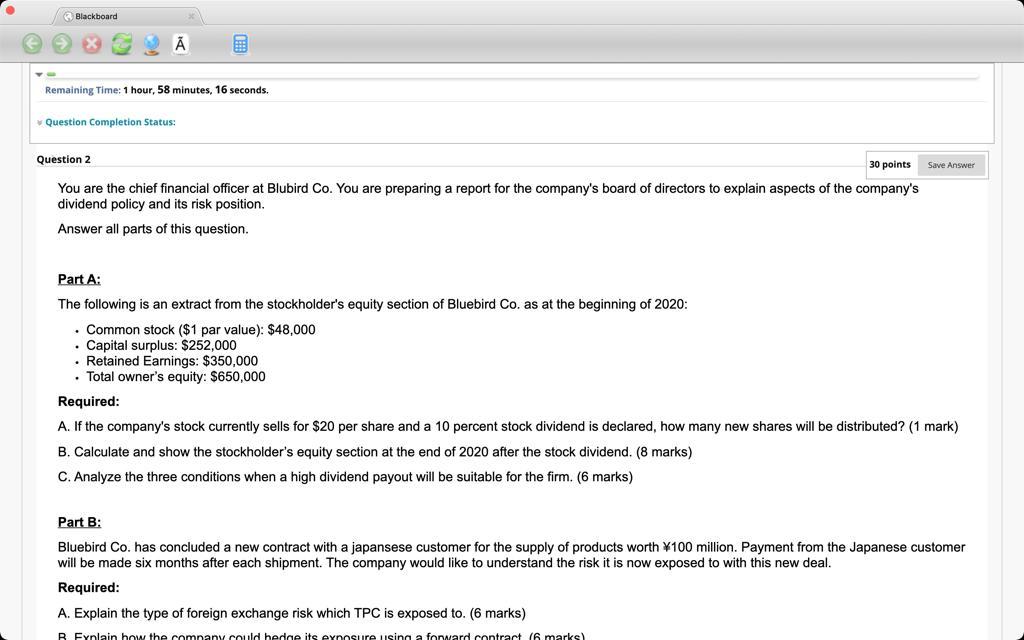

Blackboard Remaining Time: 1 hour, 58 minutes, 16 seconds. Question Completion Status: Question 2 0 points Save Answer You are the chief financial officer at Blubird Co. You are preparing a report for the company's board of directors to explain aspects of the company's dividend policy and its risk position. Answer all parts of this question. Part A: The following is an extract from the stockholder's equity section of Bluebird Co. as at the beginning of 2020: . Common stock ($1 par value): $48,000 . Capital surplus: $252,000 Retained Earnings: $350,000 Total owner's equity: $650,000 Required: A. If the company's stock currently sells for $20 per share and a 10 percent stock dividend is declared, how many new shares will be distributed? (1 mark) B. Calculate and show the stockholder's equity section at the end of 2020 after the stock dividend. (8 marks) C. Analyze the three conditions when a high dividend payout will be suitable for the firm. (6 marks) Part B: Bluebird Co. has concluded a new contract with japansese customer for the supply of products worth *100 million. Payment from the Japanese customer will be made six months after each shipment. The company would like to understand the risk it is now exposed to with this new deal. Required: A. Explain the type of foreign exchange risk which TPC is exposed to. (6 marks) R. Fynlain how the company.could hedge its exposure using a forward contract (6 marks) Blackboard Remaining Time: 1 hour, 58 minutes, 16 seconds. Question Completion Status: Question 2 0 points Save Answer You are the chief financial officer at Blubird Co. You are preparing a report for the company's board of directors to explain aspects of the company's dividend policy and its risk position. Answer all parts of this question. Part A: The following is an extract from the stockholder's equity section of Bluebird Co. as at the beginning of 2020: . Common stock ($1 par value): $48,000 . Capital surplus: $252,000 Retained Earnings: $350,000 Total owner's equity: $650,000 Required: A. If the company's stock currently sells for $20 per share and a 10 percent stock dividend is declared, how many new shares will be distributed? (1 mark) B. Calculate and show the stockholder's equity section at the end of 2020 after the stock dividend. (8 marks) C. Analyze the three conditions when a high dividend payout will be suitable for the firm. (6 marks) Part B: Bluebird Co. has concluded a new contract with japansese customer for the supply of products worth *100 million. Payment from the Japanese customer will be made six months after each shipment. The company would like to understand the risk it is now exposed to with this new deal. Required: A. Explain the type of foreign exchange risk which TPC is exposed to. (6 marks) R. Fynlain how the company.could hedge its exposure using a forward contract (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts