Question: Help me choose the correct answer. Section 6 - Itemized Deductions Exercise Answer Key 8) Vicky and Chuck file a joint return and claim their

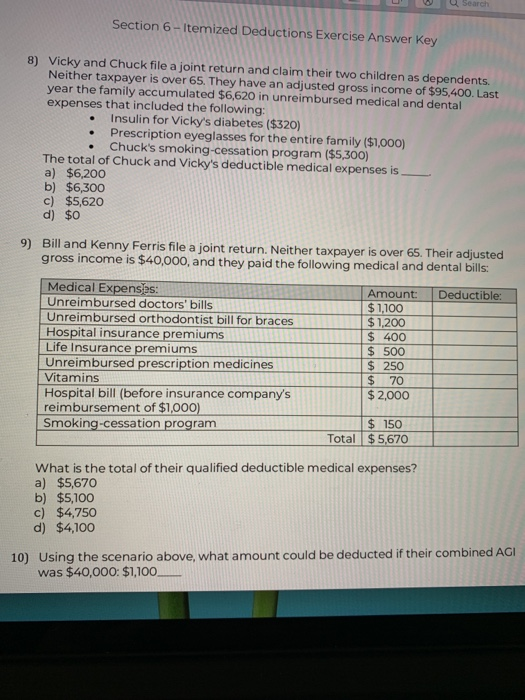

Section 6 - Itemized Deductions Exercise Answer Key 8) Vicky and Chuck file a joint return and claim their two children as dependents. Neither taxpayer is over 65. They have an adjusted gross income of $95,400. Last year the family accumulated $6,620 in unreimbursed medical and dental expenses that included the following: Insulin for Vicky's diabetes ($320) Prescription eyeglasses for the entire family ($1,000) Chuck's smoking cessation program ($5,300) The total of Chuck and Vicky's deductible medical expenses is a) $6,200 b) $6,300 c) $5,620 d) $0 9) Bill and Kenny Ferris file a joint return. Neither taxpayer is over 65. Their adjusted gross income is $40,000, and they paid the following medical and dental bills: Medical Expenses: Amount: Deductible: Unreimbursed doctors' bills $1,100 Unreimbursed orthodontist bill for braces $ 1,200 Hospital insurance premiums $ 400 Life Insurance premiums $ 500 Unreimbursed prescription medicines $ 250 Vitamins $ 70 Hospital bill (before insurance company's $ 2,000 reimbursement of $1,000) $ 150 Smoking cessation program Total $ 5,670 What is the total of their qualified deductible medical expenses? a) $5,670 b) $5,100 c) $4,750 d) $4,100 10) Using the scenario above, what amount could be deducted if their combined AGI was $40,000: $1,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts