Question: Help me explain please! during these a. Single. d. Quamy mis b. Head of household. e. Married filing separately. c. Married filing jointly. 2. April,

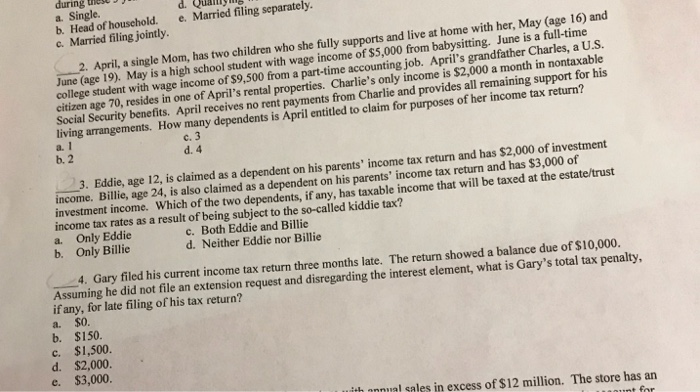

during these a. Single. d. Quamy mis" b. Head of household. e. Married filing separately. c. Married filing jointly. 2. April, a single Mom, has two children who she fully supports and live at home with her, May (age 16) and June (age 19). May is a high school student with wage income of $5,000 from babysitting. June is a full-time college student with wage income of $9,500 from a part-time accounting job. April's grandfather Charles, a U.S. citizen age 70, resides in one of April's rental properties. Charlie's only income is $2,000 a month in nontaxable Social Security benefits. April receives no rent payments from Charlie and provides all remaining support for his living arrangements. How many dependents is April entitled to claim for purposes of her income tax return? c. 3 a. 1 b.2 d. 4 3. Eddie, age 12, is claimed as a dependent on his parents' income tax return and has $2,000 of investment income. Billie, age 24. is also claimed as a dependent on his parents' income tax return and has $3,000 of investment income. Which of the two dependents, if any, has taxable income that will be taxed at the estate/trust income tax rates as a result of being subject to the so-called kiddie tax? a. Only Eddie c. Both Eddie and Billie b. Only Billie d. Neither Eddie nor Billie _4. Gary filed his current income tax return three months late. The return showed a balance due of $10,000. Assuming he did not file an extension request and disregarding the interest element, what is Gary's total tax penalty, if any, for late filing of his tax return? a. $0. b. $150. c. $1,500. d. $2,000. e. $3,000. with annual sales in excess of $12 million. The store has an T unt for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts