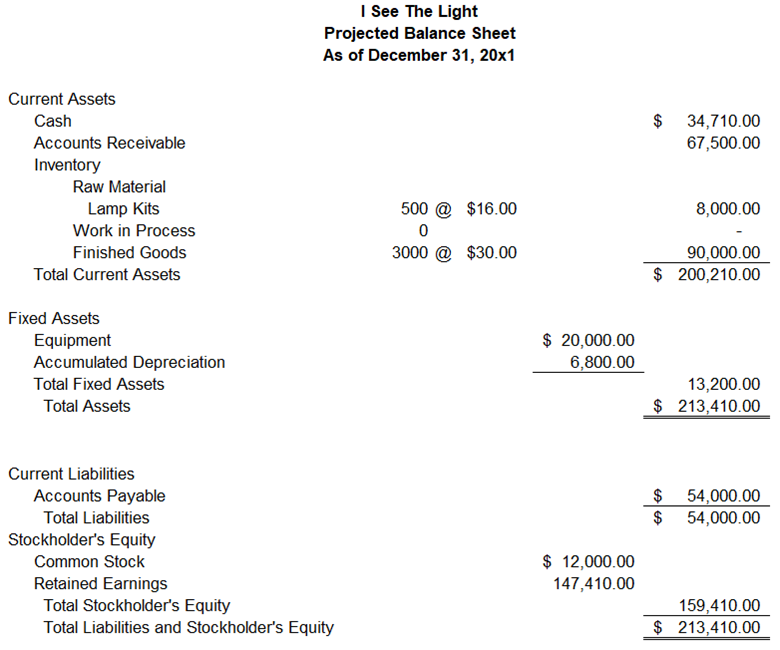

Question: Help me, please. I See The Light Projected Balance Sheet As of December 31,201 Current Assets Current Liabilities Accounts Payable begin{tabular}{cr} $54,000.00 hline$54,000.00 end{tabular}

Help me, please.

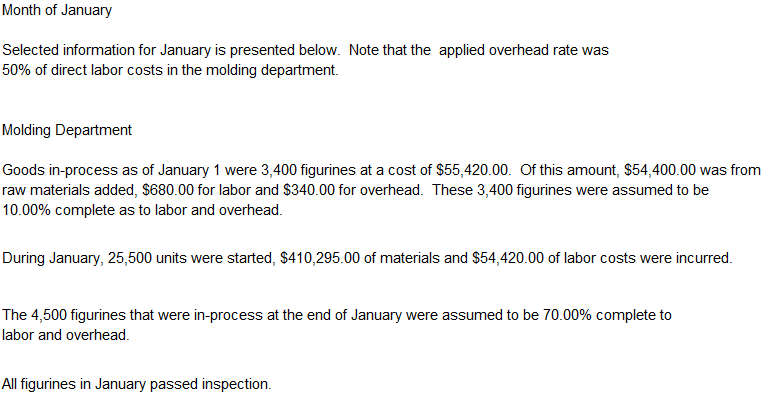

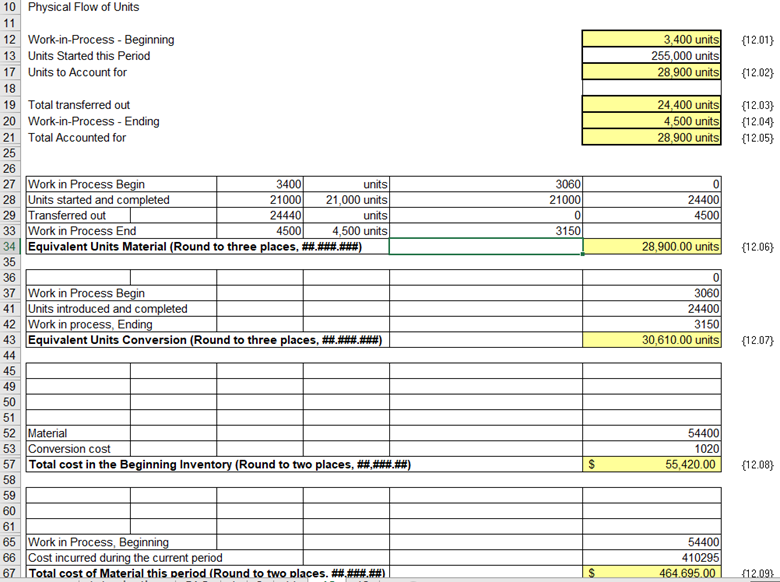

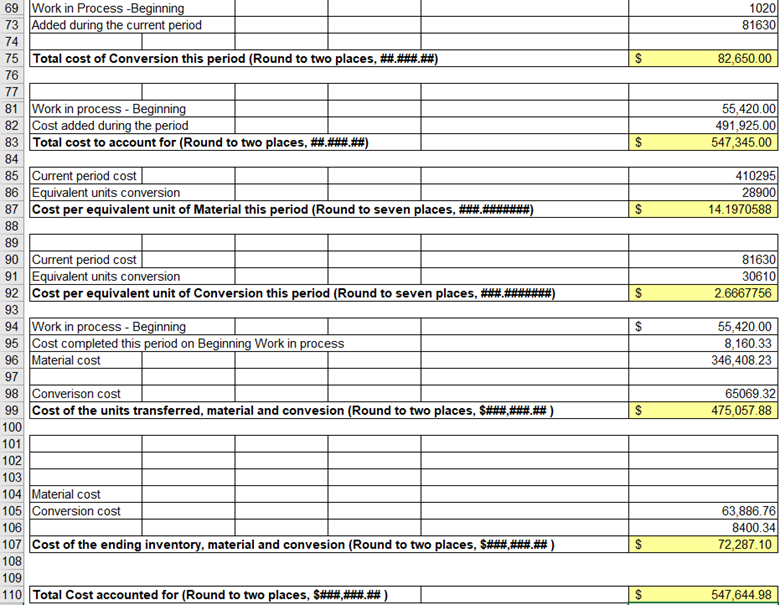

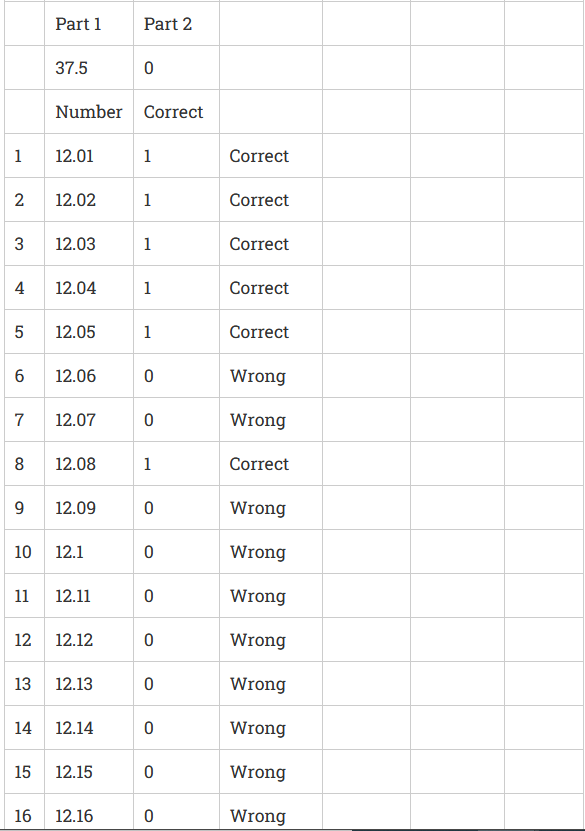

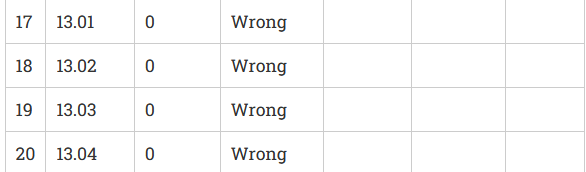

I See The Light Projected Balance Sheet As of December 31,201 Current Assets Current Liabilities Accounts Payable \begin{tabular}{cr} $54,000.00 \\ \hline$54,000.00 \end{tabular} Total Liabilities Stockholder's Equity Common Stock \$ 12,000.00 Retained Earnings 147,410.00 Total Stockholder's Equity \begin{tabular}{r} 159,410.00 \\ \hline$213,410.00 \\ \hline \hline \end{tabular} Total Liabilities and Stockholder's Equity Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,400 figurines at a cost of $55,420.00. Of this amount, $54,400.00 was from raw materials added, $680.00 for labor and $340.00 for overhead. These 3,400 figurines were assumed to be 10.00% complete as to labor and overhead. During January, 25,500 units were started, $410,295.00 of materials and $54,420.00 of labor costs were incurred. The 4,500 figurines that were in-process at the end of January were assumed to be 70.00% complete to labor and overhead. All figurines in January passed inspection. \begin{tabular}{|l|l|l|l|} \hline Total Cost accounted for (Round to two places, $ ##\#,#\#\#.\#\#) & & $ & 547,644.98 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline & Part 1 & Part 2 & \\ \hline & 37.5 & 0 & \\ \hline & Number & Correct & \\ \hline 1 & 12.01 & 1 & Correct \\ \hline 2 & 12.02 & 1 & Correct \\ \hline 3 & 12.03 & 1 & Correct \\ \hline 4 & 12.04 & 1 & Correct \\ \hline 5 & 12.05 & 1 & Correct \\ \hline 6 & 12.06 & 0 & Wrong \\ \hline 7 & 12.07 & 0 & Wrong \\ \hline 8 & 12.08 & 1 & Correct \\ \hline 9 & 12.09 & 0 & Wrong \\ \hline 13 & 12.14 & 0 & Wrong \\ \hline 15 & 12.15 & 0 & Wrong \\ \hline 12 & 12.12 & 0 & Wrong \\ \hline 11 & 12.11 & 0 & Wrong \\ \hline 12.13 & 0 & Wrong \\ \hline 16 & 0 & Wrong \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline 17 & 13.01 & 0 & Wrong \\ \hline 18 & 13.02 & 0 & Wrong \\ \hline 19 & 13.03 & 0 & Wrong \\ \hline 20 & 13.04 & 0 & Wrong \\ \hline \end{tabular} I See The Light Projected Balance Sheet As of December 31,201 Current Assets Current Liabilities Accounts Payable \begin{tabular}{cr} $54,000.00 \\ \hline$54,000.00 \end{tabular} Total Liabilities Stockholder's Equity Common Stock \$ 12,000.00 Retained Earnings 147,410.00 Total Stockholder's Equity \begin{tabular}{r} 159,410.00 \\ \hline$213,410.00 \\ \hline \hline \end{tabular} Total Liabilities and Stockholder's Equity Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,400 figurines at a cost of $55,420.00. Of this amount, $54,400.00 was from raw materials added, $680.00 for labor and $340.00 for overhead. These 3,400 figurines were assumed to be 10.00% complete as to labor and overhead. During January, 25,500 units were started, $410,295.00 of materials and $54,420.00 of labor costs were incurred. The 4,500 figurines that were in-process at the end of January were assumed to be 70.00% complete to labor and overhead. All figurines in January passed inspection. \begin{tabular}{|l|l|l|l|} \hline Total Cost accounted for (Round to two places, $ ##\#,#\#\#.\#\#) & & $ & 547,644.98 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline & Part 1 & Part 2 & \\ \hline & 37.5 & 0 & \\ \hline & Number & Correct & \\ \hline 1 & 12.01 & 1 & Correct \\ \hline 2 & 12.02 & 1 & Correct \\ \hline 3 & 12.03 & 1 & Correct \\ \hline 4 & 12.04 & 1 & Correct \\ \hline 5 & 12.05 & 1 & Correct \\ \hline 6 & 12.06 & 0 & Wrong \\ \hline 7 & 12.07 & 0 & Wrong \\ \hline 8 & 12.08 & 1 & Correct \\ \hline 9 & 12.09 & 0 & Wrong \\ \hline 13 & 12.14 & 0 & Wrong \\ \hline 15 & 12.15 & 0 & Wrong \\ \hline 12 & 12.12 & 0 & Wrong \\ \hline 11 & 12.11 & 0 & Wrong \\ \hline 12.13 & 0 & Wrong \\ \hline 16 & 0 & Wrong \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline 17 & 13.01 & 0 & Wrong \\ \hline 18 & 13.02 & 0 & Wrong \\ \hline 19 & 13.03 & 0 & Wrong \\ \hline 20 & 13.04 & 0 & Wrong \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts