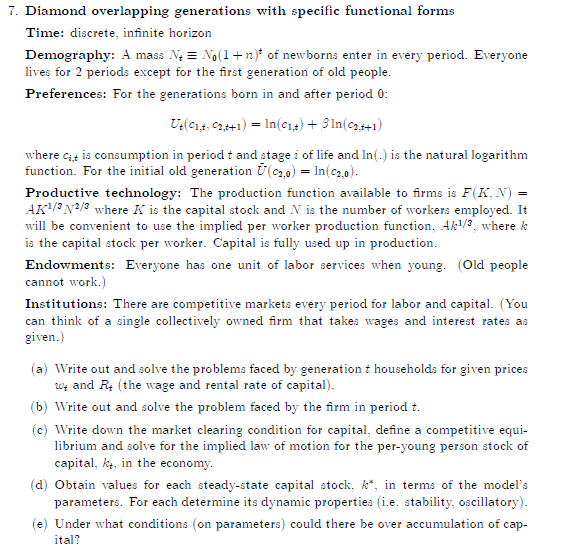

Question: Help me. i. Diamond overlapping generations with specic functional fonns Time: discrete. innite horizon Demography: :1 mass 3;} E Id 1 + n}' of newborns

Help me.

![is consumption in period t andst agei of life and In{ _].](https://s3.amazonaws.com/si.experts.images/answers/2024/06/6674eea5c42cd_3016674eea5a6b26.jpg)

![is the natural logarithm function. For the initial old generation Lil-emu] =](https://s3.amazonaws.com/si.experts.images/answers/2024/06/6674eea62637a_3026674eea60c845.jpg)

![ln{(:3'n]l. Productive technology: The production function available to rms is F{K_ I]](https://s3.amazonaws.com/si.experts.images/answers/2024/06/6674eea678112_3026674eea658583.jpg)

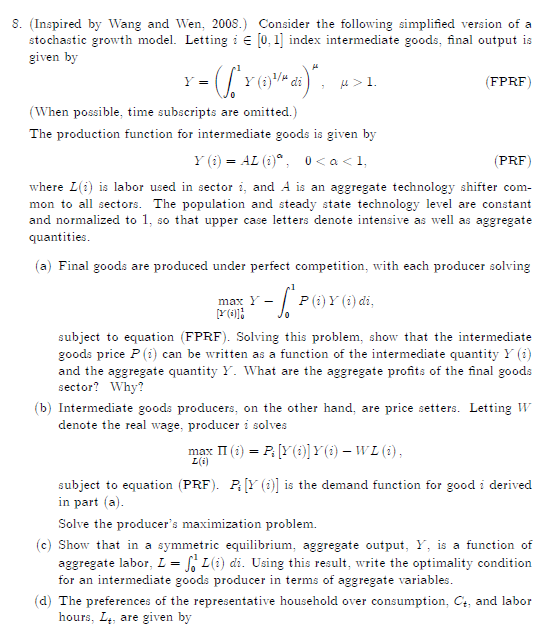

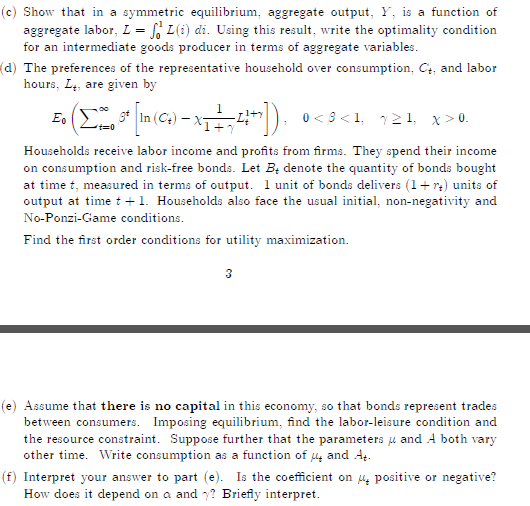

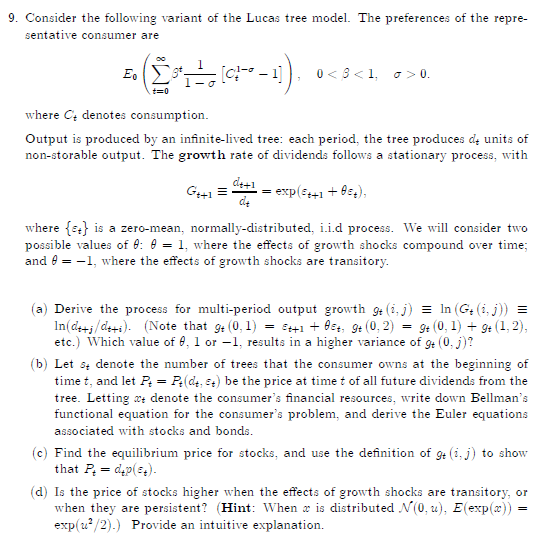

i". Diamond overlapping generations with specic functional fonns Time: discrete. innite horizon Demography: :1 mass 3;} E Id 1 + n}' of newborns enter in every period. Everyone lives for 2 periods except for the rst generation of old people. Preferences: For the generations born in and after period D: Uii;z.s+1i = liui + 3lizs+1l where cm is consumption in period t andst agei of life and In{ _]. is the natural logarithm function. For the initial old generation Lil-emu] = ln{(:3'n]l. Productive technology: The production function available to rms is F{K_ I] = ARI-\"If\" where K is the capital stock and I is the number of workers employed. It will be convenient to use the implied per worker production function. .rlkl: where k is the capital stock per worker. Capital is fully used up in production. Endowments: Everyone has one unit of labor services when young. {Old people cannot work.) Institutions: There are competitive markets every period for labor and capital. [You can think of a single collectively owned rm that takes wages and interest rates as given} {a} 1|I."|."rite out and solve the problems faced by generation t households for given prices if}: and R, {the wage and rental rate of capital}. {b} 1|I."|."rite out and solve the problem faced by the rm in period t. {c} 1|I."|."rite down the market clearing condition for capital. dene a competitive equi librium and solve for the implied law of motion for the peryoung person stock of capital. in. in the economy. {d} Obtain values for each steady-state capital stock: if. in terms of the model's parameters. For each determine its dynamic properties {i.e_ stability. oscillatory}. lie} Under what conditions 1' on parameters} could there be over accumulation of cap itll'ir \f{c} Show that in a symmetric equilibrium. aggregate output. 1'. is a function of aggregate labor. L = j: LI[3':I di. Using this result. write the optimality condition for an intermediate goods producer in terms of aggregate variables. {d} The preferences of the representative household over consumption. C}. and labor hours. L*._ are given by no . 1 En(EH3'[ln{C*jX1_HIL:H])_ lilo-3:1. 1.31. x30- Households receive labor income and prots from rms. They spend their income on consumption and riskfree bonds. Let Es denote the quantity of bonds bought at time t. measured in terms of output. 1 unit of bonds delivers {l rs] units of output at time t l. Households also face the usual initial. non-negativity and NoPonziGame conditions. Find the rst order conditions for utility maximization. 3 lie} Assume that there is no capital in this economy. so that bonds represent trades between consumers. Imposing equilibrium. nd the laborleisure condition and the resource constraint. Suppose further that the parameters is and .--1 both vary other time. \"'rite consumption as a function of In. and .rlt. {f} Interpret your answer to part {e}. Is the coefficient on In" positive or negatitre";I How does it depend on a and \"3"." Briey interpret. \f1i}. Onthejob search with a two-point wage distribution Time: Discrete, innite horizon. Demography: Single worker who lives for ever. Preferences: The worker is risk-neutral {i.e. aim} = 2:}. He diseounts the future at the rate 1". Enduwrnents: \"'hen unemployed the worker reoeives income it per period. Also with probability a he gets an offer of employment. 1|I."|."ith probability 0 :b D the offer is a low wage_. um. and with probability 1 o the offer is a high wage. war where 1'33 '3 to; l\"_-'- .5. \"Chen employed the worker receives the wage. will or mg. every period and continues to get wage offers of the same types and at the same frequency as when unemployed. "iilien employed he also gets laid off [loses his job} with probability A. {a} 1'I."|."rite down the ow or Bellman type asset equations for each of the states the worker can be in and briey explain each one. {b} Show that as long as w; :=- i: the worker will always prefer employment at the low wage to unemployment. is} Now suppose there is a continuum. measure l._ of such workers. i Draw a diagram showing the rates of flow between states. ii 'i'i'rite out a set of equations that can be solved for the steady-state measures of workers in each of the states. iii Solve for the measure of high wage workers and interpret the result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts