Question: help me fill schedule 1 form 1040 APPENDIX E Practice Set Assignments-Comprehensive Tax Return Pr PROBLEM 2 Samantha A. Cranston, age 37, is single and

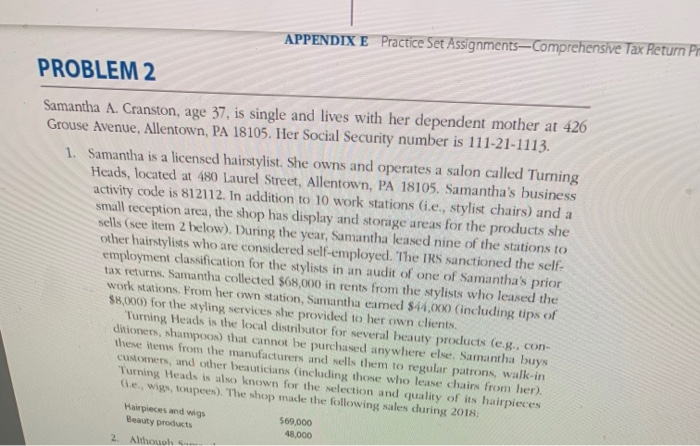

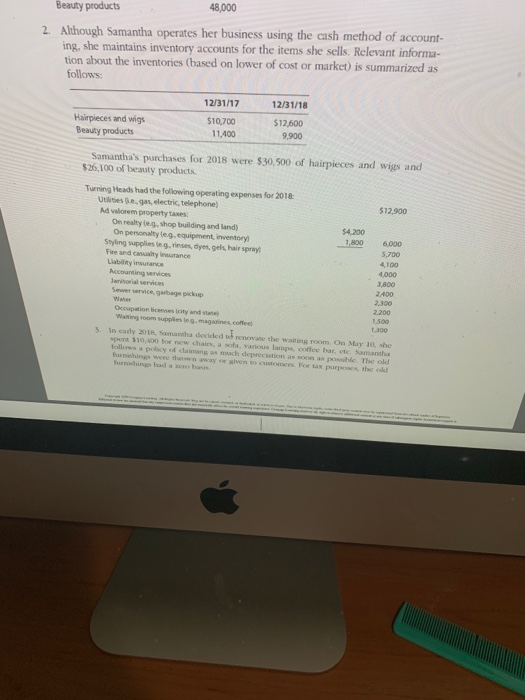

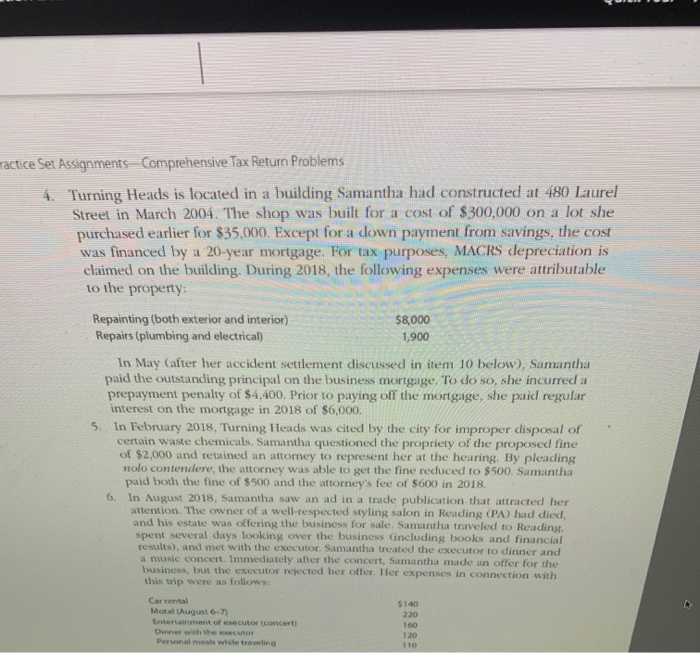

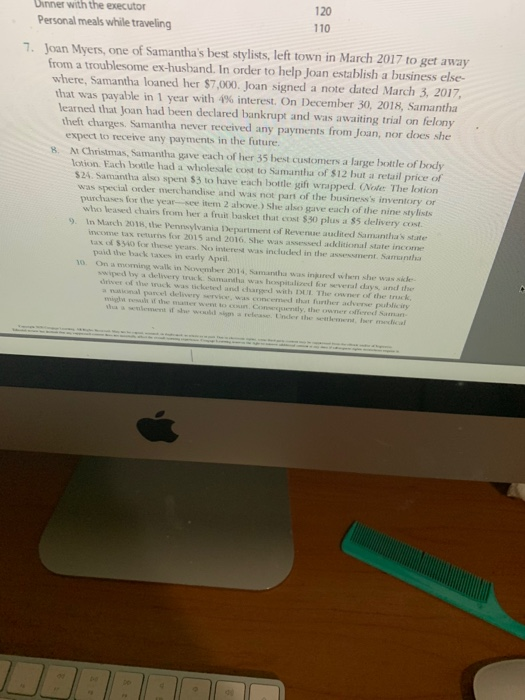

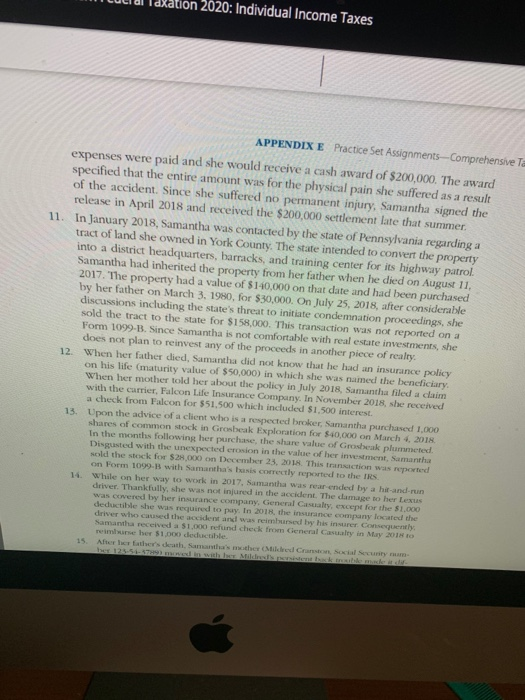

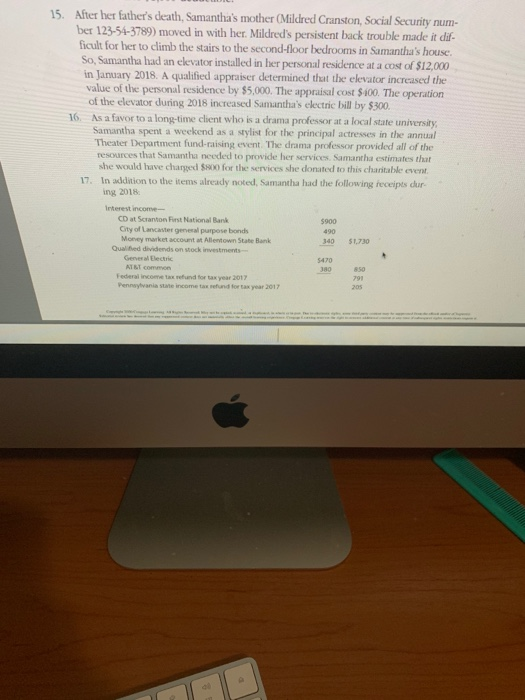

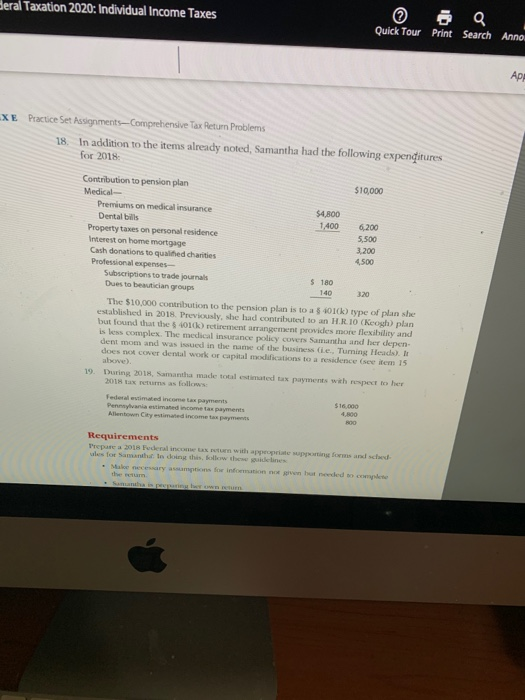

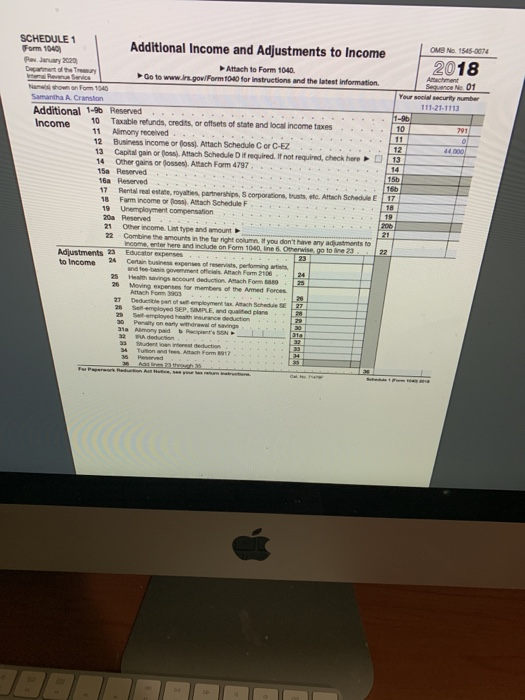

APPENDIX E Practice Set Assignments-Comprehensive Tax Return Pr PROBLEM 2 Samantha A. Cranston, age 37, is single and lives with her dependent mother at 426 Grouse Avenue, Allentown, PA 18105. Her Social Security number is 111-21-1113. 1. Samantha is a licensed hairstylist. She owns and operates a salon called Turning Heads, located at 480 Laurel Street, Allentown, PA 18105. Samantha's business activity code is 812112. In addition to 10 work stations G.e., stylist chairs) and a small reception area, the shop has display and storage areas for the products she sells (see item 2 below). During the year, Samantha leased nine of the stations to other hairstylists who are considered self-employed. The IRS sanctioned the self- employment classification for the stylists in an audit of one of Samantha's prior tax returns, Samantha collected $68,000 in rents from the stylists who leased the workstations. From her own station, Samantha eamed $44.000 (including tips of $8,000) for the styling services she provided to her own clients. Turning Heads is the local distributor for several beauty products (eg, con- ditioners, shampoos) that cannot be purchased anywhere else. Samantha buys these items from the manufacturers and sells them to regular patrons, walk-in customers, and other beauticians (including those who lease chairs from her). Turning Heads is also known for the selection and quality of its hairpieces Che, wigstoupees). The shop made the following sales during 2018: Hairpieces and wigs $69.000 Beauty products 2. Although 48,000 Beauty products 48,000 2. Although Samantha operates her business using the cash method of account- ing, she maintains inventory accounts for the items she sells. Relevant informa- tion about the inventories (based on lower of cost or market) is summarized as follows 12/31/17 510,700 11.400 12/31/18 $12,600 9.900 Hairpieces and wigs Beauty products Samantha's purchases for 2018 were $30.500 of hairpieces and wigs and $26,100 of beauty products $12.900 Turring Heads had the following operating expenses for 2018 D e gas, electric, telephone) M on property taxes On restyle shop building and land) On personalty leg.equipment, inventory Styling supplestegrinses, dyes pels halt sprapt. Fire and casualty ance L ance 6.000 4,000 3.800 2400 Jual services 2200 3. Waiting room wuppesem .co In early 2018, Samantha decided of renewate the walking room on May 10, she por S o cha a various soft har Samantha follows apoyo a much deprecat e The old wractice Set Assignments Comprehensive Tax Return Problems 4. Turning Heads is located in a building Samantha had constructed at 480 Laurel Street in March 2004. The shop was built for a cost of $300,000 on a lot she purchased earlier for $35,000. Except for a down payment from savings, the cost was financed by a 20-year mortgage. For tax purposes, MACRS depreciation is claimed on the building. During 2018, the following expenses were attributable to the property: Repainting (both exterior and interior) Repairs (plumbing and electrical) $8,000 1,900 In May (after her accident settlement discussed in item 10 below), Samantha paid the outstanding principal on the business mortgage. To do so, she incurred a prepayment penalty of $4,400. Prior to paying off the mortgage, she paid regular interest on the mortgage in 2018 of $6,000. 5. In February 2018, Turning Heads was cited by the city for improper disposal of certain waste chemicals. Samantha questioned the propriety of the proposed fine of $2,000 and retained an attorney to represent her at the hearing. By pleading nolo contendere, the attorney was able to get the fine reduced to $500. Samantha paid both the fine of $500 and the attorney's fee of $600 in 2018. 6. In August 2018, Samantha saw an ad in a trade publication that attracted her attention. The owner of a well-respected styling salon in Reading (PA) had died, and his estate was offering the business for sale. Samantha traveled to Reading spent several days looking over the business including books and financial results), and met with the executor Samantha treated the executor to dinner and a music concert. Immediately after the concert, Samantha made an offer for the business, but the executor rejected her offer. Her expenses in connection with this trip were as follows: $140 220 Car rental Motel August 6-7) Entertainment of executor concert Dinner with the executor Personal meals while traveling 160 120 110 D er with the executor Personal meals while traveling 120 110 7. Joan Myers, one of Samantha's best stylists, left town in March 2017 to get away from a troublesome ex-husband. In order to help Joan establish a business else where, Samantha loaned her $7.000. Joan signed a note dated March 3, 2017, that was payable in 1 year with 4% interest. On December 30, 2018, Samantha learned that Joan had been declared bankrupt and was awaiting trial on felony theft charges, Samantha never received any payments from Joan, nor does she expect to receive any payments in the future M Christmas, Samantha gave each of her 35 best customers a large bottle of body lotion Vachote had a wholesale cost to Samantha of $12 but a retail price of $24. Samantha also spent 53 to have each bottle ift wrapped (Note: The lotion was special onder merchandise and was not part of the business's inventory or purchases for the year sem 2 alone. She also save each of the ninetylists who lead chairs from a fruit basket that is $0 plus a 5 delivery cust 9. In March 2017, the Pennsylvania Department of He a dlied sama stante In 2015 and 2016 w e dakcial state ince tax isso for these years. No interest was included in the arenent Samantha pold the back taxes in early April... dar Samanthawishi wadays and the otchwohet huw ender the w all - xation 2020: Individual Income Taxes APPENDIX E Practice Set Assignments Comprehensive expenses were paid and she would receive a cash award of $200,000. The award specified that the entire amount was for the physical pain she suffered as a result of the accident. Since she suffered no permanent injury, Samantha signed the release in April 2018 and received the $200,000 settlement late that summer. In January 2018, Samantha was contacted by the state of Pennsylvania regarding a tract of land she owned in York County. The state intended to convert the property into a district headquarters, barracks, and training center for its highway patrol Samantha had inherited the property from her father when he died on August 11, 2017. The property had a value of $140,000 on that date and had been purchased by her father on March 3. 1980, for $30,000. On July 25, 2018, after considerable discussions including the state's threat to initiate condemnation proceedings, she sold the tract to the state for $158,000. This transaction was not reported on a Form 1099-11. Since Samantha is not comfortable with real estate investments, she does not plan to reinvest any of the proceeds in another piece of realty 12. When her father died, Samantha did not know that he had an insurance policy on his life (maturity value of $50,000) in which she was named the beneficiary. When her mother told her about the policy in July 2018, Samantha filed a claim with the carrier, Falcon Life Insurance Company. In November 2018, she received a check from Falcon for $51,500 which included $1.500 interest. 13. Upon the advice of a client who is a respected broker, Samantha purchased 1,000 shares of common stock in Cobek Exploration for $10.000 March In the months following her purchase the share value of Grosbeak plurmened. Disgusted with the unexpected erosion in the value of her investment. Samantha sold the stock for $2.0 on December 25, 2018 This transition was reported on Form 1099 with Samantha's sis correctly reported to the RS 14. While on her way to work in 2017, Samantha was rear ended by a hit-and-run deverThankfully, she was not injured in the accident. The came to her Lexus was covered by her insurance company, General Castly, except for the $1.000 deductible she was required to pay. In 2010, the insurance company located the driver who cand the accident and was reimbursed by his insurer Cou nty Samantha recolheds1000 refund check from General Casualty in May 2014 rem e he 31. deductible 15. After her father's death, Samantha's mother (Mildred Cranston, Social Security num- ber 123-54-3789) moved in with her. Mildred's persistent back trouble made it dif- ficult for her to climb the stairs to the second-floor bedrooms in Samantha's house. So, Samantha had an elevator installed in her personal residence at a cost of $12.000 in January 2018. A qualified appraiser determined that the elevator increased the value of the personal residence by $5,000. The appraisal cost $100. The operation of the elevator during 2018 increased Samantha's electric bill by $300 16. As a favor to a long-time client who is a drama professor at a local state university Samantha spent a weekend as a stylist for the principal actresses in the annual Theater Department fund-raising event. The drama professor provided all of the resources that Samantha needed to provide her services. Samantha estimates that she would have changed $200 for the services she donated to this charitable event 17. In addition to the items already noted, Samantha had the following receipts dur ing 2018 Interest income Cat Scranton stational Bank 5900 Cty of actre purpose bonds Money market account Allentown State Bank 3403 5470 al Taxation 2020: Individual Income Taxes Quick Tour Print Search Anno E Practice Set Assignments-Comprehensive Tax Return Problems 18. In addition to the items already noted, Samantha had the following expenqitures for 2018 $10,000 S4300 1,400 Contribution to pension plan Medical Premiums on medical insurance Dental bills Property taxes on personal residence Interest on home mortgage Cash donations to quitted charities Professional expenses Subscriptions to trade journals Dues to beautician groups 5.500 2.200 4.500 $ 180 The $10,000 contribution to the pension plan is to a s o k) type of plan she established in 2018. Previously, she had contributed to an HR 10 (Neosh) plan but found that the 501(k) retirement arrangement provides more flexibility and is les complex. The medical insurance policy Go Samantha and her depan den mom and was sed in the name of the businesse. Tuming Fleadh does not cover dental work or capital modifications to a residence see item 15 19. During 2018, Samantha made total estimated tax payments with respect to her $1.000 P Federal stimated income tax payments ets Allentown City time income tax payments Requirements Make necessary assumptions for information noe gon but nooded to complete OMB No 1545-0074 2018 Your Amalment Sequence01 security number 111211113 1-9 10 - Blog + 13 SCHEDULE 1 Form 1040 Additional Income and Adjustments to Income Peruary 2009 Attach to Form 1040 Dente Go to www.ins.govForm 1040 for instructions and the latest Information l ng F 140 Samantha A. Cranston Additional 1-9 Reserved ..... . . . . . . . . . . 10 Income Taxable refunds, credits, or offsets of state and local income taxes 11 Alimony received 12 Business income or oss. Attach Schedule Cor C-EZ 13 Capital gain or loss. Attach Schedule Dif required. If not required, check here 14 Other gains or losses. Attach Form 4797 . 150 Reserved - - 15a Reserved 17 Rental real estate, royalties, partnerships, corporation, trustste Attach Schedule E 18 Farm Income or ons Attach Schedule F 19 Unemployment compensation - - - - - 20a Reserved 21 Other income. Un type and amount 22 Combine the amounts in the far right you don't have any a m ants to roome.enter here and include on Form 1040. in 6. Otherwise, go to line 23 Adjustments 23 Educator expenses to Income 24 Cranber r ies performing and fee-begovement of Anth Form 2106 .. Health account detection Artach Form 236 Moving swpenses for members of the Armed Forces 27 Dec e nt Ach cha SE med SEPE employed the insurance deduction Penalty on earty with a sings 17 21 APPENDIX E Practice Set Assignments-Comprehensive Tax Return Pr PROBLEM 2 Samantha A. Cranston, age 37, is single and lives with her dependent mother at 426 Grouse Avenue, Allentown, PA 18105. Her Social Security number is 111-21-1113. 1. Samantha is a licensed hairstylist. She owns and operates a salon called Turning Heads, located at 480 Laurel Street, Allentown, PA 18105. Samantha's business activity code is 812112. In addition to 10 work stations G.e., stylist chairs) and a small reception area, the shop has display and storage areas for the products she sells (see item 2 below). During the year, Samantha leased nine of the stations to other hairstylists who are considered self-employed. The IRS sanctioned the self- employment classification for the stylists in an audit of one of Samantha's prior tax returns, Samantha collected $68,000 in rents from the stylists who leased the workstations. From her own station, Samantha eamed $44.000 (including tips of $8,000) for the styling services she provided to her own clients. Turning Heads is the local distributor for several beauty products (eg, con- ditioners, shampoos) that cannot be purchased anywhere else. Samantha buys these items from the manufacturers and sells them to regular patrons, walk-in customers, and other beauticians (including those who lease chairs from her). Turning Heads is also known for the selection and quality of its hairpieces Che, wigstoupees). The shop made the following sales during 2018: Hairpieces and wigs $69.000 Beauty products 2. Although 48,000 Beauty products 48,000 2. Although Samantha operates her business using the cash method of account- ing, she maintains inventory accounts for the items she sells. Relevant informa- tion about the inventories (based on lower of cost or market) is summarized as follows 12/31/17 510,700 11.400 12/31/18 $12,600 9.900 Hairpieces and wigs Beauty products Samantha's purchases for 2018 were $30.500 of hairpieces and wigs and $26,100 of beauty products $12.900 Turring Heads had the following operating expenses for 2018 D e gas, electric, telephone) M on property taxes On restyle shop building and land) On personalty leg.equipment, inventory Styling supplestegrinses, dyes pels halt sprapt. Fire and casualty ance L ance 6.000 4,000 3.800 2400 Jual services 2200 3. Waiting room wuppesem .co In early 2018, Samantha decided of renewate the walking room on May 10, she por S o cha a various soft har Samantha follows apoyo a much deprecat e The old wractice Set Assignments Comprehensive Tax Return Problems 4. Turning Heads is located in a building Samantha had constructed at 480 Laurel Street in March 2004. The shop was built for a cost of $300,000 on a lot she purchased earlier for $35,000. Except for a down payment from savings, the cost was financed by a 20-year mortgage. For tax purposes, MACRS depreciation is claimed on the building. During 2018, the following expenses were attributable to the property: Repainting (both exterior and interior) Repairs (plumbing and electrical) $8,000 1,900 In May (after her accident settlement discussed in item 10 below), Samantha paid the outstanding principal on the business mortgage. To do so, she incurred a prepayment penalty of $4,400. Prior to paying off the mortgage, she paid regular interest on the mortgage in 2018 of $6,000. 5. In February 2018, Turning Heads was cited by the city for improper disposal of certain waste chemicals. Samantha questioned the propriety of the proposed fine of $2,000 and retained an attorney to represent her at the hearing. By pleading nolo contendere, the attorney was able to get the fine reduced to $500. Samantha paid both the fine of $500 and the attorney's fee of $600 in 2018. 6. In August 2018, Samantha saw an ad in a trade publication that attracted her attention. The owner of a well-respected styling salon in Reading (PA) had died, and his estate was offering the business for sale. Samantha traveled to Reading spent several days looking over the business including books and financial results), and met with the executor Samantha treated the executor to dinner and a music concert. Immediately after the concert, Samantha made an offer for the business, but the executor rejected her offer. Her expenses in connection with this trip were as follows: $140 220 Car rental Motel August 6-7) Entertainment of executor concert Dinner with the executor Personal meals while traveling 160 120 110 D er with the executor Personal meals while traveling 120 110 7. Joan Myers, one of Samantha's best stylists, left town in March 2017 to get away from a troublesome ex-husband. In order to help Joan establish a business else where, Samantha loaned her $7.000. Joan signed a note dated March 3, 2017, that was payable in 1 year with 4% interest. On December 30, 2018, Samantha learned that Joan had been declared bankrupt and was awaiting trial on felony theft charges, Samantha never received any payments from Joan, nor does she expect to receive any payments in the future M Christmas, Samantha gave each of her 35 best customers a large bottle of body lotion Vachote had a wholesale cost to Samantha of $12 but a retail price of $24. Samantha also spent 53 to have each bottle ift wrapped (Note: The lotion was special onder merchandise and was not part of the business's inventory or purchases for the year sem 2 alone. She also save each of the ninetylists who lead chairs from a fruit basket that is $0 plus a 5 delivery cust 9. In March 2017, the Pennsylvania Department of He a dlied sama stante In 2015 and 2016 w e dakcial state ince tax isso for these years. No interest was included in the arenent Samantha pold the back taxes in early April... dar Samanthawishi wadays and the otchwohet huw ender the w all - xation 2020: Individual Income Taxes APPENDIX E Practice Set Assignments Comprehensive expenses were paid and she would receive a cash award of $200,000. The award specified that the entire amount was for the physical pain she suffered as a result of the accident. Since she suffered no permanent injury, Samantha signed the release in April 2018 and received the $200,000 settlement late that summer. In January 2018, Samantha was contacted by the state of Pennsylvania regarding a tract of land she owned in York County. The state intended to convert the property into a district headquarters, barracks, and training center for its highway patrol Samantha had inherited the property from her father when he died on August 11, 2017. The property had a value of $140,000 on that date and had been purchased by her father on March 3. 1980, for $30,000. On July 25, 2018, after considerable discussions including the state's threat to initiate condemnation proceedings, she sold the tract to the state for $158,000. This transaction was not reported on a Form 1099-11. Since Samantha is not comfortable with real estate investments, she does not plan to reinvest any of the proceeds in another piece of realty 12. When her father died, Samantha did not know that he had an insurance policy on his life (maturity value of $50,000) in which she was named the beneficiary. When her mother told her about the policy in July 2018, Samantha filed a claim with the carrier, Falcon Life Insurance Company. In November 2018, she received a check from Falcon for $51,500 which included $1.500 interest. 13. Upon the advice of a client who is a respected broker, Samantha purchased 1,000 shares of common stock in Cobek Exploration for $10.000 March In the months following her purchase the share value of Grosbeak plurmened. Disgusted with the unexpected erosion in the value of her investment. Samantha sold the stock for $2.0 on December 25, 2018 This transition was reported on Form 1099 with Samantha's sis correctly reported to the RS 14. While on her way to work in 2017, Samantha was rear ended by a hit-and-run deverThankfully, she was not injured in the accident. The came to her Lexus was covered by her insurance company, General Castly, except for the $1.000 deductible she was required to pay. In 2010, the insurance company located the driver who cand the accident and was reimbursed by his insurer Cou nty Samantha recolheds1000 refund check from General Casualty in May 2014 rem e he 31. deductible 15. After her father's death, Samantha's mother (Mildred Cranston, Social Security num- ber 123-54-3789) moved in with her. Mildred's persistent back trouble made it dif- ficult for her to climb the stairs to the second-floor bedrooms in Samantha's house. So, Samantha had an elevator installed in her personal residence at a cost of $12.000 in January 2018. A qualified appraiser determined that the elevator increased the value of the personal residence by $5,000. The appraisal cost $100. The operation of the elevator during 2018 increased Samantha's electric bill by $300 16. As a favor to a long-time client who is a drama professor at a local state university Samantha spent a weekend as a stylist for the principal actresses in the annual Theater Department fund-raising event. The drama professor provided all of the resources that Samantha needed to provide her services. Samantha estimates that she would have changed $200 for the services she donated to this charitable event 17. In addition to the items already noted, Samantha had the following receipts dur ing 2018 Interest income Cat Scranton stational Bank 5900 Cty of actre purpose bonds Money market account Allentown State Bank 3403 5470 al Taxation 2020: Individual Income Taxes Quick Tour Print Search Anno E Practice Set Assignments-Comprehensive Tax Return Problems 18. In addition to the items already noted, Samantha had the following expenqitures for 2018 $10,000 S4300 1,400 Contribution to pension plan Medical Premiums on medical insurance Dental bills Property taxes on personal residence Interest on home mortgage Cash donations to quitted charities Professional expenses Subscriptions to trade journals Dues to beautician groups 5.500 2.200 4.500 $ 180 The $10,000 contribution to the pension plan is to a s o k) type of plan she established in 2018. Previously, she had contributed to an HR 10 (Neosh) plan but found that the 501(k) retirement arrangement provides more flexibility and is les complex. The medical insurance policy Go Samantha and her depan den mom and was sed in the name of the businesse. Tuming Fleadh does not cover dental work or capital modifications to a residence see item 15 19. During 2018, Samantha made total estimated tax payments with respect to her $1.000 P Federal stimated income tax payments ets Allentown City time income tax payments Requirements Make necessary assumptions for information noe gon but nooded to complete OMB No 1545-0074 2018 Your Amalment Sequence01 security number 111211113 1-9 10 - Blog + 13 SCHEDULE 1 Form 1040 Additional Income and Adjustments to Income Peruary 2009 Attach to Form 1040 Dente Go to www.ins.govForm 1040 for instructions and the latest Information l ng F 140 Samantha A. Cranston Additional 1-9 Reserved ..... . . . . . . . . . . 10 Income Taxable refunds, credits, or offsets of state and local income taxes 11 Alimony received 12 Business income or oss. Attach Schedule Cor C-EZ 13 Capital gain or loss. Attach Schedule Dif required. If not required, check here 14 Other gains or losses. Attach Form 4797 . 150 Reserved - - 15a Reserved 17 Rental real estate, royalties, partnerships, corporation, trustste Attach Schedule E 18 Farm Income or ons Attach Schedule F 19 Unemployment compensation - - - - - 20a Reserved 21 Other income. Un type and amount 22 Combine the amounts in the far right you don't have any a m ants to roome.enter here and include on Form 1040. in 6. Otherwise, go to line 23 Adjustments 23 Educator expenses to Income 24 Cranber r ies performing and fee-begovement of Anth Form 2106 .. Health account detection Artach Form 236 Moving swpenses for members of the Armed Forces 27 Dec e nt Ach cha SE med SEPE employed the insurance deduction Penalty on earty with a sings 17 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts