Question: help me answer a, b, c, d, e Project: A 0 Project Life 6 years 5 years 000 000 Initial investment in plant and equipment

help me answer a, b, c, d, e

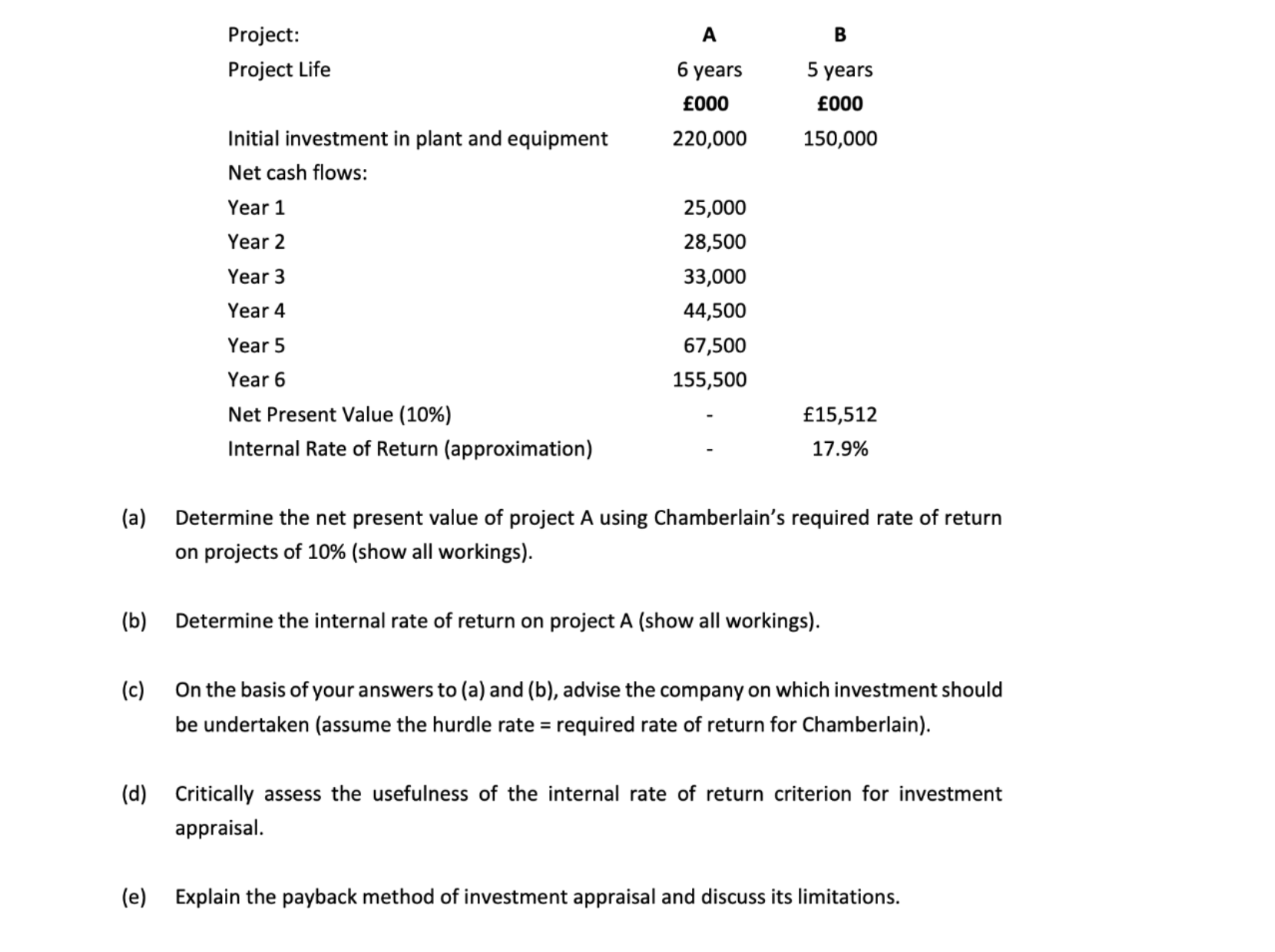

Project: A 0 Project Life 6 years 5 years 000 000 Initial investment in plant and equipment 220,000 150,000 Net cash flows: Year 1 25,000 Year 2 28,500 Year 3 33,000 Year 4 44,500 Year 5 67,500 Year 6 155,500 Net Present Value (10%) - 15,512 Internal Rate of Return (approximation) - 17.9% (a) Determine the net present value of project A using Chamberlain's required rate of return on projects of 10% (show all workings). (b) Determine the internal rate of return on project A (show all workings). (c) On the basis of your answers to (a) and (b), advise the company on which investment should be undertaken (assume the hurdle rate = required rate of return for Chamberlain). (d) Critically assess the usefulness of the internal rate of return criterion for investment appraisal. (e) Explain the payback method of investment appraisal and discuss its limitations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts