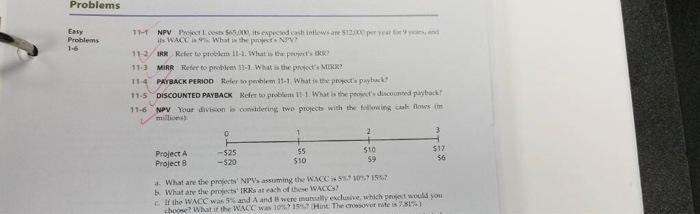

Question: help me answer these questions please Problems Easy 11 Problems 11-2 11-3 11-4 11-5 11-6 NPV Project costs $65/30, its expected cash intlows are 512x

Problems Easy 11 Problems 11-2 11-3 11-4 11-5 11-6 NPV Project costs $65/30, its expected cash intlows are 512x per year for years, and its WACC is What is the project's NIV IRR Refer to problem 11-1. What is the project's IRR? MIRR Refer to problem 11.1 What is the proyect's MRR PAYBACK PERIOD Refer to problem 11-1. What is the project's payback? DISCOUNTED PAYBACK Refer to problem 111. What is the pet's discounted payback? NPV Your division is considering two projects with the following cash flows in millions Project A Project B -$20 3. What are the projects' NPVs assuming the WACC 10.1557 b. What are the projects' is at each of these WACC) c. If the WACC was 5% and A and were mutually exclusive, which project would you choon? What if the WACC was 10% 15% Hint: The Crossover rate is 71.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts