Question: HELP ME PLEASE GROUP 3: COMPREHENSIVE PROBLEMS 1. Olive Corporation was formed and began operations on January 1, 2017. The corpora- tion's income statement for

HELP ME PLEASE

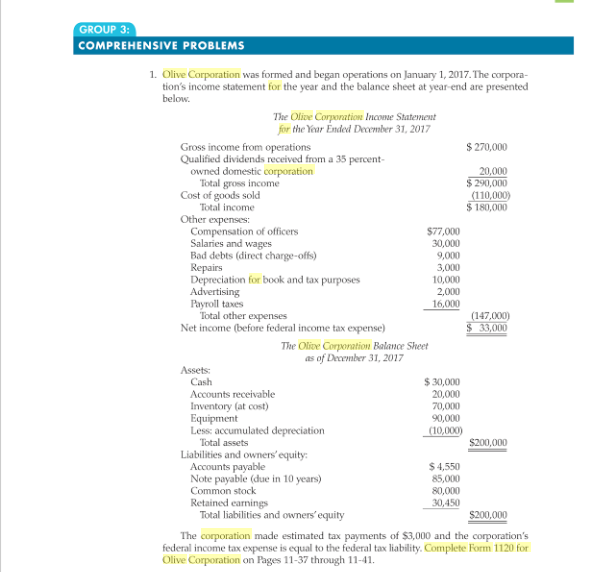

GROUP 3: COMPREHENSIVE PROBLEMS 1. Olive Corporation was formed and began operations on January 1, 2017. The corpora- tion's income statement for the year and the balance sheet at year-end are presented below The Olive Corporation Income Statement for the Year Ended December 31, 2017 $270,000 Gross income from operations Qualified dividends received from a 35 percent 20,000 290,000 110,000 180,000 owned domestic corporation Total gross income Cost of goods sold Total income Other expenses: $77,000 30,000 9,000 3,000 10,000 2,000 16,000 Compensation of officers Salaries and wages Bad debts (direct charge-offs Depreciation for book and tax purposes Advertising Payroll taxes Total other expenses Net income (before federal income tax expense 147,000) 33,000 The Olive Corporation Balance Sheet as of December 31, 2017 Assets: Accounts receivable Inventory (at cost) Equipment $ 30,000 20,000 70,000 90,000 Total assets $200,000 Liabilities and owners' equity Accounts payable Note payable (due in 10 years) Common stock Retained earnings $ 4,550 85,000 80,000 30,450 Total liabilities and owners' equity $200,000 The corporation made estimated tax payments of $3,000 and the corporation's federal income tax expense is equal to the federal tax liability.Complete Form 1120 for Olive Corporation on Pages 11-37 through 11-41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts