Question: help me I hope for a quick answer, thanks MHD is considering an expansion project that requires an initial outlay of OMR120,000. The project is

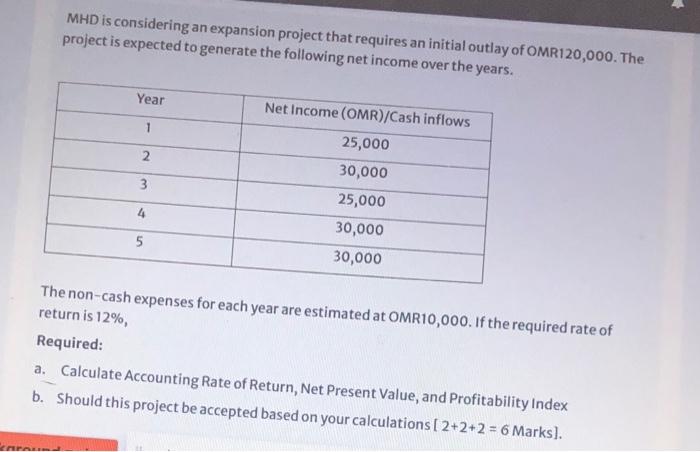

MHD is considering an expansion project that requires an initial outlay of OMR120,000. The project is expected to generate the following net income over the years. Year 1 2 3 Net Income (OMR)/Cash inflows 25,000 30,000 25,000 30,000 30,000 4 5 The non-cash expenses for each year are estimated at OMR10,000. If the required rate of return is 12%, Required: a. Calculate Accounting Rate of Return, Net Present Value, and Profitability Index b. Should this project be accepted based on your calculations [ 2+2+2 = 6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts