Question: Help me answer this question plz! Income statement part 2 company's income statement and balance sheet, as well as the industry average data for retailers.

Help me answer this question plz!

Income statement part 2

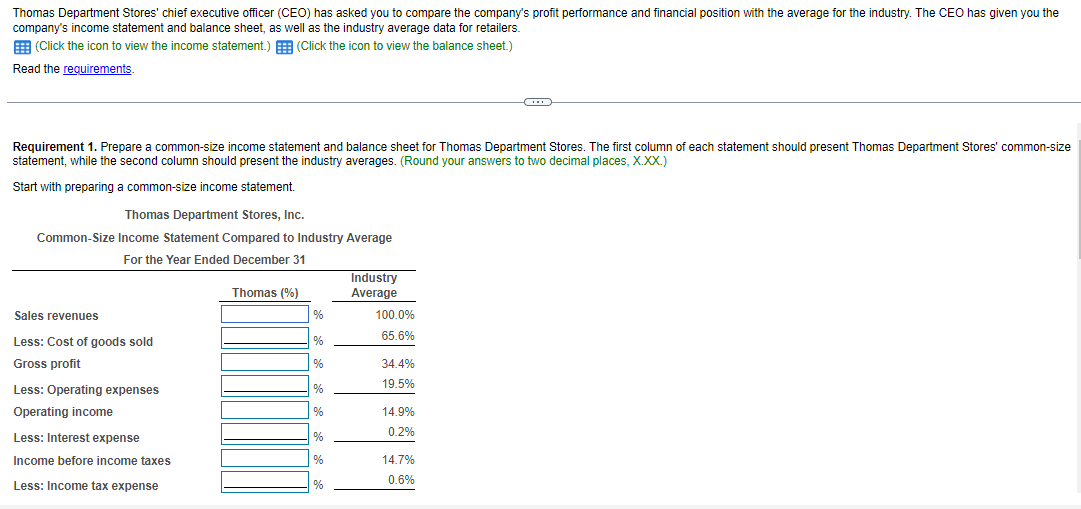

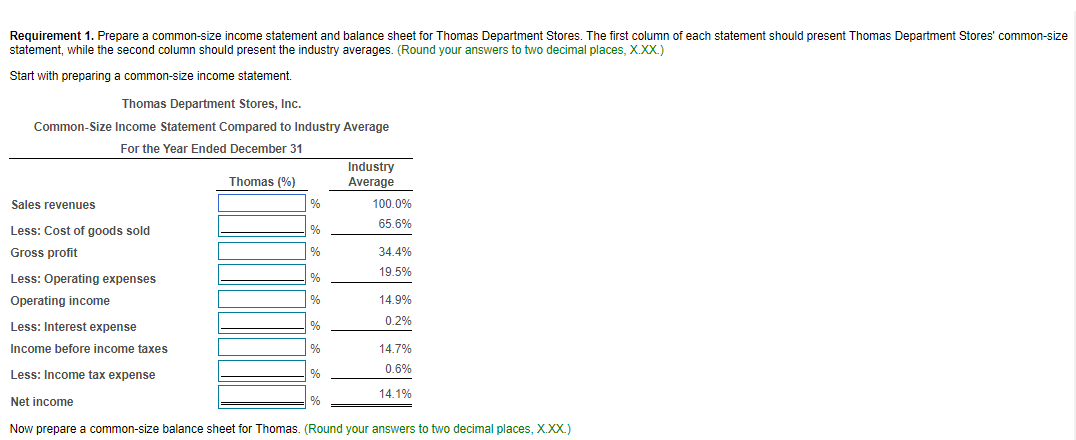

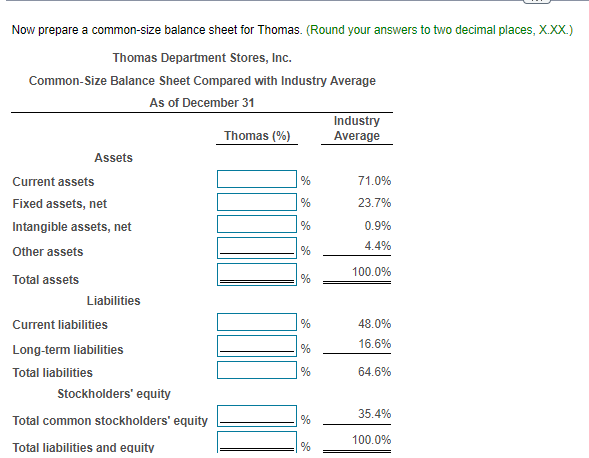

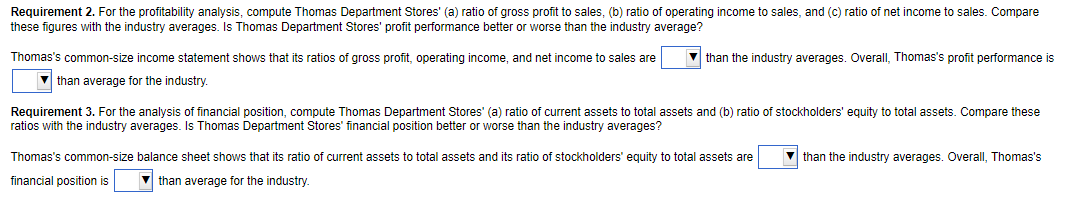

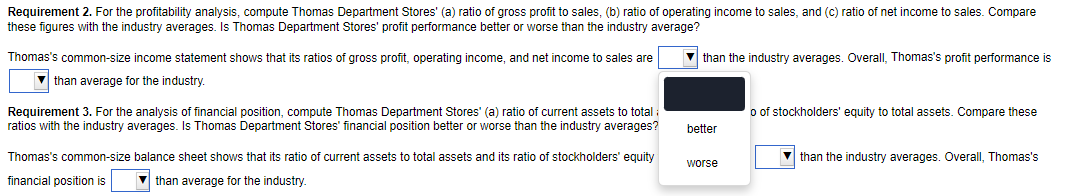

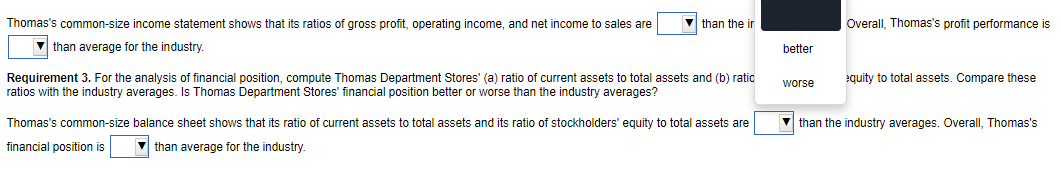

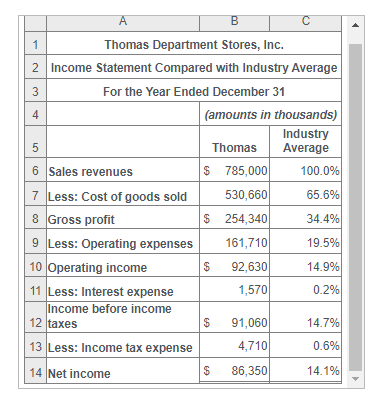

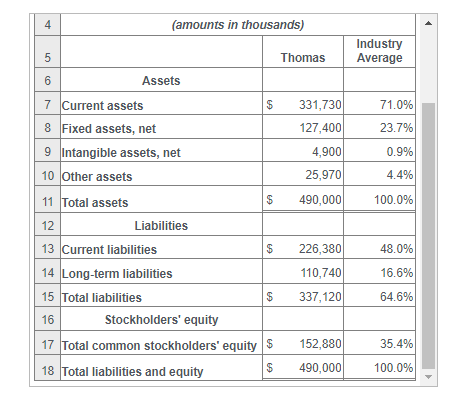

company's income statement and balance sheet, as well as the industry average data for retailers. (Click the icon to view the income statement.) (Click the icon to view the balance sheet.) Read the statement, while the second column should present the industry averages. (Round your answers to two decimal places, X.XX.) Start with preparing a common-size income statement. Thomas Department Stores, Inc. Common-Size Income Statement Compared to Industry Average statement, while the second column should present the industry averages. (Round your answers to two decimal places, X.XX.) Start with preparing a common-size income statement. Thomas Department Stores, Inc. Common-Size Income Statement Compared to Industry Average Now prepare a common-size balance sheet for Thomas. (Round your answers to two decimal places, X.XX.) Now prepare a common-size balance sheet for Thomas. (Round your answers to two decimal places, X.XX.) Thomas Department Stores, Inc. Common-Size Balance Sheet Compared with Industrv Averade these figures with the industry averages. Is Thomas Department Stores' profit performance better or worse than the industry average? Thomas's common-size income statement shows that its ratios of gross profit, operating income, and net income to sales are the industry averages. Overall, Thomas's profit performance is than average for the industry. Requirement 3. For the analysis of financial position, compute Thomas Department Stores' (a) ratio of current assets to total assets and (b) ratio of stockholders' equity to total assets. Compare these ratios with the industry averages. Is Thomas Department Stores' financial position better or worse than the industry averages? Thomas's common-size balance sheet shows that its ratio of current assets to total assets and its ratio of stockholders' equity to total assets are than the industry averages. Overall, Thomas's financial position is than average for the industry. Requirement 2. For the profitability analysis, compute Thomas Department Stores' (a) ratio of gross profit to sales, (b) ratio of operating income to sales, and (c) ratio of net income to sales. Compare these figures with the industry averages. Is Thomas Department Stores' profit performance better or worse than the industry average? Thomas's common-size income statement shows that its ratios of gross profit, operating income, and net income to sales are than the industry averages. Overall, Thomas's profit performance than average for the industry. Requirement 3. For the analysis of financial position, compute Thomas Department Stores' (a) ratio of current assets to total ; ) of stockholders' equity to total assets. Compare these ratios with the industry averages. Is Thomas Department Stores' financial position better or worse than the industry averages? Thomas's common-size balance sheet shows that its ratio of current assets to total assets and its ratio of stockholders' equity than the industry averages. Overall, Thomas's financial position is than average for the industry. Thomas's common-size income statement shows that its ratios of gross profit, operating income, and net income to sales are than the i than average for the industry. Requirement 3. For the analysis of financial position, compute Thomas Department Stores' (a) ratio of current assets to total assets and (b) rati atios with the industry averages. Is Thomas Department Stores' financial position better or worse than the industry averages? Thomas's common-size balance sheet shows that its ratio of current assets to total assets and its ratio of stockholders' equity to total assets are inancial position is than average for the industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts