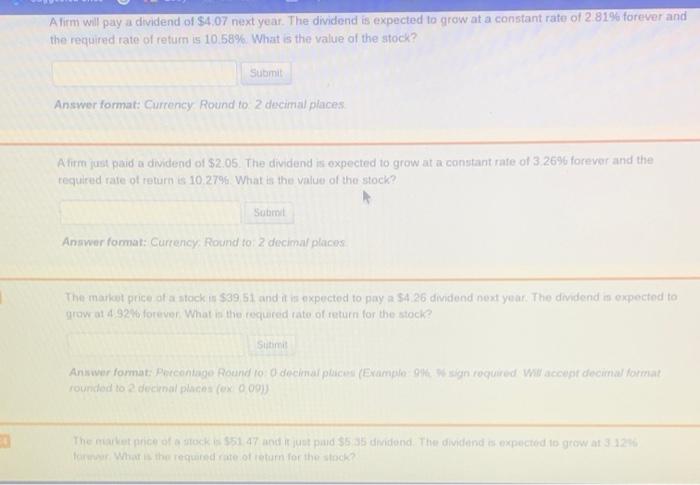

Question: help me answer this plz Alirm will pay a dividend of $4.07 next year. The dividend is expected to grow at a constant rate of

Alirm will pay a dividend of $4.07 next year. The dividend is expected to grow at a constant rate of 2.81% forever and the required rate of retum is 10.58%. What is the value of the stock? Submit Answer format: Currency Round to 2 decimal places A firm just paid a dividend of $2.05. The dividend is expected to grow at a constant rate of 3 26% forever and the required rate of return is 10:2796 What is the value of the stock? Sub Answer format: Currency: Round to 2 decimal places The market price of a stock $39,51 and it is expected to pay $4 26 dividend next year. The dividend in expected to grow at 4 32 forever. What in the required rate of return for the stock? Stim Answer format: Petcontage Round too gochar poco (Example on required accept cocina Format rounded to 2 decimal places (ex 009) The articolo 551 47 and just pand dividend the dividend expected to grow at 3 What is the required to return for the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts