Question: Help me finish this problem please I will rate!!!! . will rate Toying With Nature wants to take advantage of children's fascination with dinosaurs by

Help me finish this problem please I will rate!!!!

. will rate

. will rate

Toying With Nature wants to take advantage of children's fascination with dinosaurs by adding several scale-model dinosaurs to its existing product line. Annual sales of the dinosaurs are estimated at 80,000 units at a price of $6 per unit. Variable manufacturing costs are estimated at $2.50 per unit, incremental fixed manufacturing costs (excluding depreciation) at $43,000 annually, and additional selling and general expenses related to the dinosaurs at $57,000 annually.

To manufacture the dinosaurs, the company must invest $350,000 in design molds and special equipment. Since toy fads wane in popularity rather quickly, Toying With Nature anticipates the special equipment will have a three-year service life with only a $20,000 salvage value. Depreciation will be computed on a straight-line basis. All revenue and expenses other than depreciation will be received or paid in cash. The company's combined federal and state income tax rate is 40 percent.

Required:

a. Prepare a schedule showing the estimated increase in annual net income from the planned manufacture and sale of dinosaur toys.

b. Compute the annual net cash flows expected from this project.

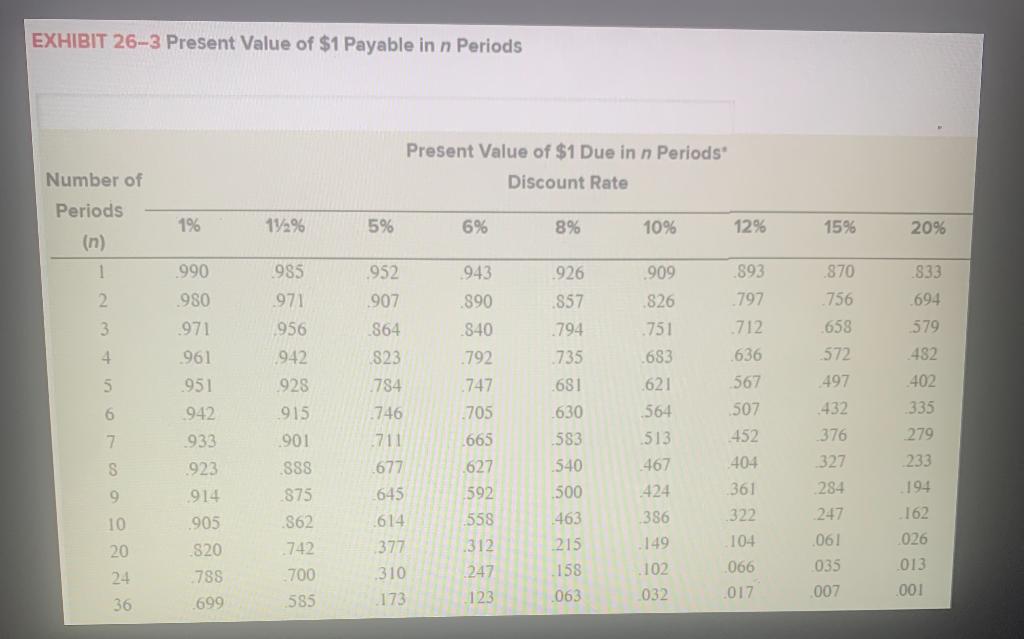

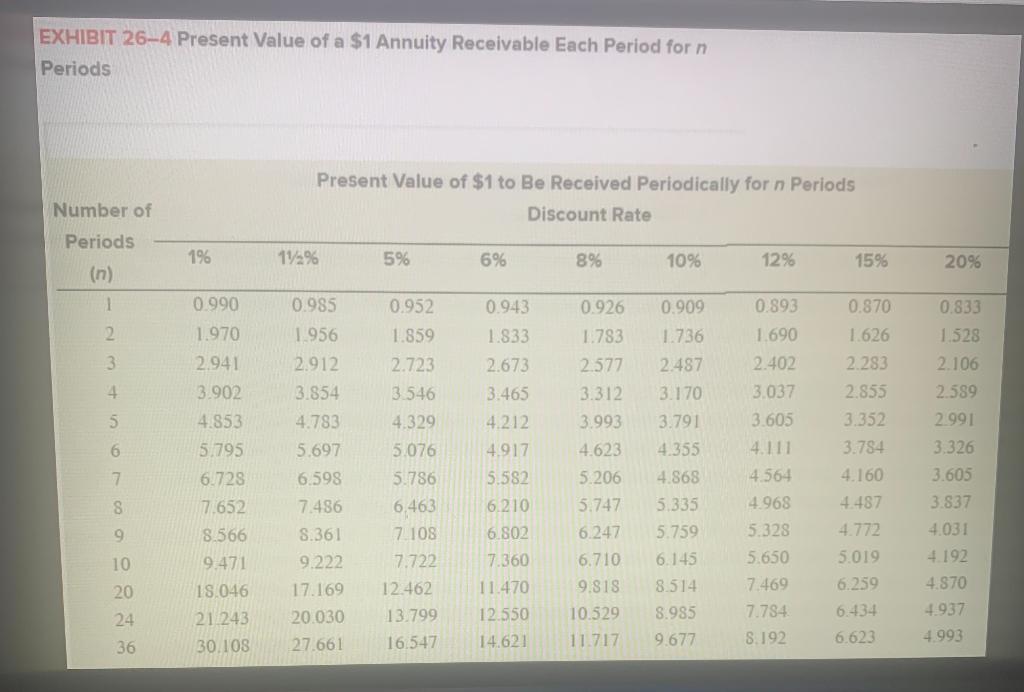

c. Compute the following. Assume discounted at an annual rate of 15 percent. Use Exhibits 26-3 and 26-4 where necessary.

Prepare a schedule showing the estimated increase in annual net income from the planned manufacture and sale of dinosaur toys.

Prepare a schedule showing the estimated increase in annual net income from the planned manufacture and sale of dinosaur toys.

Is this table correct, what I have so far??? VVV

| |||||||||||||||||||||||||||||||||||||

b.

|

c.

Compute the following. Assume discounted at an annual rate of 15 percent. Use Exhibits 26-3 and 26-4 where necessary. (Round your "PV factors" to 3 decimal places, payback period and the return on average investment answers to 1 decimal place. Round net present value to the nearest whole dollar amount.)

|

EXHIBIT 26-3 Present Value of $1 Payable in n Periods Number of Periods (n) 1 2 3 4 5 6 7 S 9 10 20 24 36 1% 990 .980 971 961 951 942 933 .923 914 905 820 788 .699 12% 985 971 956 942 928 915 901 888 875 862 742 .700 585 5% 952 .907 864 823 784 .746 711 677 645 614 377 310 173 Present Value of $1 Due in n Periods Discount Rate 6% 943 890 840 .792 747 .705 .665 627 592 558 312 247 123 8% 926 857 794 735 681 .630 583 540 500 463 215 158 063 10% .909 .826 .751 .683 621 564 513 467 424 386 149 .102 032 12% 893 797 .712 .636 567 507 452 361 322 104 .066 .017 15% 870 756 658 572 497 432 376 327 284 247 .061 035 007 20% 833 694 579 482 402 .335 279 233 194 162 026 013 001 EXHIBIT 26-4 Present Value of a $1 Annuity Receivable Each Period for n Periods Number of Periods (n) 1 2 3 4 5 6 7 8 9 10 20 24 36 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 18.046 21.243 30.108 Present Value of $1 to Be Received Periodically for n Periods Discount Rate 11% 0.985 1.956 2.912 3.854 4.783 5.697 6.598 7.486 8.361 9.222 17.169 20.030 27.661 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 12.462 11.470 13.799 12.550 16.547 14.621 8% 10% 0.926 0.909 1.783 1.736 2.577 2.487 3.312 3.170 3.993 3.791 4.623 4.355 5.206 4.868 5.747 5.335 6.247 5.759 6.710 6.145 9.818 8.514 10.529 8.985 11.717 9.677 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 7.469 7.784 8.192 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 6.259 6.434 6.623 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.870 4.937 4.993

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts