Question: help me PA For your answer Question 2: Porter Electronics is a small subsidiary of a larger group specializing in distributing semiconductor components in Thailand.

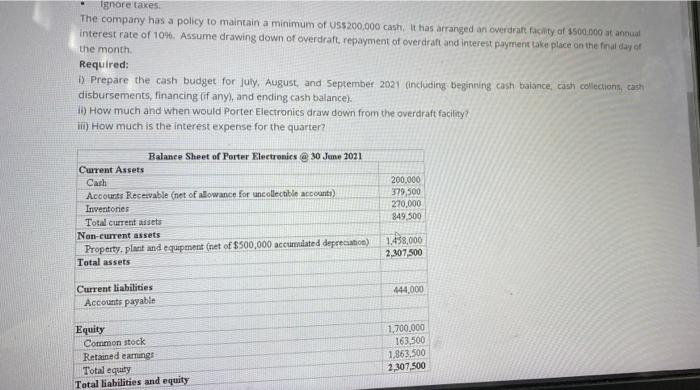

For your answer Question 2: Porter Electronics is a small subsidiary of a larger group specializing in distributing semiconductor components in Thailand. All sales and purchases of semiconductors are in US dollars. Therefore, its accounting records are also kept in US dollars. Data regarding its operations follow: Revenue in June 2021 was $550,000. Sales are budgeted at $560,000 for July, $530,000 for August, and $510,000 for September Collections are expected to be 30% in the month of sale, 69% in the month following the sale, and 19 uncollectible. The cost of goods sold is 80% of sales. The company purchases 50% of its merchandise in the month prior to the month of sale and 50% in the month of sale. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $105,500. Monthly depreciation is $45,000. The company has a policy to maintain a minimum of US$200,000 cash. It has arranged an overdraft facility of $500,000 at annual Ignore taxes. . . . Ignore taxes The company has a policy to maintain a minimum of U55200,000 cash. It has arranged an overdratt facility of $500.000 at annual interest rate of 10%. Assume drawing down of overdraft, repayment of overdraft and interest payment take place on the final day of the month Required: Prepare the cash budget for July August, and September 2021 (including beginning cash balance, cash collections, cash disbursements, financing of anys, and ending cash balance). ih) How much and when would Porter Electronics draw down from the overdraft facility? HT) How much is the interest expense for the quarter? Balance Sheet of Porter Electronics @ 30 June 2011 Current Assets Cash Accounts Receivable (net of allowance for collectible accounts) Inventories Total current assets Non-current assets Property, plant and equipment (net of $500,000 accumulated depreciation) Total assets 200,000 379,500 270.000 849,500 1.438,000 2,307,500 Current liabilities Accounts payable 444,000 Equity Common stock Retained earnings Total equity Total liabilities and equity 1,700.000 163,500 1.863,500 2,307,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts