Question: Help me answer Second-Stage Allocation and Margin Calculations Foam Products. Inc.. makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing

Help me answer

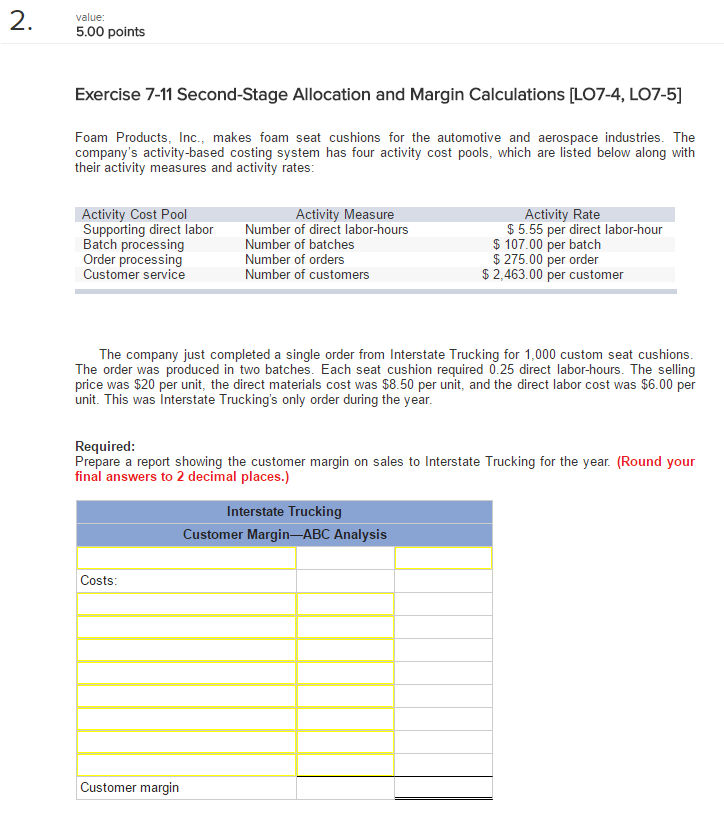

Second-Stage Allocation and Margin Calculations Foam Products. Inc.. makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: The company just completed a single order from Interstate Trucking for 1.000 custom seat cushions. The order was produced In two batches. Each seat cushion required 0.25 direct labor-hours. The selling price was $20 per unit, the direct materials cost was $8.50 per unit, and the direct labor cost was $6.00 per unit. This was Interstate Trucking's only order during the year. Required: Prepare a report showing the customer margin on sales to Interstate Trucking for the year. (Round your final answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts