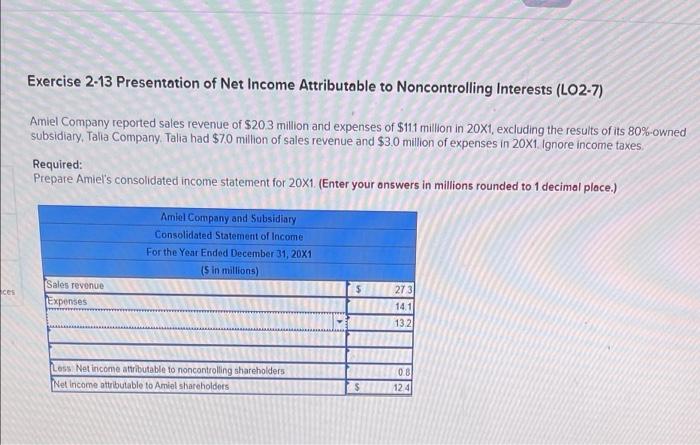

Question: -Help me answer this completly- -the third column is wrong! 13.2 is incorrect. - - picture 2-7 is just the choices for the left column.

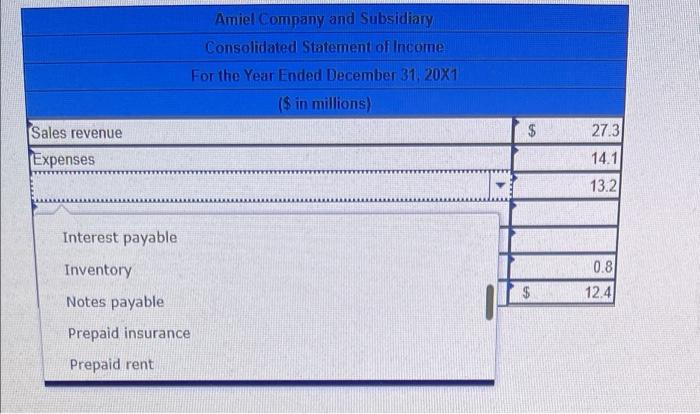

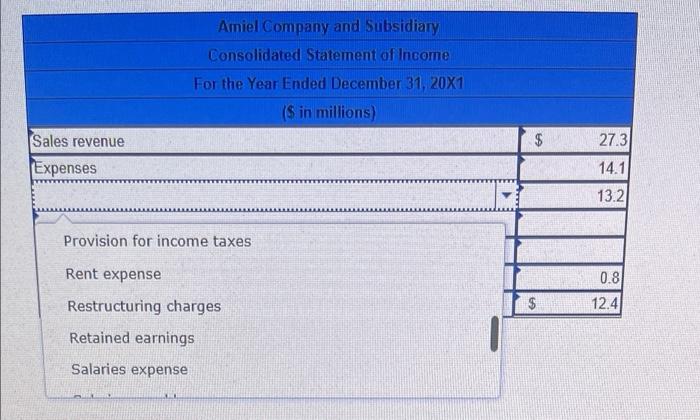

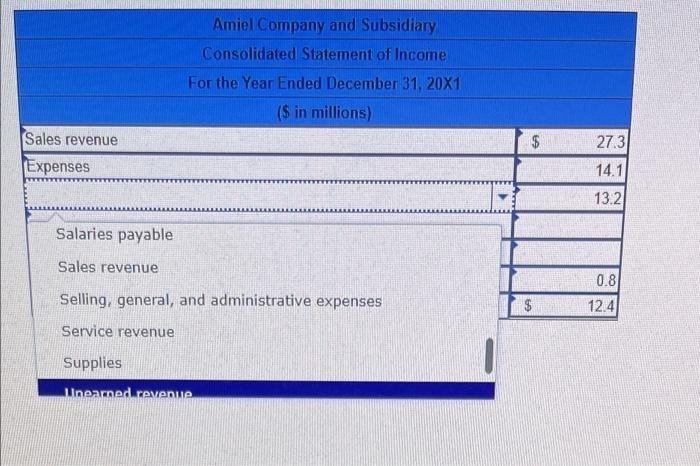

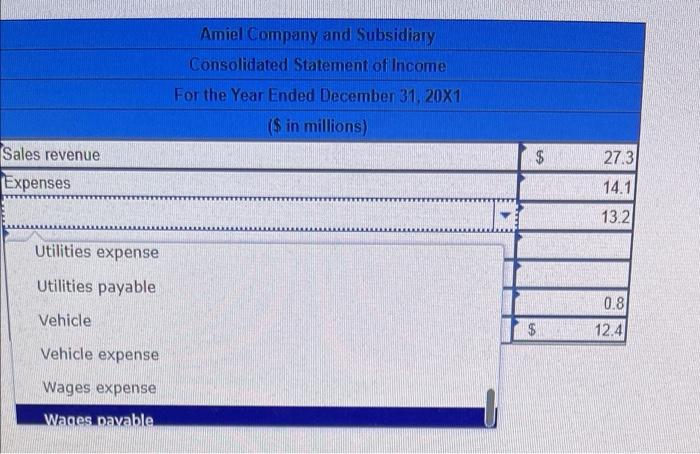

Exercise 2-13 Presentation of Net Income Attributable to Noncontrolling Interests (L02-7) Amiel Company reported sales revenue of $20.3 million and expenses of $111 million in 20x1, excluding the results of its 80%-owned subsidiary. Talia Company. Talia had $70 million of sales revenue and $3.0 million of expenses in 20X1. Ignore income taxes. Required: Prepare Amiel's consolidated income statement for 20X1. (Enter your answers in millions rounded to 1 decimal place.) Amiel Company and Subsidiary Consolidated Statement of Income For the Year Ended December 31, 20X1 (5 in millions) ces Sales revenue Expenses 273 14.1 13.2 Loss Net Income attributable to noncontrolling shareholders Net Income attributable to Amiel shareholders 0.8 124 $ Amiel Company and Subsidiary Consolidated Statement of Income For the Year Ended December 31, 20X1 1$ in millions) Sales revenue GA $ 27.3 Expenses 14.1 13.2 Accounts payable Accounts receivable Accrued tax liability 0.8 12.4 Accumulated depreciation Advances from customer Buildinas Amiel company and Subsidiary Consolidated Statement of income For the Year Ended December 31, 20X1 (S in millions) Sales revenue $ BA 27.3 S Expenses 14.1 13.2 Capital stock Cash 0.8 12.4 Cost of goods sold Depreciation expense Equipment Amiel Company and Subsidiary Consolidated Statement of Income For the Year Ended December 31, 20X1 ($ in millions) Sales revenue Expenses 27.3 14.1 13.2 Expenses Gasoline expense 0.8 12.41 Income tax expense Income tax payable Interest expense Amiel Company and Subsidiary Consolidated Statement of Income! For the Year Ended December 31, 20X1 ($ in millions) $ 27.3 Sales revenue Expenses 14.1 13.2 Interest payable 0.8 12.4 Inventory Notes payable Prepaid insurance Prepaid rent Amiel Company and Subsidiary Consolidated Statement of Income For the Year Ended December 31, 20X1 (in millions) $ Sales revenue Expenses 27.3 14.1 13.2 Provision for income taxes Rent expense 0.8 12.4 Da N- $ Restructuring charges Retained earnings Salaries expense Amiel Company and Subsidiary Consolidated Statement of Income For the Year Ended December 31, 20X1 ($ in millions) 27.3 Sales revenue Expenses 14.1 13.2 Salaries payable Sales revenue Selling, general, and administrative expenses 0.8 12.4 Service revenue Supplies Unearned. revenue Amiel Company and Subsidiary Consolidated Statement of Income For the Year Ended December 31, 20X1 ($ in millions) Sales revenue $ 27.3 Expenses 14.1 13.2 Utilities expense Utilities payable 0.8 Vehicle 12.4 Vehicle expense Wages expense Wages pavable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts