Question: Help me answer question 1 9 and 2 0 SUPPLEMENT A DECISION MAKING 1 8 . Benjamin Moses, chief engineer of Offshore Chemicals, Inc., must

Help me answer question and

SUPPLEMENT A

DECISION MAKING

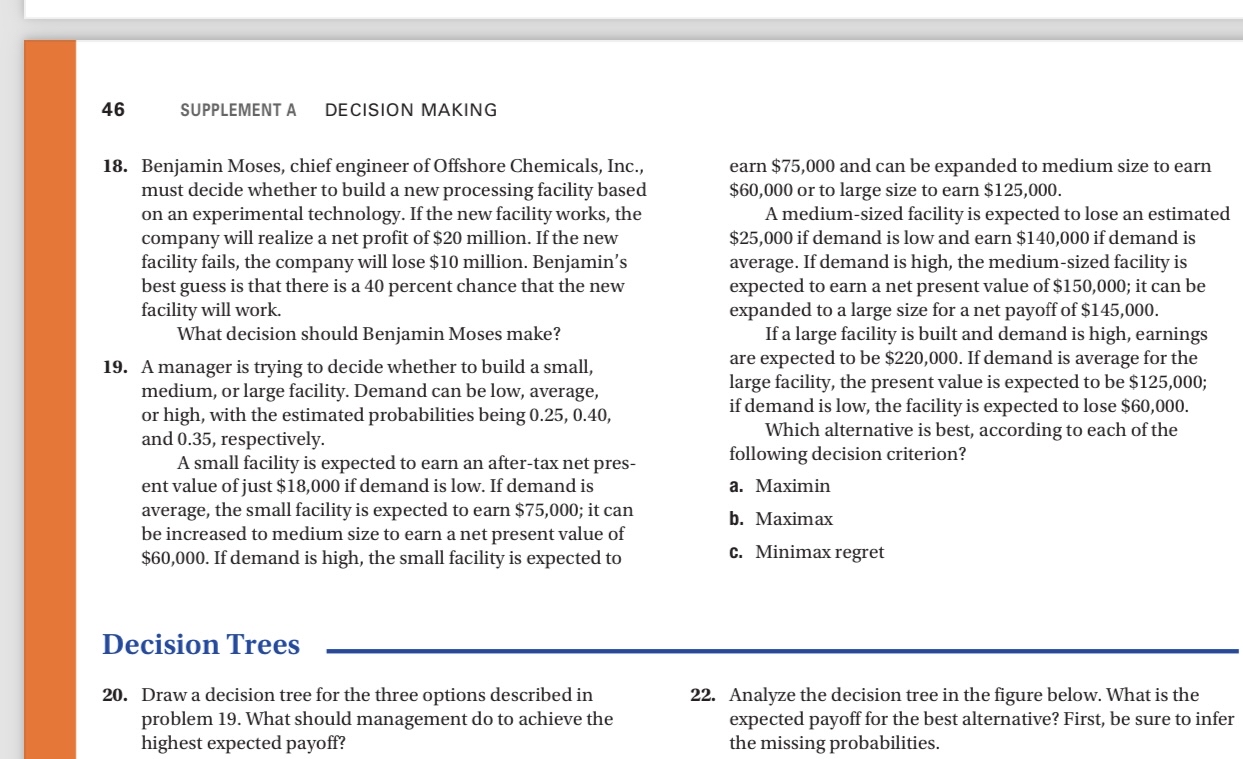

Benjamin Moses, chief engineer of Offshore Chemicals, Inc., must decide whether to build a new processing facility based on an experimental technology. If the new facility works, the company will realize a net profit of $ million. If the new facility fails, the company will lose $ million. Benjamin's best guess is that there is a percent chance that the new facility will work.

What decision should Benjamin Moses make?

A manager is trying to decide whether to build a small, medium, or large facility. Demand can be low, average, or high, with the estimated probabilities being and respectively.

A small facility is expected to earn an aftertax net present value of just $ if demand is low. If demand is average, the small facility is expected to earn $; it can be increased to medium size to earn a net present value of $ If demand is high, the small facility is expected to

earn $ and can be expanded to medium size to earn $ or to large size to earn $

A mediumsized facility is expected to lose an estimated $ if demand is low and earn $ if demand is average. If demand is high, the mediumsized facility is expected to earn a net present value of $; it can be expanded to a large size for a net payoff of $

If a large facility is built and demand is high, earnings are expected to be $ If demand is average for the large facility, the present value is expected to be $; if demand is low, the facility is expected to lose $

Which alternative is best, according to each of the following decision criterion?

a Maximin

b Maximax

c Minimax regret

Decision Trees

Draw a decision tree for the three options described in problem What should management do to achieve the highest expected payoff?

Analyze the decision tree in the figure below. What is the expected payoff for the best alternative? First, be sure to infer the missing probabilities.Try

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock