Question: help me answer problem 1 and 2 PROBLEMS 1. AAA Company is being liquidated. The following information is related to the liquidation: L Bonds payable

help me answer problem 1 and 2

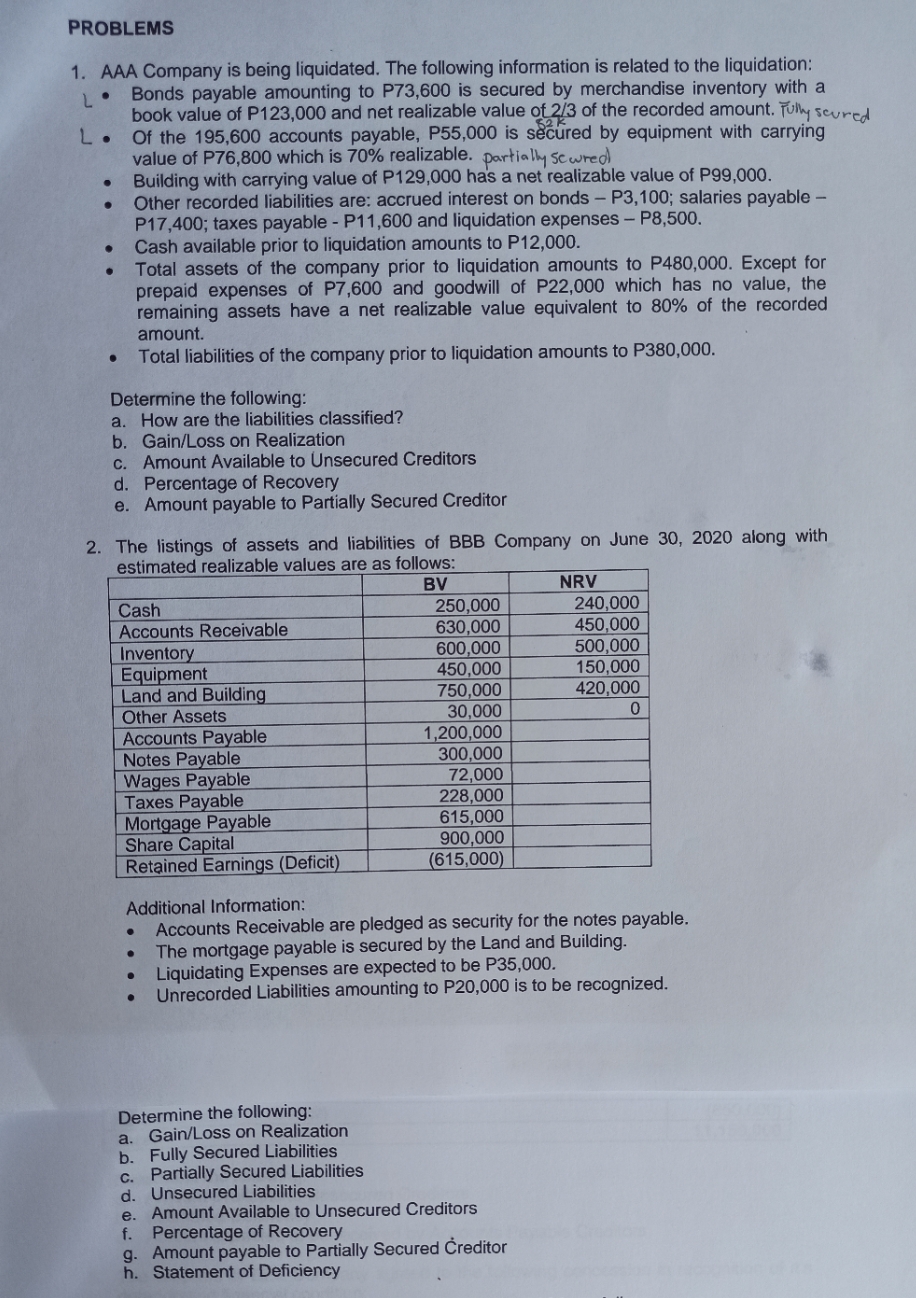

PROBLEMS 1. AAA Company is being liquidated. The following information is related to the liquidation: L Bonds payable amounting to P73,600 is secured by merchandise inventory with a book value of P123,000 and net realizable value of 2/3 of the recorded amount. fully scured L . Of the 195,600 accounts payable, P55,000 is secured by equipment with carrying value of P76,800 which is 70% realizable. partially sewreal Building with carrying value of P129,000 has a net realizable value of P99,000. . Other recorded liabilities are: accrued interest on bonds - P3, 100; salaries payable - P17,400; taxes payable - P11,600 and liquidation expenses - P8,500. Cash available prior to liquidation amounts to P12,000. . Total assets of the company prior to liquidation amounts to P480,000. Except for prepaid expenses of P7,600 and goodwill of P22,000 which has no value, the remaining assets have a net realizable value equivalent to 80% of the recorded amount. Total liabilities of the company prior to liquidation amounts to P380,000. Determine the following: a. How are the liabilities classified? b. Gain/Loss on Realization C. Amount Available to Unsecured Creditors d. Percentage of Recovery e. Amount payable to Partially Secured Creditor 2. The listings of assets and liabilities of BBB Company on June 30, 2020 along with estimated realizable values are as follows: BV NRV Cash 250,000 240,000 Accounts Receivable 630,000 450,000 Inventory 600,000 500,000 Equipment 450,000 150,000 Land and Building 750,000 420,000 Other Assets 30,000 0 Accounts Payable 1,200,000 Notes Payable 300,000 Wages Payable 72,000 Taxes Payable 228,000 Mortgage Payable 615,000 Share Capita 900,000 Retained Earnings (Deficit) (615,000) Additional Information: Accounts Receivable are pledged as security for the notes payable. The mortgage payable is secured by the Land and Building. Liquidating Expenses are expected to be P35,000. Unrecorded Liabilities amounting to P20,000 is to be recognized. Determine the following: a. Gain/Loss on Realization b. Fully Secured Liabilities C. Partially Secured Liabilities d. Unsecured Liabilities e . Amount Available to Unsecured Creditors f. Percentage of Recovery g- Amount payable to Partially Secured Creditor h. Statement of Deficiency