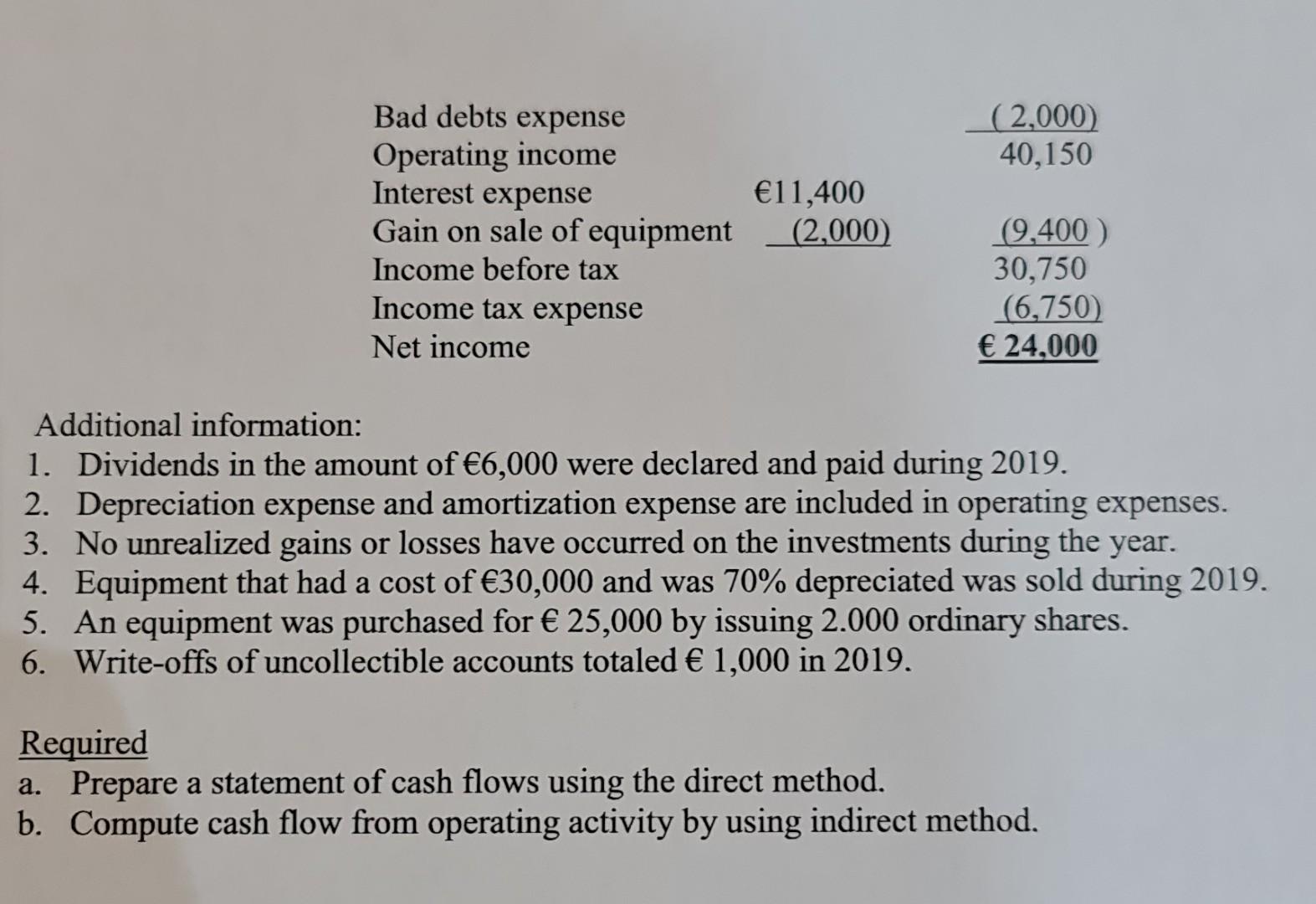

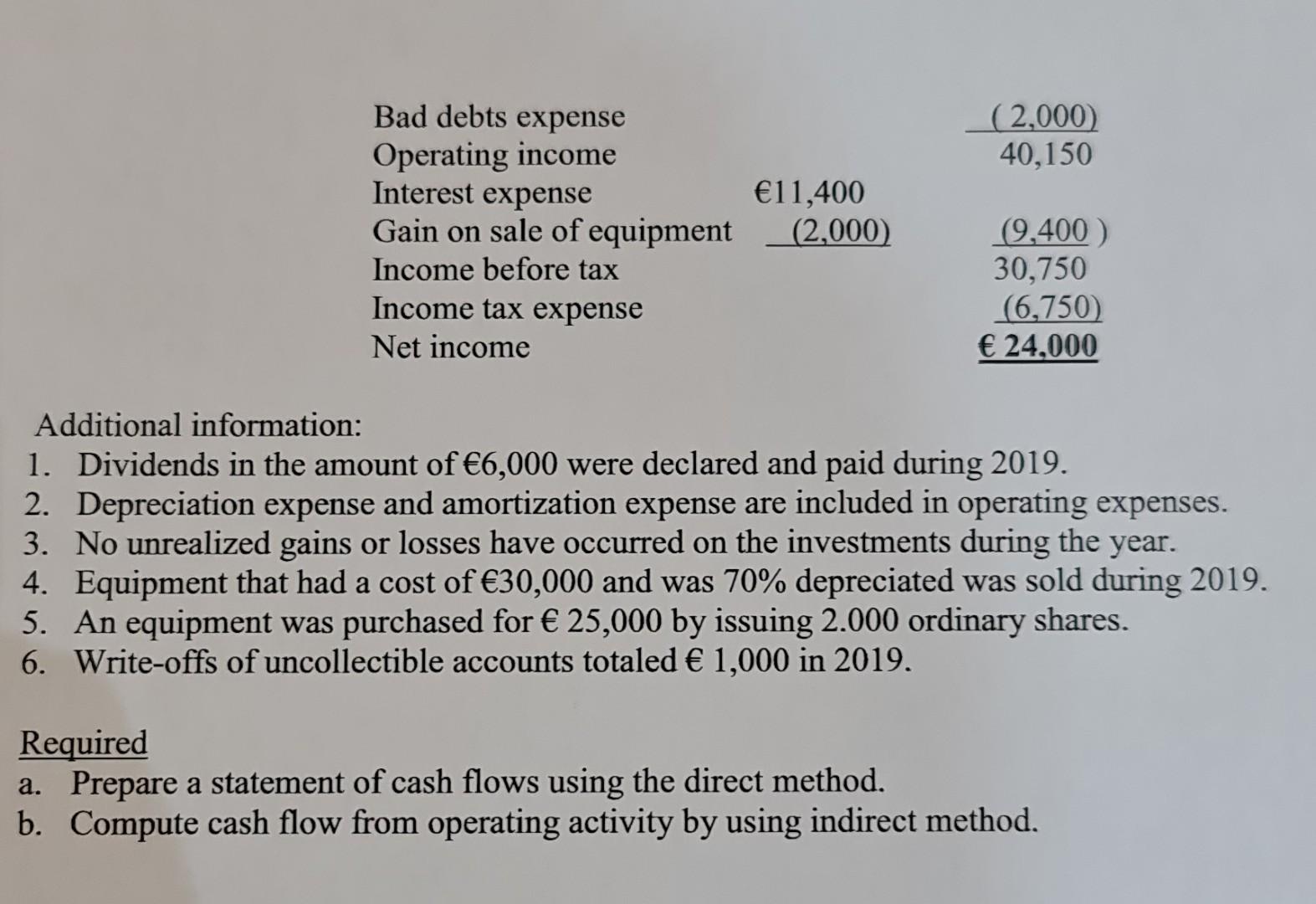

Question: help me answer exercise 1 (2,000) Bad debts expense Operating income 40,150 Interest expense 11,400 Gain on sale of equipment (2,000) (9,400) Income before tax

help me answer exercise 1

(2,000) Bad debts expense Operating income 40,150 Interest expense 11,400 Gain on sale of equipment (2,000) (9,400) Income before tax 30,750 Income tax expense (6,750) Net income 24,000 Additional information: 1. Dividends in the amount of 6,000 were declared and paid during 2019. 2. Depreciation expense and amortization expense are included in operating expenses. 3. No unrealized gains or losses have occurred on the investments during the year. 4. Equipment that had a cost of 30,000 and was 70% depreciated was sold during 2019. 5. An equipment was purchased for 25,000 by issuing 2.000 ordinary shares. 6. Write-offs of uncollectible accounts totaled 1,000 in 2019. Required a. Prepare a statement of cash flows using the direct method. b. Compute cash flow from operating activity by using indirect method. (2,000) Bad debts expense Operating income 40,150 Interest expense 11,400 Gain on sale of equipment (2,000) (9,400) Income before tax 30,750 Income tax expense (6,750) Net income 24,000 Additional information: 1. Dividends in the amount of 6,000 were declared and paid during 2019. 2. Depreciation expense and amortization expense are included in operating expenses. 3. No unrealized gains or losses have occurred on the investments during the year. 4. Equipment that had a cost of 30,000 and was 70% depreciated was sold during 2019. 5. An equipment was purchased for 25,000 by issuing 2.000 ordinary shares. 6. Write-offs of uncollectible accounts totaled 1,000 in 2019. Required a. Prepare a statement of cash flows using the direct method. b. Compute cash flow from operating activity by using indirect method. (2,000) Bad debts expense Operating income 40,150 Interest expense 11,400 Gain on sale of equipment (2,000) (9,400) Income before tax 30,750 Income tax expense (6,750) Net income 24,000 Additional information: 1. Dividends in the amount of 6,000 were declared and paid during 2019. 2. Depreciation expense and amortization expense are included in operating expenses. 3. No unrealized gains or losses have occurred on the investments during the year. 4. Equipment that had a cost of 30,000 and was 70% depreciated was sold during 2019. 5. An equipment was purchased for 25,000 by issuing 2.000 ordinary shares. 6. Write-offs of uncollectible accounts totaled 1,000 in 2019. Required a. Prepare a statement of cash flows using the direct method. b. Compute cash flow from operating activity by using indirect method. (2,000) Bad debts expense Operating income 40,150 Interest expense 11,400 Gain on sale of equipment (2,000) (9,400) Income before tax 30,750 Income tax expense (6,750) Net income 24,000 Additional information: 1. Dividends in the amount of 6,000 were declared and paid during 2019. 2. Depreciation expense and amortization expense are included in operating expenses. 3. No unrealized gains or losses have occurred on the investments during the year. 4. Equipment that had a cost of 30,000 and was 70% depreciated was sold during 2019. 5. An equipment was purchased for 25,000 by issuing 2.000 ordinary shares. 6. Write-offs of uncollectible accounts totaled 1,000 in 2019. Required a. Prepare a statement of cash flows using the direct method. b. Compute cash flow from operating activity by using indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts