Question: Help me answer this question please Nick's Novelties, Inc. is considering the purchase of electronic pinball machines to place in game arcades. The machines would

Help me answer this question please

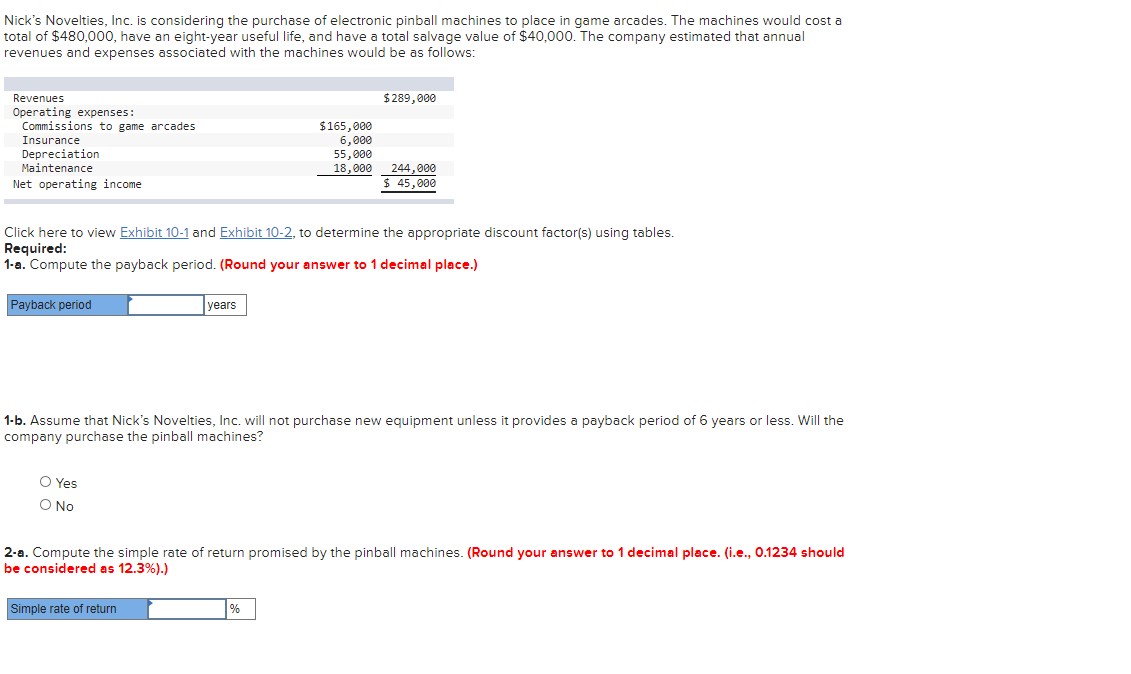

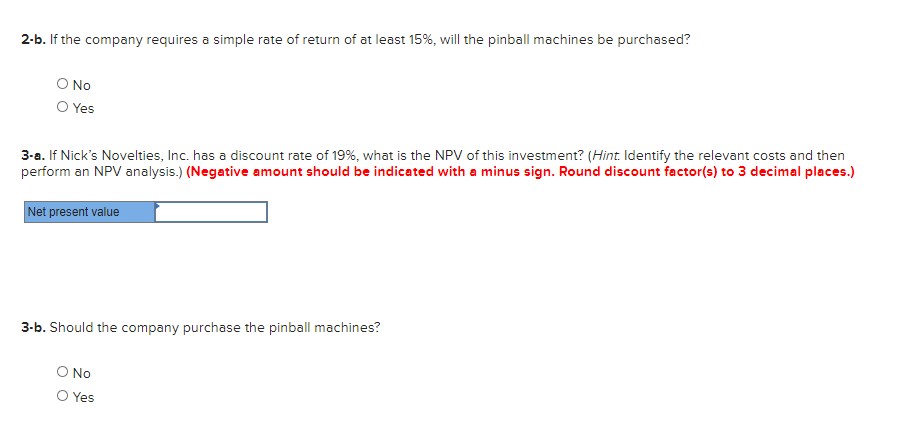

Nick's Novelties, Inc. is considering the purchase of electronic pinball machines to place in game arcades. The machines would cost a total of $480,000, have an eightyear useful life, and have a total salvage value of $40,000. The company estimated that annual revenues and expenses associated with the machines would be as follows: Revenues $239,888 Operating expenses: Commissions to game arcades $165,888 Insurance 6,888 Depreciation 55,888 Maintenance 18,888 244,888 Net operating income S 45,888 Click here to view Exhibit 10-1 and Exhibit 10-2, to determine the appropriate discount factor{s) using tables. Required: 1-a. Compute the payback period. (Round your answer to 1 decimal place.) years 1-b. Assume that Nick's Novelties, Inc. will not purchase new equipment unless it provides a payback period of 6 years or less. Will the company purchase the pinball machines? 0 Yes 0 No 2-a. Compute the simple rate of return promised bythe pinball machines. [Round your answeruo 1 decimal place. (i.e., 0.1234 should be considered as 12.3%}.) _:|E 2-b. If the company requires a simple rate of return of at least 15%, will the pinball machines be purchased? 0 No D Yes 3-a. If Nick's Novelties, Inc. has a discount rate of19%,what is the NPU ofthis investment? {Hint Identify the relevant costs and then perform an NPV analysis.) [Negative amount should be indicated with a minus sign. Round discount factorlsl to 3 decimal places.] _:| EM). Should the company purchase the pinball machines? 0 No D Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts