Question: help me asap need text answer only.briefly explain! Question John owns a convenience shop called City Conv. The following events occurred for John during 2019-

help me asap

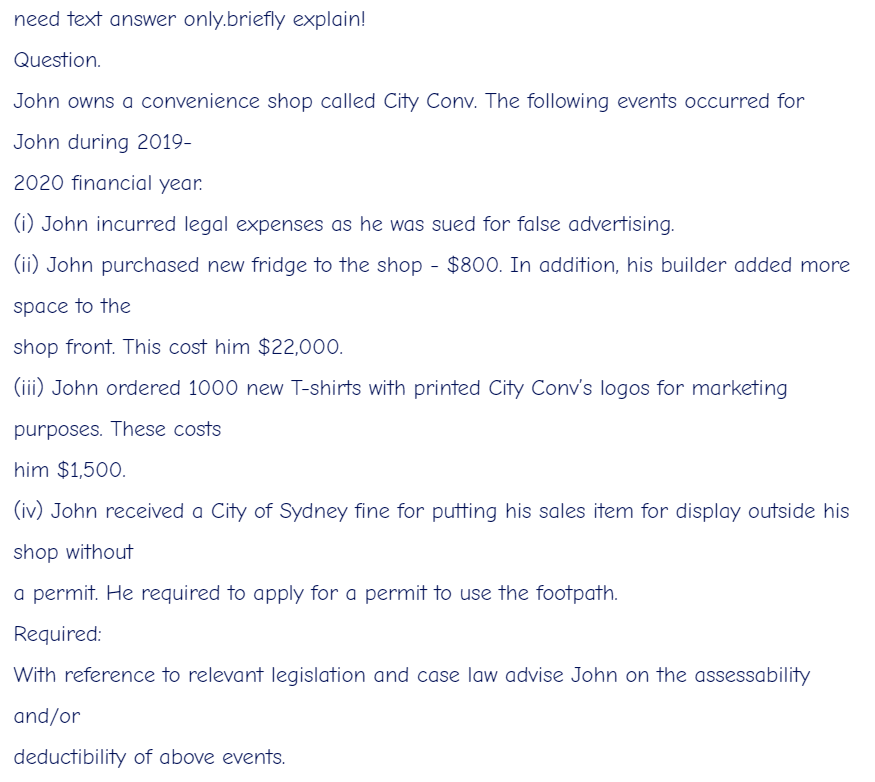

need text answer only.briefly explain! Question John owns a convenience shop called City Conv. The following events occurred for John during 2019- 2020 financial year. (i) John incurred legal expenses as he was sued for false advertising. (ii) John purchased new fridge to the shop - $800. In addition, his builder added more space to the shop front. This cost him $22,000. (iii) John ordered 1000 new T-shirts with printed City Conv's logos for marketing purposes. These costs him $1,500. (iv) John received a City of Sydney fine for putting his sales item for display outside his shop without a permit. He required to apply for a permit to use the footpath. Required: With reference to relevant legislation and case law advise John on the assessability and/or deductibility of above events

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts