Question: Help me check the answer Question: Lim Coaches needs to acquire a new coach. They have the option of leasing the new coach or buying

Help me check the answer

Question:

Lim Coaches needs to acquire a new coach. They have the option of leasing the new coach or buying it outright.

The lease proposal involves:

A five year lease

Payments of $100,000 at the beginning of each year

A final residual payment at the end of the 5th year of $500,000

No residual value for depreciation calculations

A possible resale value, if sold after 5 years, of $200,000

If the company chooses to buy the coach, it involves:

An initial cost of $800,000

Depreciation, on a straight line basis over 5 years

No residual for depreciation calculations

A possible resale value after 5 years of $200,000

The cost of the coach will be finance with a deposit of 20% by the company and the balance financed with an interest only loan at 10%

Interest is payable at the end of each year

The loan principal is repaid at the end of 5 years

Other information relevant to the decision:

Company tax of 30% is payable at the end of each year

Cost of capital is 10% per annum

The coach will be sold at the end of 5 years, regardless of which option is chosen

Required:

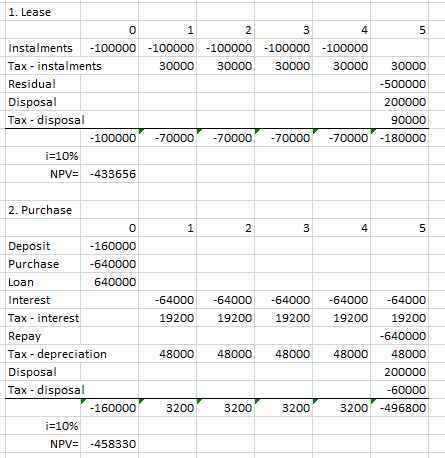

- Calculate the NPV of the lease proposal

- Calculate the NPV of the purchase proposal

My answer:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts