Question: help let me know if this is better net capital spending is 650000 and sales change %per year is 1% lmk if u have any

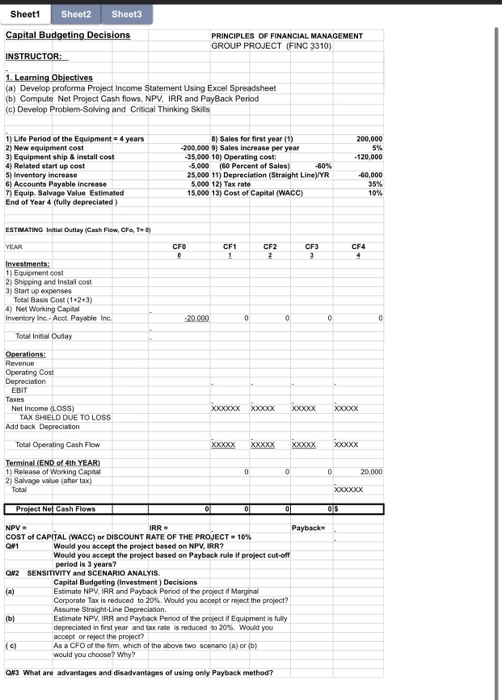

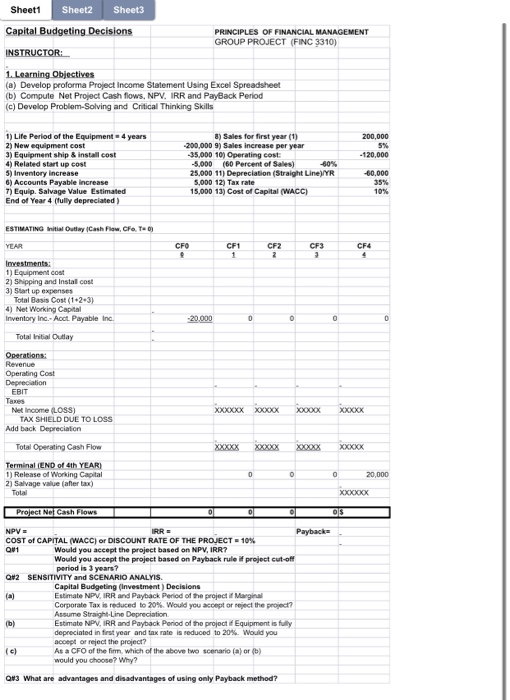

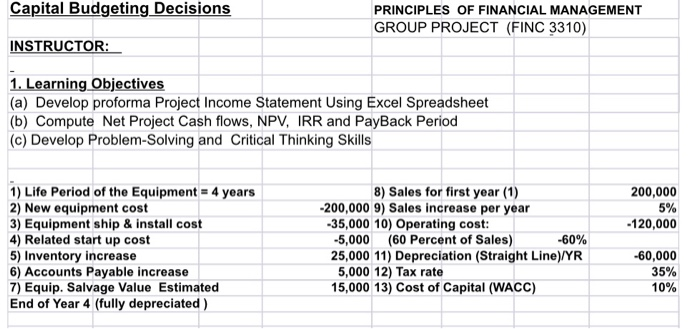

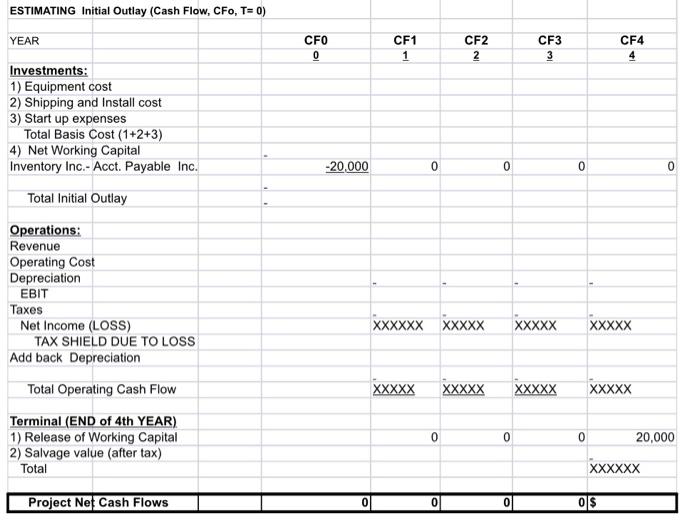

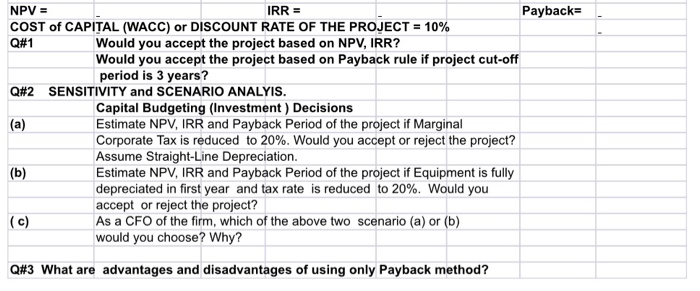

Sheet1 Sheet2 Sheet3 Capital Budgeting Decisions INSTRUCTOR: PRINCIPLES OF FINANCIAL MANAGEMENT GROUP PROJECT (FINC 3310) 1. Learning Objectives (a) Develop proforma Project Income Statement Using Excel Spreadsheet (b) Compute Net Project Cash flows, NPV, IRR and PayBack Period (c) Develop Problem Solving and Critical Thinking Skills 200,000 5% -120,000 1) Life Period of the Equipment 4 years 2) New equipment cost 3) Equipment ship & Install cost 4) Related start up cost 5) Inventory increase 6) Accounts Payable increase T) Equip. Salvage Value Estimated End of Year 4 (fully depreciated) 8) Sales for first year (1) -200.000 9) Sales increase per year -35.000 10) Operating cost -5,000 (60 Percent of Sales) -60% 25.000 11) Depreciation (Straight Line)YR 5.000 12) Tax rate 15.000 13) Cost of Capital (WACC) -60,000 35% 10% ESTIMATING Initial Outlay Cash Flow, Cro, T) YEAR CFO 0 CF1 CF2 2 CF3 3 CF4 4 - 0 0 0 0 Investments 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) 4) Net Working Capital Inventory line-Acet. Payable Inc. Total Initial Outlay Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS Add back Depreciation Total Operating Cash Flow Terminal (END of 4th YEAR) 1) Release of Working Capital 2) Salvage value (atter tax) Total XXXXXXXXXXX xxxxx XXXXX XXXXX xxxxx 0 0 0 20,000 os Project No Cash Flows O NPV- IRR Payback COST of CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT -10% QM1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off period is 3 years? ON2 SENSITIVITY and SCENARIO ANALYIS. Capital Budgeting (Investment ) Decisions Estimate NPV IRR and Payback period of the project Marginal Corporate Tax is reduced to 20%. Would you accept or reject the project? Assume Straight-Line Depreciation (b) Estimate NPV, IRR and Payback period of the projectil Equipment is fully deprecated in first year and tax rate is reduced to 20%. Would you accept of reject the project? (c) As a CFO of the firm, which of the above two scenario(a) or (b) would you choose? Why? #3 What are advantages and disadvantages of using only Payback method? Sheet1 Sheet2 Sheet3 Capital Budgeting Decisions PRINCIPLES OF FINANCIAL MANAGEMENT GROUP PROJECT (FINC 3310) INSTRUCTOR: 1. Learning Objectives (a) Develop proforma Project Income Statement Using Excel Spreadsheet (b) Compute Net Project Cash flows, NPV. IRR and PayBack Period (c) Develop Problem Solving and Critical Thinking Skills 200,000 5% -120,000 1) Life Period of the Equipment - 4 years 2) New equipment cost 3) Equipment ship & install cost 4) Related start up cost 5) Inventory increase 6) Accounts Payable increase 7) Equip. Salvage Value Estimated End of Year 4 (fully depreciated) 8) Sales for first year (1) 200,000 9) Sales increase per year -35.000 10) Operating cost: -5,000 (60 Percent of Sales) -60% 25,000 11) Depreciation (Straight Line)/YR 5,000 12) Tax rate 15,000 13) Cost of Capital (WACC) -60.000 35% 10% ESTIMATING Initial Outlay (Cash Flow, CFO. TO) YEAR CFO CF1 1 CF2 2 CF3 3 CF4 4 Investments: 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1-2-3) 4) Net Working Capital Inventory Inc.- Act. Payable Inc. -20.000 0 o 0 0 Totalital Outlay Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS Add back Depreciation xxxxxxxxxxx XXXXX XXXXX Total Operating Cash Flow Terminal (END of 4th YEAR) 1) Release of Working Capital 2) Salvage value (after tax) 0 0 0 20,000 OS Project Ne Cash Flows 0 NPV IRR = Payback COST of CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 10% QN1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off period is 3 years? Q#2 SENSITIVITY and SCENARIO ANALYIS Capital Budgeting investment) Decisions (a) Estimate NPV, IRR and Payback period of the project in Marginal Corporate Tax is reduced to 20%. Would you accept or reject the project? Assume Straight-Line Depreciation (6) Estimate NPV, IRR and Payback period of the project Equipment is fully depreciated in first year and tax rate is reduced to 20%. Would you accept or reject the project? As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? Q#3 What are advantages and disadvantages of using only Payback method? Capital Budgeting Decisions PRINCIPLES OF FINANCIAL MANAGEMENT GROUP PROJECT (FINC 3310) INSTRUCTOR: 1. Learning Objectives (a) Develop proforma Project Income Statement Using Excel Spreadsheet (b) Compute Net Project Cash flows, NPV, IRR and PayBack Period (c) Develop Problem-solving and Critical Thinking Skills 200,000 5% -120,000 1) Life Period of the Equipment = 4 years 2) New equipment cost 3) Equipment ship & install cost 4) Related start up cost 5) Inventory increase 6) Accounts Payable increase 7) Equip. Salvage Value Estimated End of Year 4 (fully depreciated) 8) Sales for first year (1) -200,000 9) Sales increase per year -35,000 10) Operating cost: -5,000 (60 Percent of Sales) -60% 25,000 11) Depreciation (Straight Line)/YR 5,000 12) Tax rate 15,000 13) Cost of Capital (WACC) -60,000 35% 10% ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) YEAR CFO 0 CF1 1 CF2 2 CF3 3 CF4 4 Investments: 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) 4) Net Working Capital Inventory Inc.- Acct. Payable Inc. -20,000 0 0 0 0 Total Initial Outlay Operations: Revenue Operating cost Depreciation EBIT Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS Add back Depreciation Total Operating Cash Flow XXXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX 0 0 0 Terminal (END of 4th YEAR) 1) Release of Working Capital 2) Salvage value (after tax) Total 20,000 XXXXXX Project Net Cash Flows 0 0 0 OS a) NPV = IRR = Payback= COST of CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 10% Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off period is 3 years? Q#2 SENSITIVITY and SCENARIO ANALYIS. Capital Budgeting (Investment ) Decisions Estimate NPV, IRR and Payback Period of the project if Marginal Corporate Tax is reduced to 20%. Would you accept or reject the project? Assume Straight-Line Depreciation. (b) Estimate NPV, IRR and Payback Period of the project if Equipment is fully depreciated in first year and tax rate is reduced to 20%. Would you accept or reject the project? (c) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? Q#3 What are advantages and disadvantages of using only Payback method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts