Question: Help me in this assignment. PLEASE HELP ASAP! Due in 1 HOUR!!! Have to show all work QUESTION 1 (22 marks) On June 1, 2019,

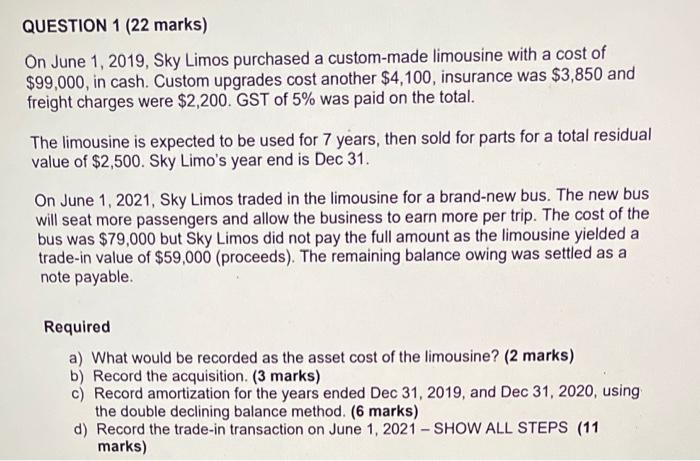

QUESTION 1 (22 marks) On June 1, 2019, Sky Limos purchased a custom-made limousine with a cost of $99,000, in cash. Custom upgrades cost another $4,100, insurance was $3,850 and freight charges were $2,200, GST of 5% was paid on the total. The limousine is expected to be used for 7 years, then sold for parts for a total residual value of $2,500. Sky Limo's year end is Dec 31. On June 1, 2021, Sky Limos traded in the limousine for a brand-new bus. The new bus will seat more passengers and allow the business to earn more per trip. The cost of the bus was $79,000 but Sky Limos did not pay the full amount as the limousine yielded a trade-in value of $59,000 (proceeds). The remaining balance owing was settled as a note payable. Required a) What would be recorded as the asset cost of the limousine? (2 marks) b) Record the acquisition. (3 marks) c) Record amortization for the years ended Dec 31, 2019, and Dec 31, 2020, using the double declining balance method. (6 marks) d) Record the trade-in transaction on June 1, 2021 - SHOW ALL STEPS (11 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts