Question: help me calculate Toronto Hydro has two options for upgrading a hydroelectric power station to meet new government standards. Dption 1:Toronto Hydro will make the

help me calculate

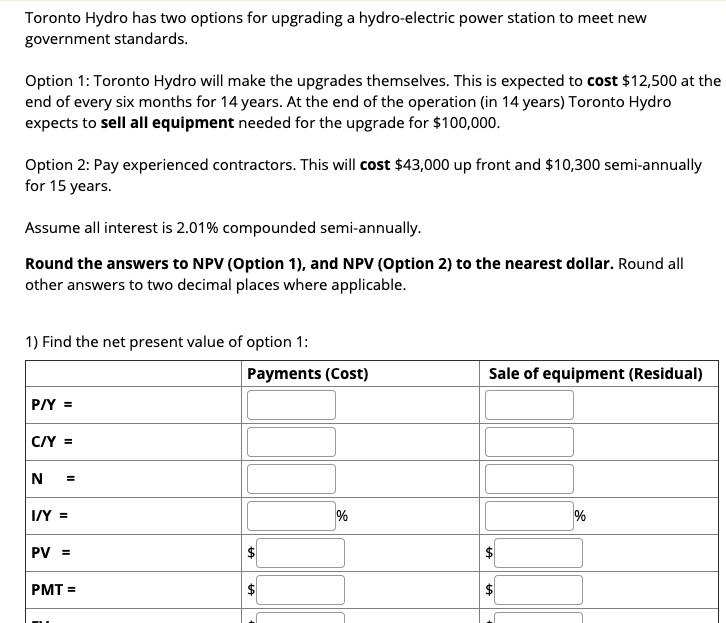

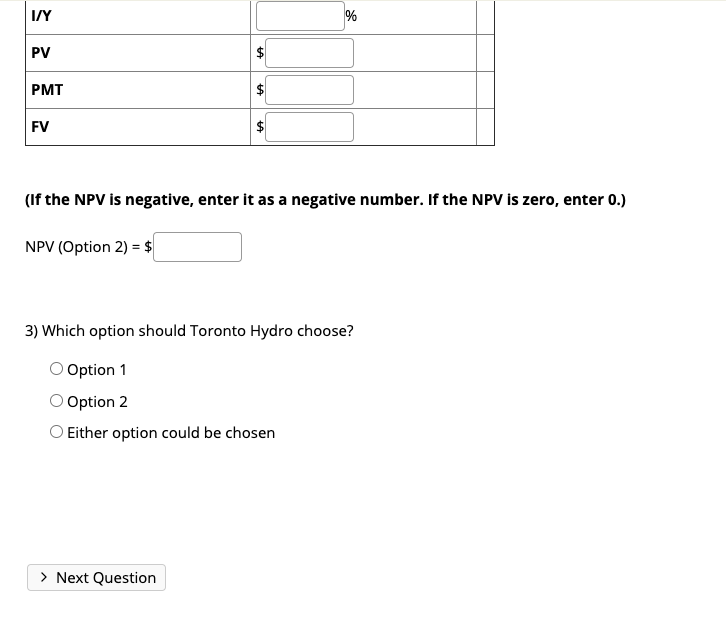

Toronto Hydro has two options for upgrading a hydroelectric power station to meet new government standards. Dption 1:Toronto Hydro will make the upgrades themselves. This is expected to cost $12.5D at the end of every six months for 14 years. At the end of the operation [in 14 years] Toronto Hydro expects to sell all equlpmerlt needed for the upgrade for $1DD,DIJID. Option 2: Pay experienced contractors. This will cost $43300 up front and $10,3 semi-annually for 15 years. Assume all interest is 2.131% compounded semi-annually. Round the answers to NW [ption 1}, and NW {ptinn 2} to the nearest dollar. Round all other answers to two decimal places where applicable. 1} Find the net present value of option 1: I/Y % PV PMT FV (If the NPV is negative, enter it as a negative number. If the NPV is zero, enter 0.) NPV (Option 2) = $ 3) Which option should Toronto Hydro choose? O Option 1 O Option 2 O Either option could be chosen > Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts