Question: help Kim Jung is a U.S. citizen working for Byte Corporation. For the last six years Kim has been stationed in the company's Tokyo office:

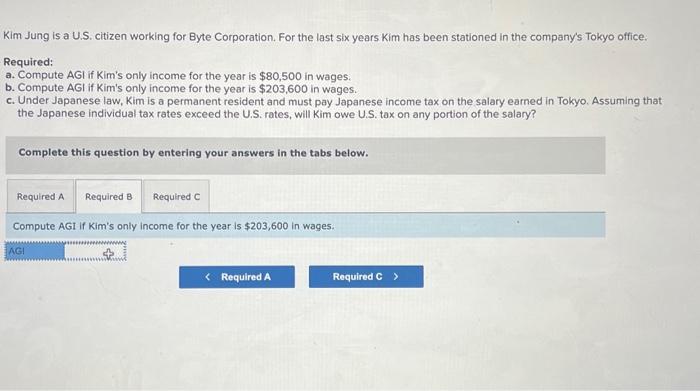

Kim Jung is a U.S. citizen working for Byte Corporation. For the last six years Kim has been stationed in the company's Tokyo office: Required: a. Compute AGI if Kim's only income for the year is $80,500 in wages. b. Compute AGI if Kim's only income for the year is $203,600 in wages. c. Under Japanese law, Kim is a permanent resident and must pay Japanese income tax on the salary earned in Tokyo. Assuming that the Japanese individual tax rates exceed the U.S. rates, will Kim owe U.S. tax on any portion of the salary? Complete this question by entering your answers in the tabs below. Compute AGI if Kim's only income for the year is $203,600 in wages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts