Question: Help me answer this case report section based on the given case, and it's instructions and related formatting. Aston Clinton Motor Company ( ACM )

Help me answer this case report section based on the given case, and it's instructions and related formatting. Aston Clinton Motor Company ACM is a European corporation that manufactures commercial vehicles and passenger cars in many countries in North America, South America, Asia and Europe. It also provides automotive financing services through its wholly owned subsidiary, ACM Financial. ACM has raised capital from share issues and external bonds issues to finance its operations. Its shares are listed on the London Stock Exchange. It has been using IFRS for financial reporting purposes. It is now February ACM is in the process of finalizing its financial statements for the year ended December The chief financial officer CFO is preparing for a planning meeting with ACM's auditors. Before the meeting, the CFO would like his assistant to prepare an analysis of all financial reporting issues identified below. All values are in thousands of US dollars.

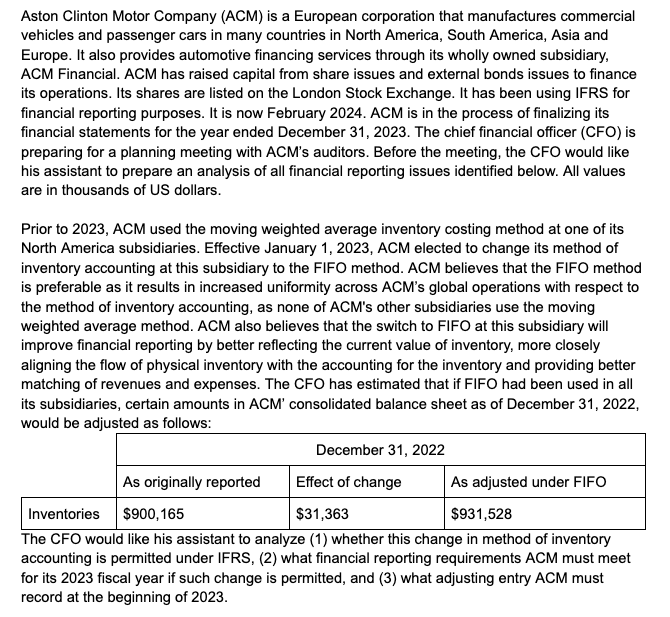

Prior to ACM used the moving weighted average inventory costing method at one of its North America subsidiaries. Effective January ACM elected to change its method of inventory accounting at this subsidiary to the FIFO method. ACM believes that the FIFO method is preferable as it results in increased uniformity across ACM's global operations with respect to the method of inventory accounting, as none of ACM's other subsidiaries use the moving weighted average method. ACM also believes that the switch to FIFO at this subsidiary will improve financial reporting by better reflecting the current value of inventory, more closely aligning the flow of physical inventory with the accounting for the inventory and providing better matching of revenues and expenses. The CFO has estimated that if FIFO had been used in all its subsidiaries, certain amounts in ACM' consolidated balance sheet as of December would be adjusted as follows:

The CFO would like his assistant to analyze whether this change in method of inventory accounting is permitted under IFRS, what financial reporting requirements ACM must meet for its fiscal year if such change is permitted, and what adjusting entry ACM must record at the beginning of Instructions:

Assume the role of the CFO's assistant and complete all the analyses requested by the CFO. Ignore any income tax adjustments, as they will be handled by ACM's tax team.

No appendix allowed

Cite paraphrase specific IFRS paragraphs with professional judgement to support the analysis

IAS : events after the reporting period particularly IAS

IAS : accounting policies, changes in accounting estimates and errors

IFRS : financial instruments

IAS : investments in associates and joint ventures Structure:

Issue: provide a succinct and specific description of the financial reporting issue. For example, "Issue: Discontinued operations resulting from the exit of US business have not been properly classified, measured, or presented."

Identification of the implication: offer a brief statement outlining the potential impact. For example, "The missing depreciation will overstate PP&E assets and net earnings", or "The adjustment to record the missing depreciation will reduce the net book value of PP&E assets and net earnings."

Analysis: this section should constitute the core of the discussion. It is expected to paraphrase relevant sections of IFRS to support your analysis on the identified financial reporting issues. Since IFRS is principlebased, you may not be able to find relevant IFRS for each issue.

Recommendation: conclude each section with a clear and well supported recommendation based on the preceding analysis.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock