Question: Help m e solve what I got worng and what's missing t o cpmplete this assiment: O n February 1 , 2 0 2 4

Help solve what I got worng and what's missing cpmplete this assiment:

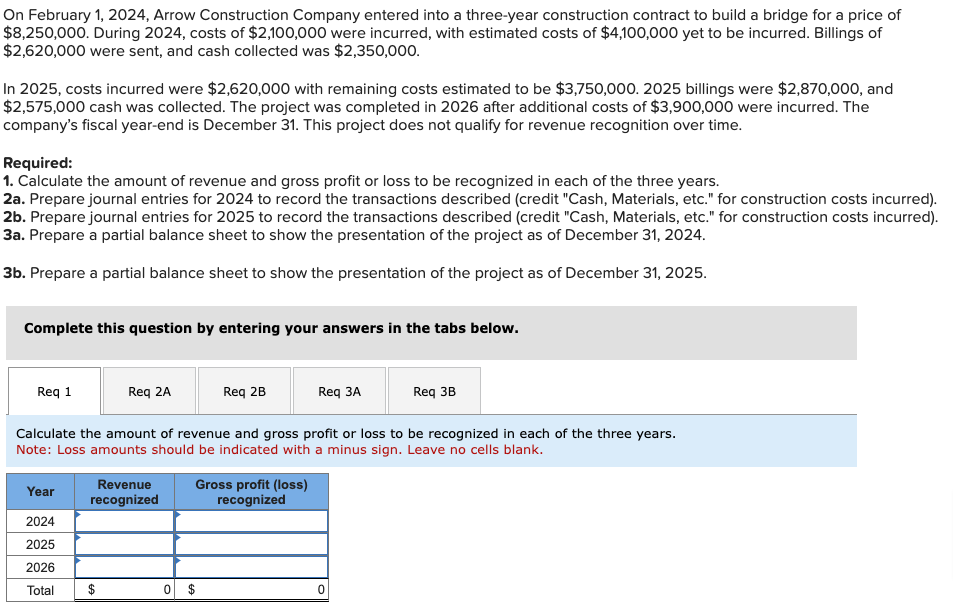

February Arrow Construction Company entered into a threeyear construction contract build a bridge for a price

$ During costs $ were incurred, with estimated costs $ yet incurred. Billings

$ were sent, and cash collected was $

costs incurred were $ with remaining costs estimated $ billings were $ and

$ cash was collected. The project was completed after additional costs $ were incurred. The

company's fiscal yearend December This project does not qualify for revenue recognition over time.

Required:

Calculate the amount revenue and gross profit loss recognized each the three years.

Prepare journal entries for record the transactions described "Cash, Materials, etc." for construction costs incurred

Prepare journal entries for record the transactions described "Cash, Materials, etc." for construction costs incurred

Prepare a partial balance sheet show the presentation the project December

Prepare a partial balance sheet show the presentation the project December

Complete this question entering your answers the below.

Calculate the amount revenue and gross profit loss recognized each the three years.

Note: Loss amounts should indicated with a minus sign. Leave cells blank. February Arrow Construction Company entered into a threeyear construction contract build a bridge for a price

$ During costs $ were incurred, with estimated costs $ yet incurred. Billings

$ were sent, and cash collected was $

costs incurred were $ with remaining costs estimated $ billings were $ and

$ cash was collected. The project was completed after additional costs $ were incurred. The

company's fiscal yearend December This project does not qualify for revenue recognition over time.

Required:

Calculate the amount revenue and gross profit loss recognized each the three years.

Prepare journal entries for record the transactions described "Cash, Materials, etc." for construction costs incurred

Prepare journal entries for record the transactions described "Cash, Materials, etc." for construction costs incurred

Prepare a partial balance sheet show the presentation the project December

Prepare a partial balance sheet show the presentation the project December

Complete this question entering your answers the below.

Prepare journal entries for record the transactions described "Cash, Materials, etc." for construction costs incurred

Note: entry required for a transactiovent, select journal entry required" the first account field.

Journal entry worksheet

Record the gross profit loss.

Note: Enter debits before credits. February Arrow Construction Company entered into a threeyear construction contract build a bridge for a price

$ During costs $ were incurred, with estimated costs $ yet incurred. Billings

$ were sent, and cash collected was $

costs incurred were $ with remaining costs estimated $ billings were $ and

$ cash was collected. The project was completed after additional costs $ February Arrow Construction Company entered into a threeyear construction contract build a bridge for a price

$ During costs $ were incurred, with estimated costs $ yet incurred. Billings

$ were sent, and cash collected was $

costs incurred were $ with remaining costs estimated $ billings were $ and

$ cash was collected. The project was completed after additional costs $ were incurred. The

company's fiscal yearend December This project does not qualify for revenue recognition over time.

Required:

Calculate the amount revenue and gross profit loss recognized each the three years.

Prepare journal entries for record the transactions described "Cash, Materials, etc." for construction costs incurred

Prepare journaOn February Arrow Construction Company entered into a threeyear construction contract build a bridge for a price

$ During costs $ were incurred, with estimated costs $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock