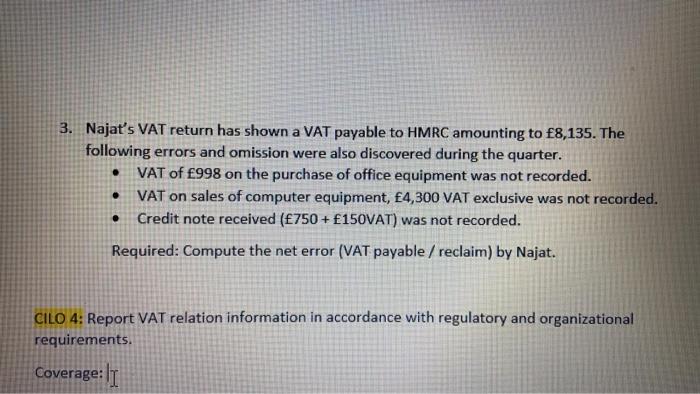

Question: help me . 3. Najat's VAT return has shown a VAT payable to HMRC amounting to 8,135. The following errors and omission were also discovered

help me

. 3. Najat's VAT return has shown a VAT payable to HMRC amounting to 8,135. The following errors and omission were also discovered during the quarter. VAT of 998 on the purchase of office equipment was not recorded. VAT on sales of computer equipment, 4,300 VAT exclusive was not recorded. Credit note received (750 + 150VAT) was not recorded. Required: Compute the net error (VAT payable / reclaim) by Najat. . . CILO 4: Report VAT relation information in accordance with regulatory and organizational requirements. Coverage

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock