Question: Help me answer the following and explain. Also please do follow the page numbers for easy format (page 1 to 14) 16.1 Multiple Choice Encircle

Help me answer the following and explain. Also please do follow the page numbers for easy format (page 1 to 14)

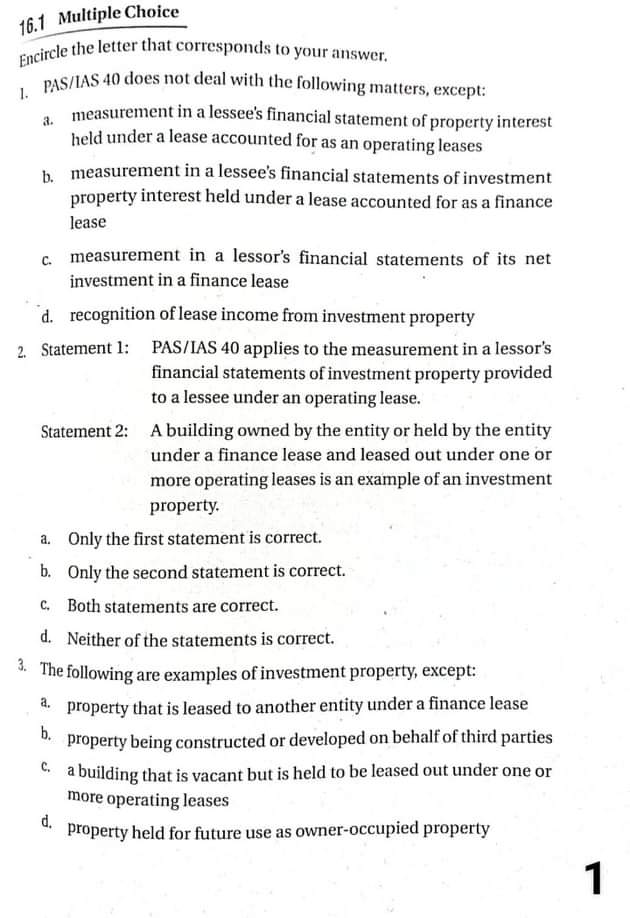

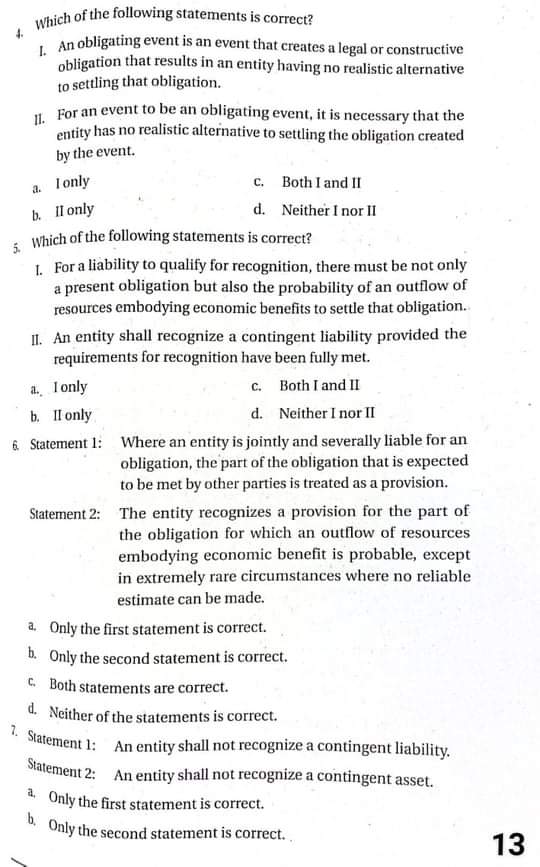

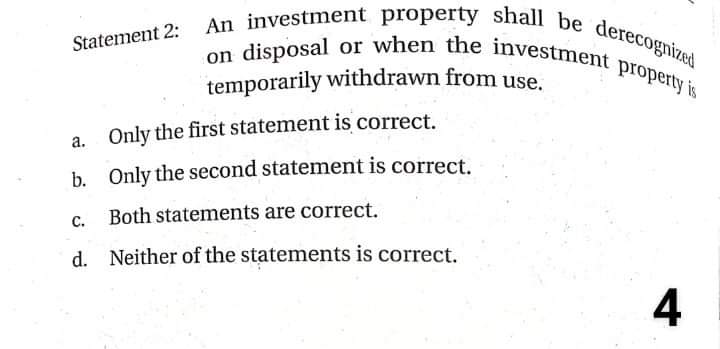

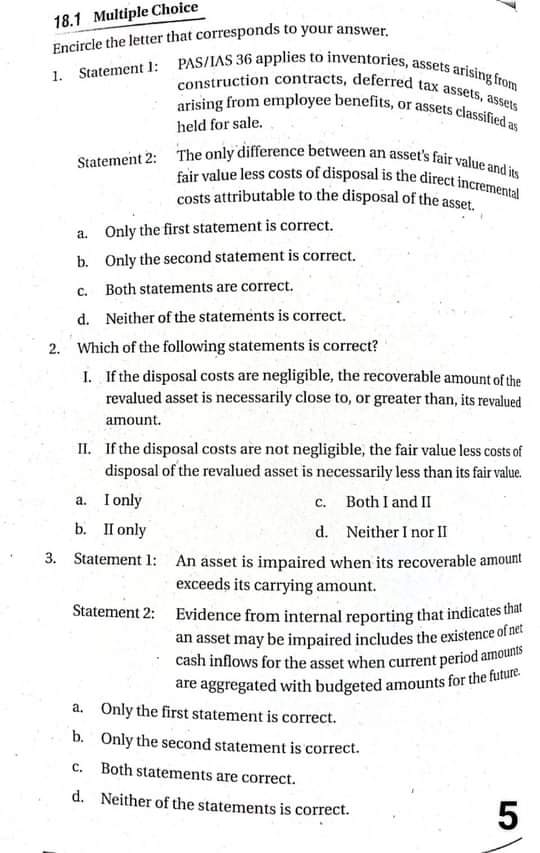

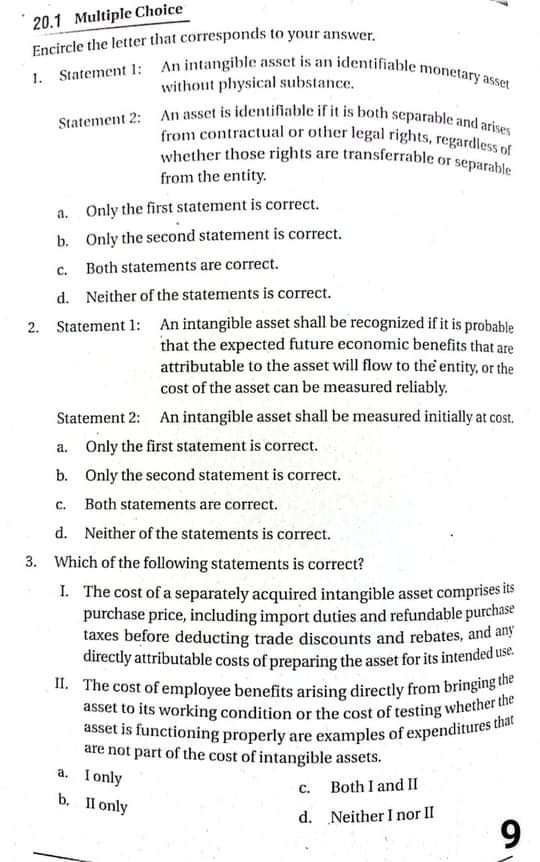

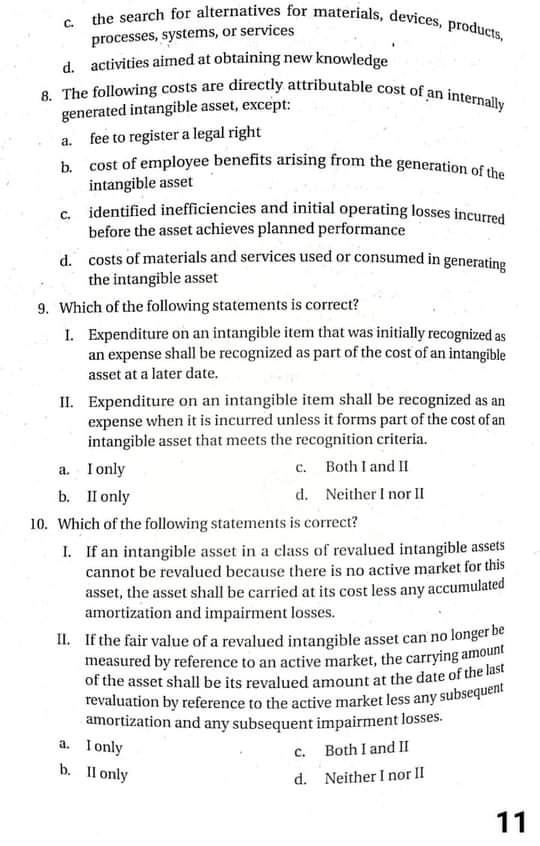

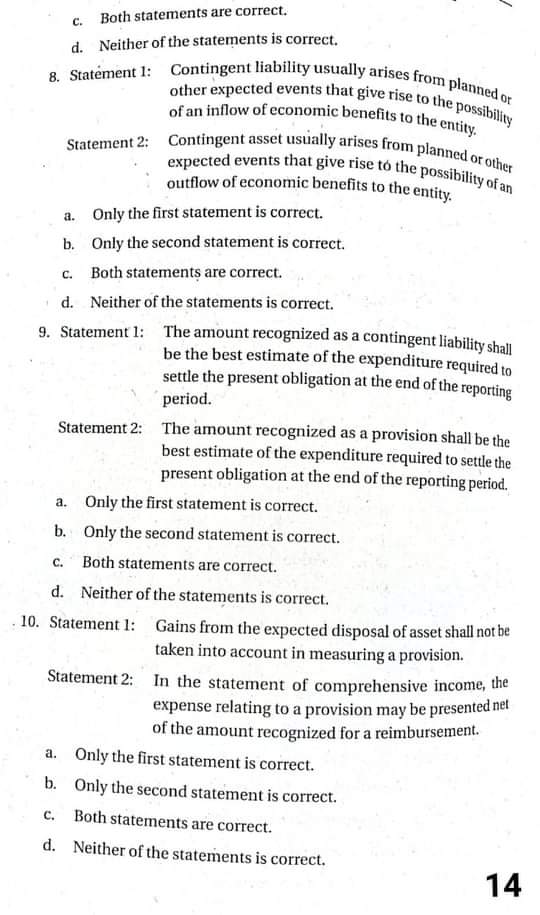

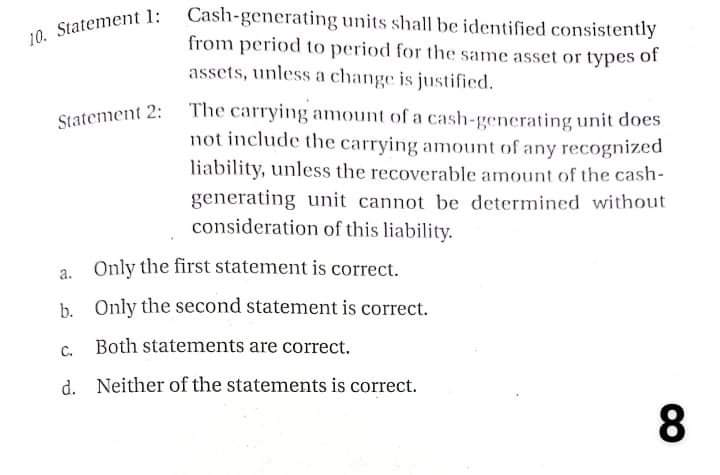

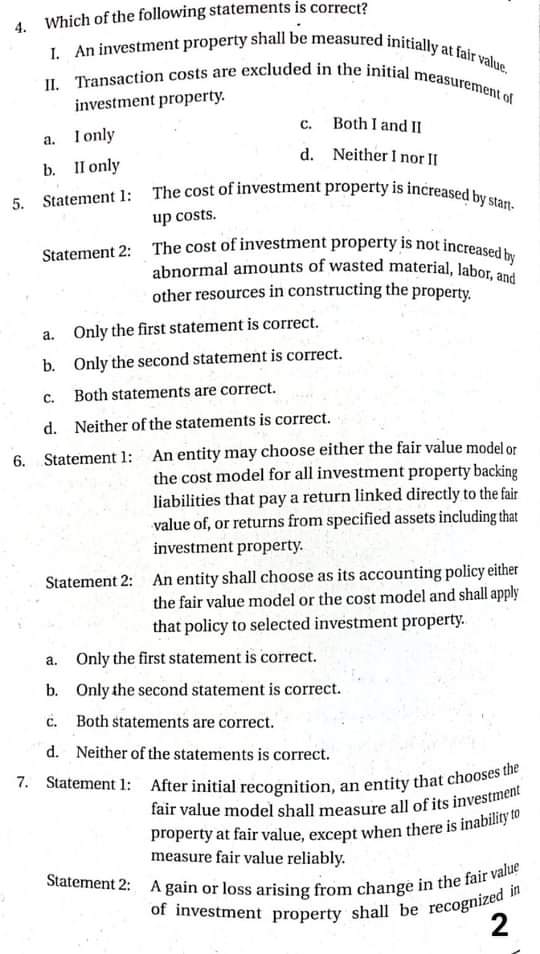

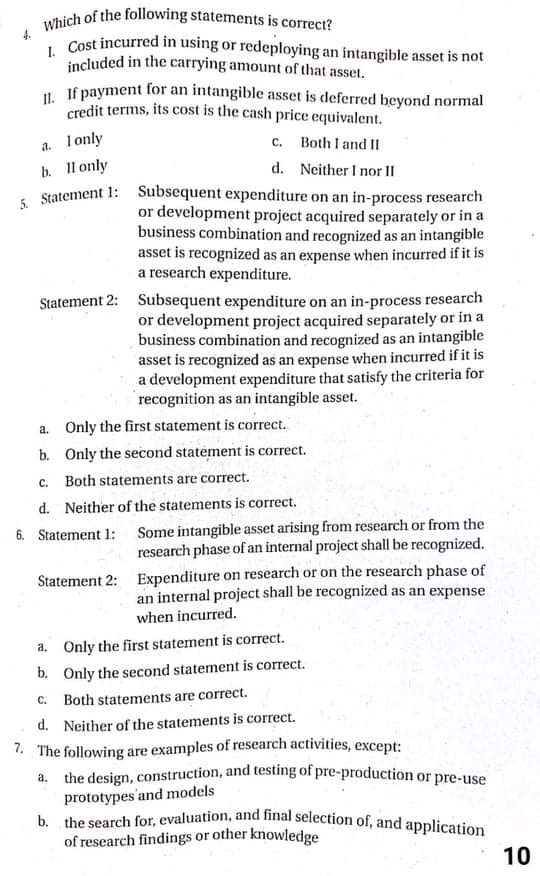

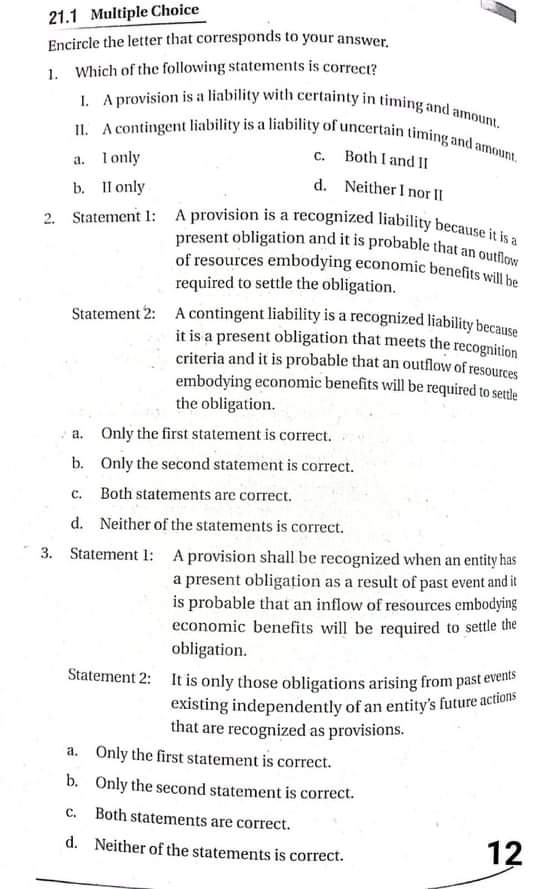

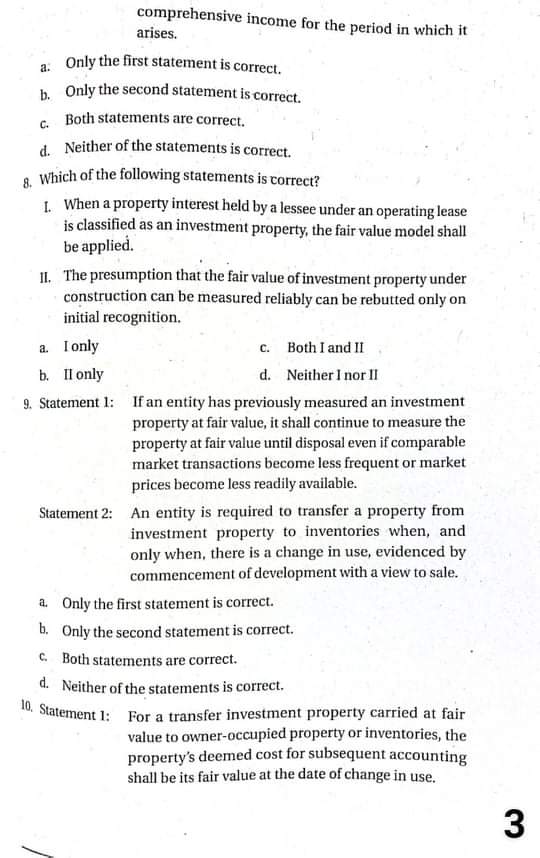

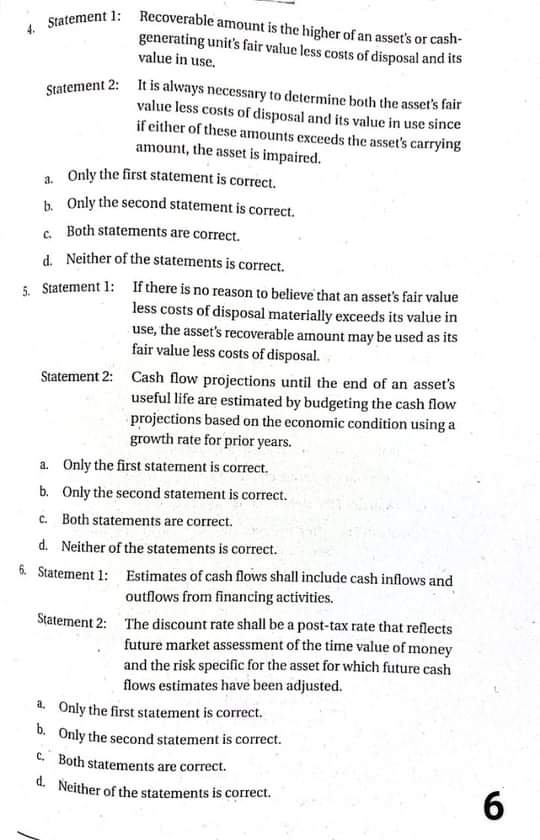

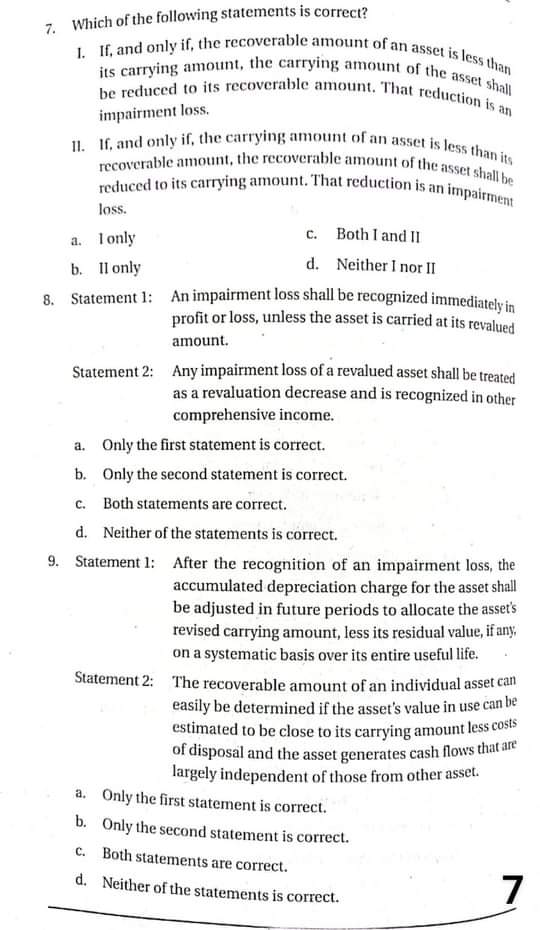

16.1 Multiple Choice Encircle the letter that corresponds to your answer. 1. PAS/IAS 40 does not deal with the following matters, except: a. measurement in a lessee's financial statement of property interest held under a lease accounted for as an operating leases b. measurement in a lessee's financial statements of investment property interest held under a lease accounted for as a finance lease c. measurement in a lessor's financial statements of its net investment in a finance lease d. recognition of lease income from investment property 2. Statement 1: PAS/IAS 40 applies to the measurement in a lessor's financial statements of investment property provided to a lessee under an operating lease. Statement 2: A building owned by the entity or held by the entity under a finance lease and leased out under one or more operating leases is an example of an investment property. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 3. The following are examples of investment property, except: a. property that is leased to another entity under a finance lease b. property being constructed or developed on behalf of third parties C. a building that is vacant but is held to be leased out under one or more operating leases d. property held for future use as owner-occupied propertyWhich of the following statements is correct? 1. An obligating event is an event that creates a legal or constructive obligation that results in an entity having no realistic alternative to settling that obligation. 17. For an event to be an obligating event, it is necessary that the entity has no realistic alternative to settling the obligation created by the event. a. Ionly C. Both I and II b. II only d. Neither I nor II Which of the following statements is correct? 1. For a liability to qualify for recognition, there must be not only a present obligation but also the probability of an outflow of resources embodying economic benefits to settle that obligation. I1. An entity shall recognize a contingent liability provided the requirements for recognition have been fully met. a. Ionly c. Both I and II b. II only d. Neither I nor II 6. Statement 1: Where an entity is jointly and severally liable for an obligation, the part of the obligation that is expected to be met by other parties is treated as a provision. Statement 2: The entity recognizes a provision for the part of the obligation for which an outflow of resources embodying economic benefit is probable, except in extremely rare circumstances where no reliable estimate can be made. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. Statement 1: An entity shall not recognize a contingent liability. Statement 2: An entity shall not recognize a contingent asset. a, Only the first statement is correct. b. Only the second statement is correct. 13Statement 2: An investment property shall be derecognize on disposal or when the investment property is temporarily withdrawn from use. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 418.1 Multiple Choice Encircle the letter that corresponds to your answer. I. Statement 1: PAS/IAS 36 applies to inventories, assets arising from construction contracts, deferred tax assets, assets arising from employee benefits, or assets classified as held for sale. Statement 2: The only difference between an asset's fair value and its fair value less costs of disposal is the direct incremental costs attributable to the disposal of the asset. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 2. Which of the following statements is correct? I. If the disposal costs are negligible, the recoverable amount of the revalued asset is necessarily close to, or greater than, its revalued amount. II. If the disposal costs are not negligible, the fair value less costs of disposal of the revalued asset is necessarily less than its fair value. a. Ionly c. Both I and II b. II only d. Neither I nor II 3. Statement 1: An asset is impaired when its recoverable amount exceeds its carrying amount. Statement 2: Evidence from internal reporting that indicates that an asset may be impaired includes the existence of net cash inflows for the asset when current period amounts are aggregated with budgeted amounts for the future a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct.20.1 Multiple Choice Encircle the letter that corresponds to your answer. 1. Statement 1: An intangible asset is an identifiable monetary asset without physical substance. Statement 2: An asset is identifiable if it is both separable and arises from contractual or other legal rights, regardless of whether those rights are transferrable or separable from the entity. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 2. Statement 1: An intangible asset shall be recognized if it is probable that the expected future economic benefits that are attributable to the asset will flow to the entity, or the cost of the asset can be measured reliably. Statement 2: An intangible asset shall be measured initially at cost. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 3. Which of the following statements is correct? I. The cost of a separately acquired intangible asset comprises its purchase price, including import duties and refundable purchase taxes before deducting trade discounts and rebates, and any directly attributable costs of preparing the asset for its intended use. II. The cost of employee benefits arising directly from bringing the asset to its working condition or the cost of testing whether the asset is functioning properly are examples of expenditures that are not part of the cost of intangible assets. a. Ionly C. Both I and II b. II only d. Neither I nor II 9C. the search for alternatives for materials, devices, products, processes, systems, or services d. activities aimed at obtaining new knowledge 8. The following costs are directly attributable cost of an internally generated intangible asset, except: a. fee to register a legal right b. cost of employee benefits arising from the generation of the intangible asset c. identified inefficiencies and initial operating losses incurred before the asset achieves planned performance d. costs of materials and services used or consumed in generating the intangible asset 9. Which of the following statements is correct? I. Expenditure on an intangible item that was initially recognized as an expense shall be recognized as part of the cost of an intangible asset at a later date. II. Expenditure on an intangible item shall be recognized as an expense when it is incurred unless it forms part of the cost of an intangible asset that meets the recognition criteria. a. I only C. Both I and II b. II only d. Neither I nor II 10. Which of the following statements is correct? I. If an intangible asset in a class of revalued intangible assets cannot be revalued because there is no active market for this asset, the asset shall be carried at its cost less any accumulated amortization and impairment losses. II. If the fair value of a revalued intangible asset can no longer be measured by reference to an active market, the carrying amount of the asset shall be its revalued amount at the date of the last revaluation by reference to the active market less any subsequent amortization and any subsequent impairment losses. a. Ionly c. Both I and II b. II only d. Neither I nor II 11c. Both statements are correct. d. Neither of the statements is correct. 8. Statement 1: Contingent liability usually arises from planned or other expected events that give rise to the possibility of an inflow of economic benefits to the entity. Statement 2: Contingent asset usually arises from planned or other expected events that give rise to the possibility of an outflow of economic benefits to the entity. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 9. Statement 1: The amount recognized as a contingent liability shall be the best estimate of the expenditure required to settle the present obligation at the end of the reporting period. Statement 2: The amount recognized as a provision shall be the best estimate of the expenditure required to settle the present obligation at the end of the reporting period. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 10. Statement 1: Gains from the expected disposal of asset shall not be taken into account in measuring a provision. Statement 2: In the statement of comprehensive income, the expense relating to a provision may be presented net of the amount recognized for a reimbursement. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 14in Statement I. Cash-generating units shall be identified consistently from period to period for the same asset or types of assets, unless a change is justified. Statement 2: The carrying amount of a cash-generating unit does not include the carrying amount of any recognized liability, unless the recoverable amount of the cash- generating unit cannot be determined without consideration of this liability. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct.4. Which of the following statements is correct? I. An investment property shall be measured initially at fair value II. Transaction costs are excluded in the initial measurement of investment property. a. Ionly C. Both I and II b. II only d. Neither I nor II 5. Statement 1: The cost of investment property is increased by stan. up costs. Statement 2: The cost of investment property is not increased by abnormal amounts of wasted material, labor, and other resources in constructing the property. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 6. Statement 1: An entity may choose either the fair value model or the cost model for all investment property backing liabilities that pay a return linked directly to the fair value of, or returns from specified assets including that investment property. Statement 2: An entity shall choose as its accounting policy either the fair value model or the cost model and shall apply that policy to selected investment property. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 7. Statement 1: After initial recognition, an entity that chooses the fair value model shall measure all of its investment property at fair value, except when there is inability to measure fair value reliably. Statement 2: A gain or loss arising from change in the fair value of investment property shall be recognized in 2Which of the following statements is correct? 1. Cost incurred in using or redeploying an intangible asset is not included in the carrying amount of that assel. 1. If payment for an intangible asset is deferred beyond normal credit terms, its cost is the cash price equivalent. a. Ionly C. Both I and II b. II only d. Neither I nor II Statement 1: Subsequent expenditure on an in-process research or development project acquired separately or in a business combination and recognized as an intangible asset is recognized as an expense when incurred if it is a research expenditure. Statement 2: Subsequent expenditure on an in-process research or development project acquired separately or in a business combination and recognized as an intangible asset is recognized as an expense when incurred if it is a development expenditure that satisfy the criteria for recognition as an intangible asset. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 6. Statement 1: Some intangible asset arising from research or from the research phase of an internal project shall be recognized. Statement 2: Expenditure on research or on the research phase of an internal project shall be recognized as an expense when incurred. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 7. The following are examples of research activities, except: a. the design, construction, and testing of pre-production or pre-use prototypes and models b. the search for, evaluation, and final selection of, and application of research findings or other knowledge 1021.1 Multiple Choice Encircle the letter that corresponds to your answer. 1. Which of the following statements is correct? I. A provision is a liability with certainty in timing and amount. II. A contingent liability is a liability of uncertain timing and amount a. Ionly C. Both I and II b. II only d. Neither I nor II 2. Statement 1: A provision is a recognized liability because it is a present obligation and it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation. Statement 2: A contingent liability is a recognized liability because it is a present obligation that meets the recognition criteria and it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 3. Statement 1: A provision shall be recognized when an entity has a present obligation as a result of past event and it is probable that an inflow of resources embodying economic benefits will be required to settle the obligation. Statement 2: It is only those obligations arising from past events existing independently of an entity's future actions that are recognized as provisions. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 12comprehensive income for the period in which it arises. a: Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 8. Which of the following statements is correct? [. When a property interest held by a lessee under an operating lease is classified as an investment property, the fair value model shall be applied. 11. The presumption that the fair value of investment property under construction can be measured reliably can be rebutted only on initial recognition. a. Ionly C. Both I and II b. II only d. Neither I nor II 9. Statement 1: If an entity has previously measured an investment property at fair value, it shall continue to measure the property at fair value until disposal even if comparable market transactions become less frequent or market prices become less readily available. Statement 2: An entity is required to transfer a property from investment property to inventories when, and only when, there is a change in use, evidenced by commencement of development with a view to sale. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct, 10. Statement 1: For a transfer investment property carried at fair value to owner-occupied property or inventories, the property's deemed cost for subsequent accounting shall be its fair value at the date of change in use. 3Statement : Recoverable amount is the higher of an asset's or cash- generating unit's fair value less costs of disposal and its value in use. Statement 2: It is always necessary to determine both the asset's fair value less costs of disposal and its value in use since if either of these amounts exceeds the asset's carrying amount, the asset is impaired. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 5. Statement 1: If there is no reason to believe that an asset's fair value less costs of disposal materially exceeds its value in use, the asset's recoverable amount may be used as its fair value less costs of disposal. Statement 2: Cash flow projections until the end of an asset's useful life are estimated by budgeting the cash flow projections based on the economic condition using a growth rate for prior years. a. Only the first statement is correct. b. Only the second statement is correct. c. Both statements are correct. d. Neither of the statements is correct. 6. Statement 1: Estimates of cash flows shall include cash inflows and outflows from financing activities. Statement 2: The discount rate shall be a post-tax rate that reflects future market assessment of the time value of money and the risk specific for the asset for which future cash flows estimates have been adjusted. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. O7. Which of the following statements is correct? I. If, and only if, the recoverable amount of an asset is less than its carrying amount, the carrying amount of the asset shall be reduced to its recoverable amount. That reduction is an impairment loss. II. If, and only if, the carrying amount of an asset is less than its recoverable amount, the recoverable amount of the asset shall be reduced to its carrying amount. That reduction is an impairment loss. a. Ionly C. Both I and II b. II only d. Neither I nor II 8. Statement 1: An impairment loss shall be recognized immediately in profit or loss, unless the asset is carried at its revalued amount. Statement 2: Any impairment loss of a revalued asset shall be treated as a revaluation decrease and is recognized in other comprehensive income. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct. 9. Statement 1: After the recognition of an impairment loss, the accumulated depreciation charge for the asset shall be adjusted in future periods to allocate the asset's revised carrying amount, less its residual value, if any, on a systematic basis over its entire useful life. Statement 2: The recoverable amount of an individual asset can easily be determined if the asset's value in use can be estimated to be close to its carrying amount less costs of disposal and the asset generates cash flows that are largely independent of those from other asset. a. Only the first statement is correct. b. Only the second statement is correct. C. Both statements are correct. d. Neither of the statements is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts