Question: Help me ! Excel Activity: Forecasting Financial Statements Morrissey Technologies Inc.'s 2021 financial statements are shown here. Morrissey Technologies Inc.: Income Statement for December 31,

Help me !

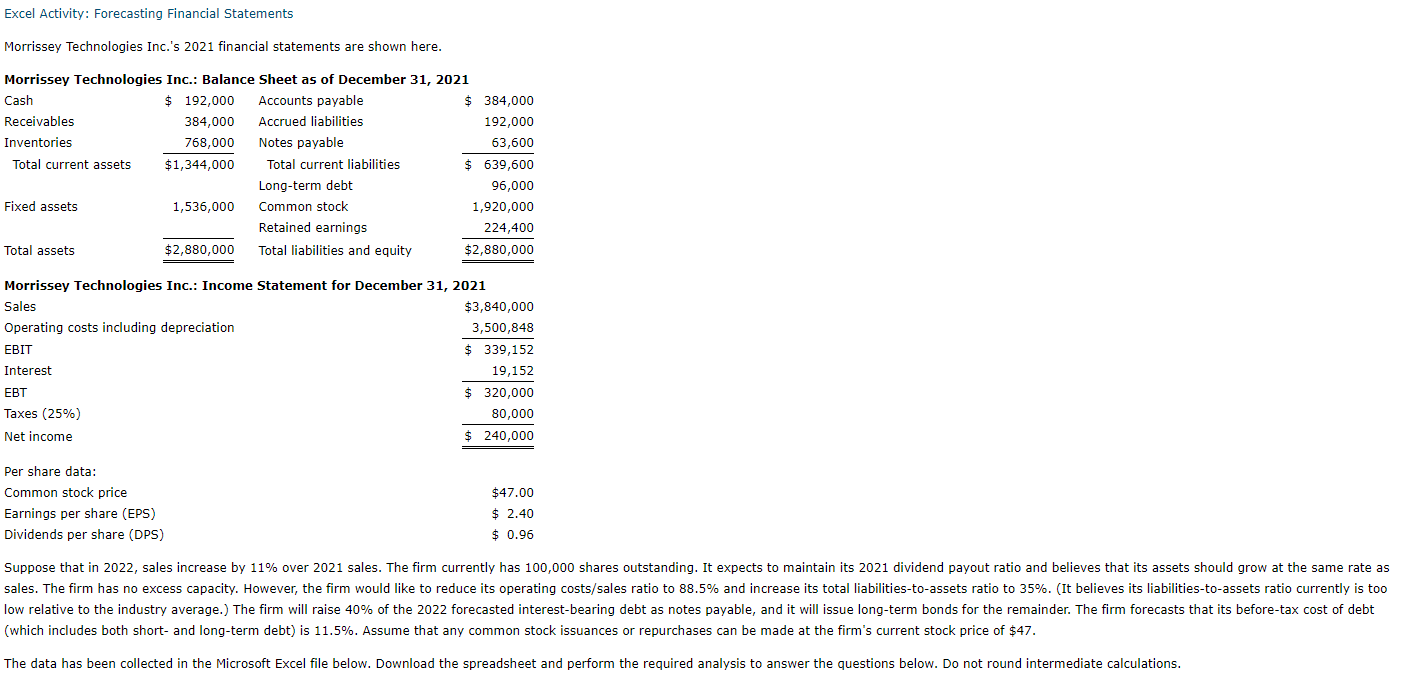

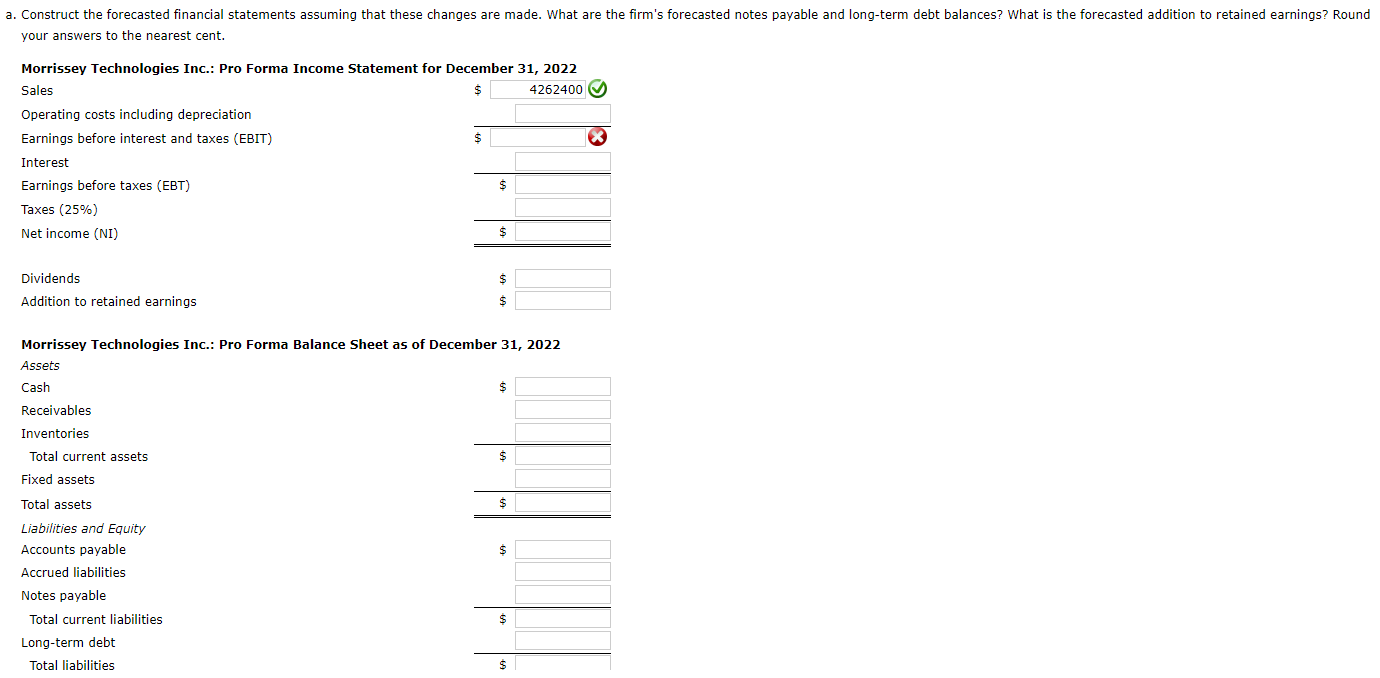

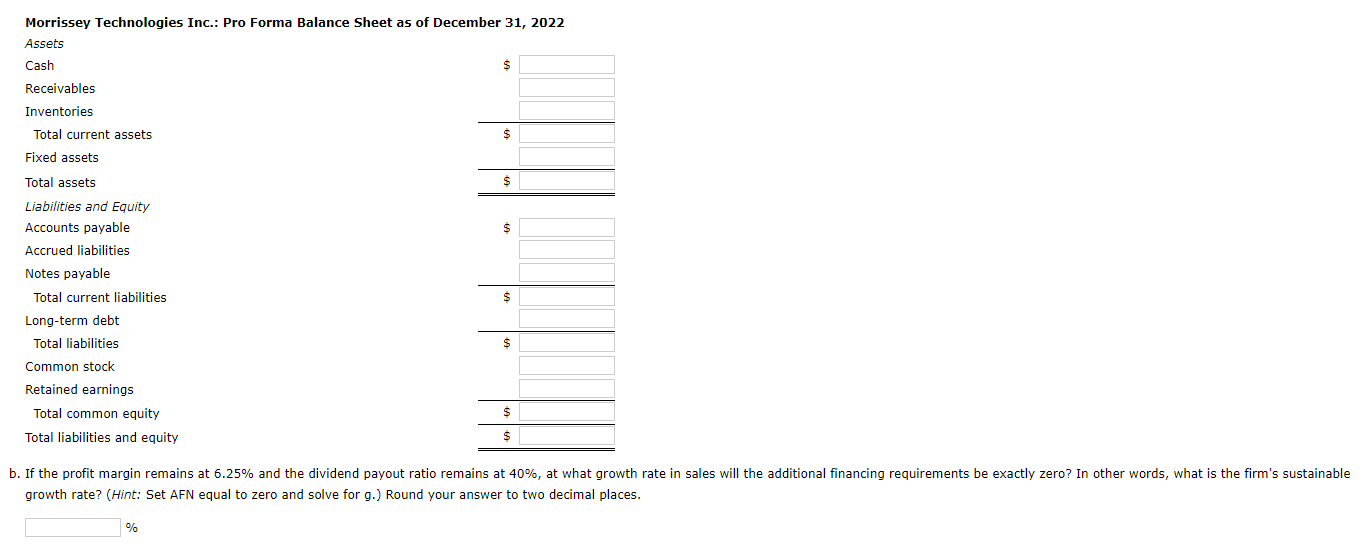

Excel Activity: Forecasting Financial Statements Morrissey Technologies Inc.'s 2021 financial statements are shown here. Morrissey Technologies Inc.: Income Statement for December 31, 2021 r-1(which includes both short- and long-term debt) is 11.5%. Assume that any common stock issuances or repurchases can be made at the firm's current stock price $47. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. your answers to the nearest cent. Morrissey Technologies Inc.: Pro Forma Income Statement for December 31, 2022 Sales $4262400 Operating costs including depreciation Earnings before interest and taxes (EBIT) Interest Earnings before taxes (EBT) Taxes (25\%) Net income (NI) Dividends Addition to retained earnings \begin{tabular}{c|} \hline$ \\ \hline$ \\ \hline \hline \end{tabular} Morrissey Technologies Inc.: Pro Forma Balance Sheet as of December 31, 2022 Assets Cash Receivables Inventories Total current assets Fixed assets Total assets Liabilities and Equity Accounts payable Accrued liabilities Notes payable Total current liabilities Long-term debt Total liabilities Morrissey Technologies Inc.: Pro Forma Balance Sheet as of December 31, 2022 growth rate? (Hint: Set AFN equal to zero and solve for g.) Round your answer to two decimal places. % Excel Activity: Forecasting Financial Statements Morrissey Technologies Inc.'s 2021 financial statements are shown here. Morrissey Technologies Inc.: Income Statement for December 31, 2021 r-1(which includes both short- and long-term debt) is 11.5%. Assume that any common stock issuances or repurchases can be made at the firm's current stock price $47. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. your answers to the nearest cent. Morrissey Technologies Inc.: Pro Forma Income Statement for December 31, 2022 Sales $4262400 Operating costs including depreciation Earnings before interest and taxes (EBIT) Interest Earnings before taxes (EBT) Taxes (25\%) Net income (NI) Dividends Addition to retained earnings \begin{tabular}{c|} \hline$ \\ \hline$ \\ \hline \hline \end{tabular} Morrissey Technologies Inc.: Pro Forma Balance Sheet as of December 31, 2022 Assets Cash Receivables Inventories Total current assets Fixed assets Total assets Liabilities and Equity Accounts payable Accrued liabilities Notes payable Total current liabilities Long-term debt Total liabilities Morrissey Technologies Inc.: Pro Forma Balance Sheet as of December 31, 2022 growth rate? (Hint: Set AFN equal to zero and solve for g.) Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts