Question: Help me please :) Market Value Capital Structure Suppose the Schoof Company has this book value balance sheet: The notes payable are to banks, and

Help me please :)

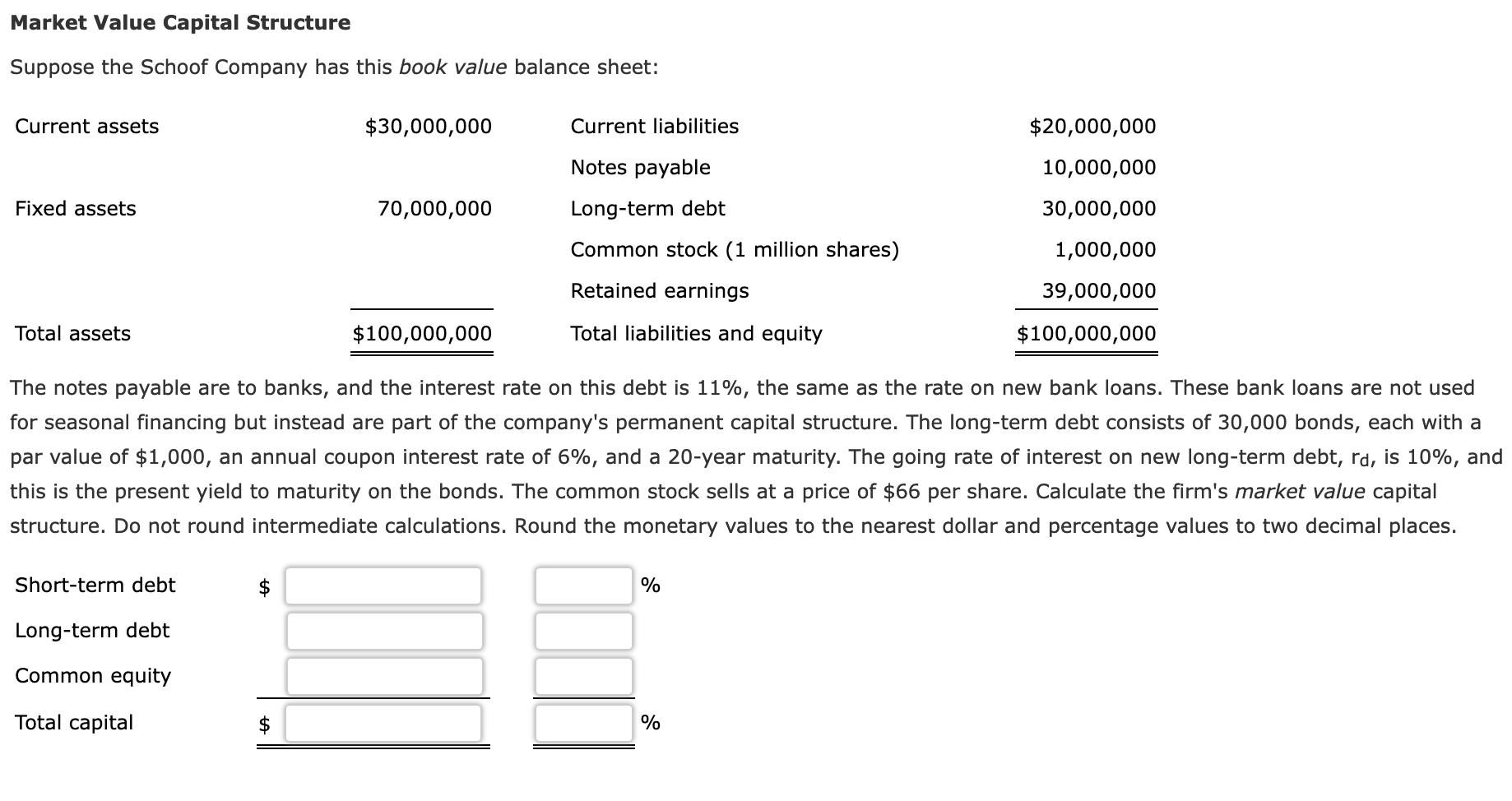

Market Value Capital Structure Suppose the Schoof Company has this book value balance sheet: The notes payable are to banks, and the interest rate on this debt is 11%, the same as the rate on new bank loans. These bank for seasonal financing but instead are part of the company's permanent capital structure. The long-term debt consists of 30 , bonds, par value of $1,000, an annual coupon interest rate of 6%, and a 20 -year maturity. The going rate of interest on new long-term debt, is 10%, and structure. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts